Headquartered in Sunnyvale, CA, Accuray Inc. (NASDAQ:ARAY) recently announced that the Boise-based Summit Cancer Center has initiated cancer treatment with its Radixact Treatment Delivery System. Notably, the Radixact system leverages on the company’s flagship TomoTherapy platform.

Radixact system provides complex treatments such as craniospinal and total marrow irradiation. Added to these functionalities, Summit Cancer Center has the capability to perform stereotactic radiosurgery (SRS) and stereotactic body radiotherapy (SBRT) while sparing normal tissues and maintaining optimal treatment efficacy.

The Radixact System has been designed to deliver image-guided intensity-modulated radiation therapy, an extremely precise form of radiation therapy. The platform gained Japanese regulatory approval (Shonin approval) in the last quarter and is expected to start formal treatments from the fourth quarter.

In this regard, a glimpse at the preliminary fourth-quarter results reveals that Accuray expects approximately $86 million of gross product orders. Solid growth in gross orders is buoyed by the full commercial launch of the Radixact system and continued strong demand for the company’s flagship CyberKnife system.

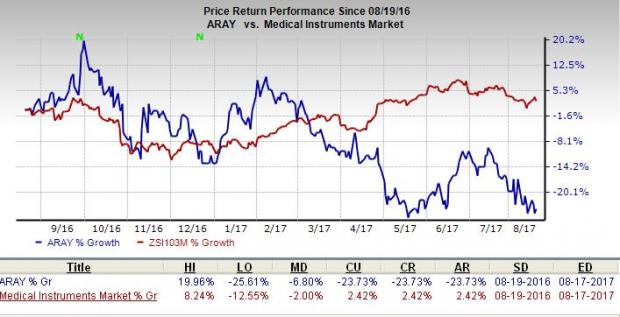

Stock Price & Estimate Revision Trend

Accuray has had an unimpressive run on the bourse over the last one year. The company has lost 23.7%, way wider than the broader industry’s rally of almost 2.4%. Moreover, the current level compares unfavorably with the S&P 500’s 11% gain.

Furthermore, the estimate revision for the stock has been unfavorable. The full-year estimates deteriorated 3 cents to a loss of 28 cents per share. Owing to the bearish analyst sentiments, Accuray carries a Zacks Rank #4 (Sell), which signifies underperformance in the near term.

Our Take

Accuray’s top-line growth is highly dependent on CyberKnife and TomoTherapy systems sales. However, both systems involve significant capital spending, which many healthcare providers are reluctant to spend, primarily due to the sluggish macro-economic conditions. This might mar revenues over the long haul.

However, the company has been gaining ground on a series of positive tidings on the regulatory front recently. Of the notable ones, Accuray received 510(k) clearance from the FDA for its iDMS Data Management System in July.

Key Picks

A few better-ranked stocks in the broader medical sector are Edwards Lifesciences Corp. (NYSE:EW) , IDEXX Laboratories, Inc. (NASDAQ:IDXX) and Stryker Corporation (NYSE:SYK) . Notably, Edwards Lifesciences sports a Zacks Rank #1 (Strong Buy), while IDEXX Laboratories and Stryker Corporation have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. Notably, the stock represents an impressive year-to-date return of 21.2%.

IDEXX Laboratories has a long-term expected earnings growth rate of 19.8%. Notably, the stock represents a stellar year-to-date return of 29.5%.

Stryker represents an impressive year-to-date return of 21.3%. The stock has a long-term expected earnings growth rate of 10%.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Accuray Incorporated (ARAY): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Stryker Corporation (SYK): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Original post

Zacks Investment Research