Acal has made further progress in its growth strategy with the acquisition of Young Electronics Group for £1.7m, adding new and complementary products to the Electronics division line-up. We make no changes to earnings estimates, but reflect the purchase price and estimated integration and acquisition costs in our net cash/debt forecasts.

Continuing on the acquisition path

Acal has acquired the trade and assets of Young Electronics Group (YEG) for cash (pre-expenses) of £1.7m. YEG has operations in the UK and Ireland, acting as a specialist provider of electronic components, solutions and services including solid state lighting and related components, electronic components, power supplies, power cords and custom cable assembly. The business has internal manufacturing capacity used to make own label products and also to offer electronics manufacturing services to customers. For Acal, this brings a new product line – solid state lighting – and other complementary product lines that will be suitable for cross-selling.

Funded from existing facilities

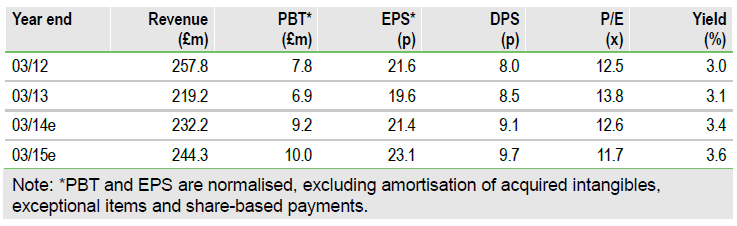

The company has not disclosed historical revenues for YEG, although notes that the business made a small loss in CY12. Acal plans to integrate YEG by the end of FY14; we would expect cost synergies from integrating back office functions. Until details are available regarding revenues and profitability, we make no changes to our P&L forecasts; we reduce our net cash forecast to reflect the cash acquisition cost plus our estimate of acquisition and integration costs (total £2.5m cash outflow). Net cash at the end of FY14 reduces from £1.5m to a net debt position of £1m, and net cash at the end of FY15 reduces to £0.1m.

Valuation: Growing market share to drive margins

Positive PMI data over the past few months (eurozone manufacturing PMI hitting 51 in August, with the UK at 57 and above 50 since April) have helped drive Acal’s share price up by 15% since the end of June. The stock now trades on a P/E of 12.6x FY14 and 11.7x FY15, but remains at a small discount to its peer group. Bookings activity is showing positive momentum and the level of design activity over the past two years positions the company well for volume orders as the economy recovers across Europe.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Acal Expands Product Range

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.