Acadia Healthcare Company Inc. (NASDAQ:ACHC) reported second-quarter 2017 adjusted earnings of 66 cents per share, beating the Zacks Consensus Estimate by a penny. Earnings were down 9.6% year over year.

A number of factors like strong U.S. dollar relative to British pound, the divestiture of 22 facilities in the U.K. affected second-quarter results.

Quarter Details

Acadia Healthcare’s revenues for the second quarter increased 6.4% to $715.9 million from the prior-year quarter. The top line, however, missed the Zacks Consensus Estimate by 0.1%

The year-over-year upside in revenues resulted partially from the addition of 625 new beds to existing facilities in the 12 months ended Jun 30, 2017. During the second quarter, 91 new beds were added to the existing facilities. The company expects to add approximately 800 new beds to existing facilities and three de novo facilities in 2017.

The U.S. same facility revenues were up 7.8% from the year-ago quarter. The company also recorded a 6% increase in patient days from 2016.

The U.K. same facility revenues inched up 4% year over year to $73 million. The number of patient days rose just 1.1% from the year-ago quarter.

We note that revenues per patient day were up 1.7% in the U.S. and rose 1.1% in the U.K.

Total expenses declined 4.8% year over year to $649.7 million.

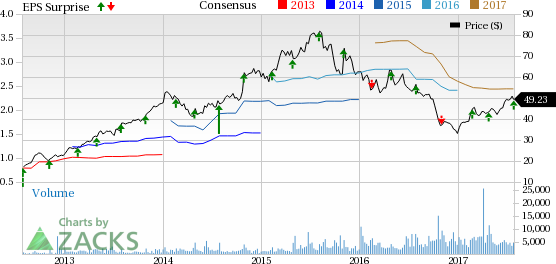

Acadia Healthcare Price, Consensus and EPS Surprise

Financial Update

Cash and cash equivalents as of Jun 30, 2017 were $79.4 million, up 38.5% from year-end 2016.

Long-term debt was $3.24 billion as of Jun 30, 2017, down 0.4% from the 2016-end level.

Net cash provided by operating activities was $187 million, up 3% from year-end 2016.

2017 Guidance

The company expects adjusted earnings per diluted share between $2.42 and $2.47 on revenues of $2.85–$2.87 billion.

Adjusted EBITDA is expected between $628 million and $635 million.

Zacks Rank and Stocks to Consider

Acadia Healthcare currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Among the other firms in the medical sector that have reported their second-quarter earnings so far, the bottom line of Centene Corp. (NYSE:CNC) , Quest Diagnostics Incorporated (NYSE:DGX) and UnitedHealth Group Inc. (NYSE:UNH) beat their respective Zacks Consensus Estimate.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's second traillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Acadia Healthcare Company, Inc. (ACHC): Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX): Free Stock Analysis Report

Original post

Zacks Investment Research