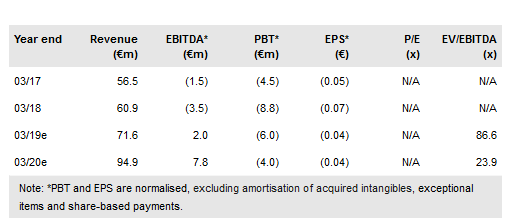

Accsys (LON:ACCS) continues to make positive progress and is now generating revenue from its latest investment at Arnhem. We expect the new, under-construction Tricoya facility to follow suit within the next year, at which point annual group revenue potential will be around €150m according to management. In the near term, we expect to see an EBITDA positive outturn in FY19.

Enlarged Arnhem facility improving performance

Increased revenue, Arnhem profitability and a halved group EBITDA loss were the financial highlights in H119. Behind this, Accsys achieved a c 8% uplift in Accoya volumes or c 21,400m3 sold in the period, which included the third reactor at Arnhem coming on stream. Based on previously released five-month data, the implied September throughput was c 4,500m3, which is approaching the enlarged annual capacity (ie 60,000m3) on a monthly run rate basis. Elsewhere, other costs appeared to be well controlled and the current investment phase resulted in a €34m net debt position at the end of September. As expected, no interim dividend was declared.

To read the entire report Please click on the pdf File Below..