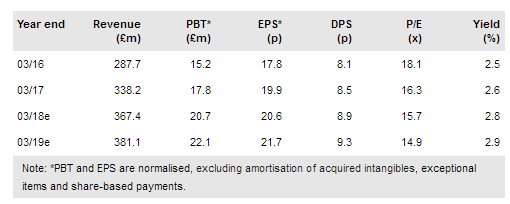

Acal PLC (LON:ACL) continues to see strong trading, with organic constant currency year-on-year revenue growth of 9% in Q118. Order intake also remains strong, with a 15% organic growth rate in the quarter. We maintain our forecasts but highlight that if growth continues at a similar rate in Q2, there may be scope for upgrades.

Strong trading continues into Q118

The strong trading environment in Q417, which saw year-on-year revenue growth of 15% at constant exchange rates (CER) and 11% organic growth, continued into Q118. Acal saw Q118 revenue growth of 14% CER and 9% organic; the organic growth rates by division were broadly similar. Order intake was also strong, up 21% CER and 15% on an organic basis (similar across both divisions), accelerating from 16% CER and 13% organic growth in Q417.

On a geographic basis, demand was strong in Europe (and the rest of the world) with low growth in the UK (mirroring the increase in the eurozone manufacturing PMI versus a small decline in the UK). Gross margin was maintained at a similar level to Q417, with the currency effect on UK import costs depressing the margin compared to a year ago. The Variohm business is performing well and cross-selling between the two divisions also contributed to growth.

To read the entire report Please click on the pdf File Below: