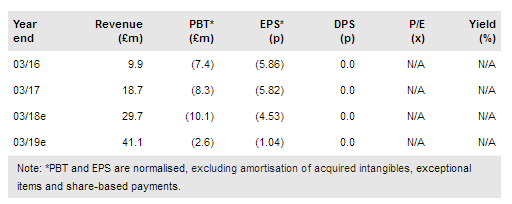

Abzena PLC (LON:ABZA) reported solid FY17 results with underlying revenue growth of 41% (to £18.7m). In FY17, Abzena continued to focus on the integration of its service offering across its three sites (US and UK), which has been expanded by its recent placing of £25m gross (issuing 75.8m new shares at 33p). We expect this to enable strong growth and take Abzena to profitability in FY20, which will be a significant milestone for the company. We maintain our valuation at £132m, 62p per share, but note potential upside as it demonstrates growth and as Abzena inside products progress.

Funded to deliver on its growth plans

Abzena recently announced a £25m (£23.9m net) fund-raising through a placing of 75.8m shares at a price of 33p each. The funds will be used to expand its services, capabilities and capacity across its three service areas: biomanufacturing, chemistry and research services. The company has indicated that the investments will be complete and resulting capability and capacity in use in H218, Q118 and late 2017, respectively. Abzena’s target over the next three years is to grow its service business revenue by c.40% (CAGR) and improve gross margins to 50% (from 41% in FY17), which should move it towards profitability in a shorter time frame.

Abzena inside clinical pipeline maturing

The Abzena inside pipeline has grown to 12 products now in the clinic and progressing toward commercialisation, most notably Gilead’s andecaliximab (formerly GS-5745) in gastric cancer, in Phase III. In FY17, Abzena announced a second ThioBridge ADC technology deal and two Composite Human Antibody licence agreements. According to the company, these deals in total have the potential to deliver $554m in licence fees and milestone payments plus royalties on commercial sales of products. Also recently announced was the acquisition of True North Therapeutics and its Abzena inside product TNT009 for up to $825m by Bioverativ. These deals provide validation of Abzena’s technology, which indicates there is potential upside via the Abzena inside pipeline as well as demonstrating the quality of service that can be provided, which should underpin its growth.

To read the entire report please click on the pdf file below: