Gold bugs can’t wait for the year to be over.

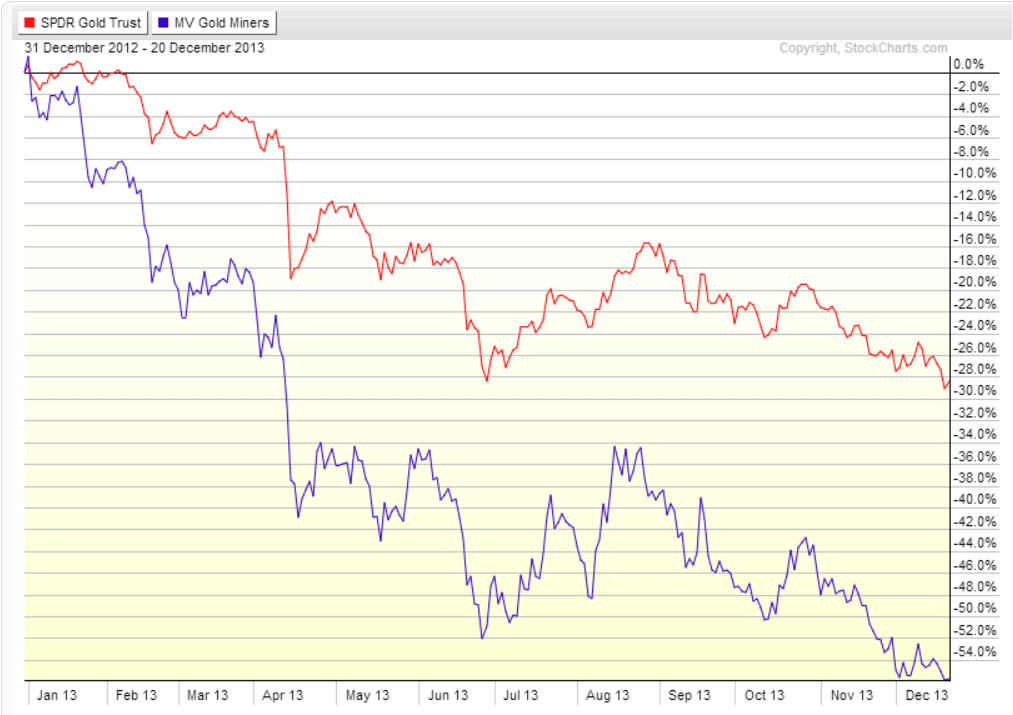

2013 was truly horrible for them, as the following performance chart shows:

As of this writing gold (via the popular SPDR Gold Trust ETF (GLD)) is down nearly 30% for the year. Gold miners are down roughly 55%. This bloodbath is a result of a complete and total misread as to the macro level impacts of Federal Reserve policy on inflation. Namely we didn’t get any actual inflation, except in risk assets, and the Fed never lost control. Whether or not inflation comes “later” — the argument for latent QE effects — no longer matters from a portfolio management standpoint. When it comes to actual trading and investing, theory has to synch up with timing to some reasonable degree. If you were so wrong in your timing as to have lost half your money, there is no reasonable shape or form in which you can claim to have been right.

(And lest anyone accuse us of hindsight bias, note we have been vocally bearish on gold for quite a long time, as shown here and here and here.)

Ideology is a terrible basis on which to invest. If you choose to put your hard-earned capital at risk on dubious theories justified by emotion and political belief, rather than a hard-nosed commitment to detached objectivity and acceptance of the facts, then you deserve exactly what you get. (Which includes no sympathy, because plenty of people lack the funds to invest or trade at all.)

2013 will be the first year since 2000 that gold finishes in the red. That in itself should be a glaring sign the party is over. But “pigs get fat and hogs get slaughtered,” as the saying goes, and many gold bulls are holding out for yet more upside, having given away huge chunks of gain already (and countless billions in client dollars). Here is fund manager Eric Sprott — whose assets under management have shrunk from a $3 billion peak to just $350 million on declines of 50% and worse — justifying a viewpoint that is seemingly free of adjustment to facts or data:

…you got to stick to your beliefs, that’s the other thing. I mean yes, I’ve taken some big down hits this year. But when I think of where we could go from here, and I’ve done it before, I’ve done it so many times I can’t even tell you…I might have been bullish and [everyone] thought we were in a bear market and it turns out to be a bull market. I’m going back over 40 to 50 years now. So that’s a lot of time. If you believe you’re right and the data says hold your ground, you hold your ground. Normally there’s a pretty big payday at the end. - Eric Sprott, via mining.com

Holding one’s ground with an overlay of risk management and objective assessment of the facts makes sense to us. Losing more than half one’s money with a total misread of the macro — and a total refusal to adjust to obvious realities — does not. As we touched on in our secular bullish dollar thesis, the impact of QE is grossly misunderstood (as it is not true ‘money printing’ at all). A lot of the justification used by stuck gold bugs is little more than cargo cult science.

What are the arguments for being long gold and gold stocks at present levels? Let’s consider the big ones:

Because gold and gold stocks are incredibly beaten down and cheap. This is the basic “look at the charts” argument. Anyone who went long commodities in the late 1990s, or long beaten down internet stocks after the dotcom bust, should understand why this is a flawed rationale. At the tail end of the commodity bear market cycle, dirt-cheap commodities became double-dirt-cheap, and then progressed to insanely cheap. Many half-dead dot com stocks, meanwhile, failed to ever come back. A big and gruesome downtrend is not automatically a reason to buy. You need logical justification as to why your purchase is not dead money, or naive investment in a value trap.

Because the Federal Reserve will lose control and all hell will break loose. Really? There should be a statute of limitations on this argument, because how old is it now? The notion that things would spiral out of control actually predates the financial crisis. We are told over and over “Oh it will happen, you just wait.” But the assumptions behind this prediction have proven so flat-out wrong, the prediction itself is worthless. Most predicting a meltdown (or gold meltup or what have you) do not actually understand the mechanism of QE. Nor do they understand the impacts of balance sheet strengths (offsetting weaknesses) or the realities of cost-push and demand-pull inflation.

Because the dollar is doomed. This is just plain stupid. See here and here as to why.

The Best Case Scenario

Is there any plausible scenario that will make gold (and thus gold stocks) attractive again?

Yes — and it looks something like this:

As the US economic recovery accelerates, cost-push inflation picks up. Wages start to rise for the first time in years, even as corporations start increasing spending to increase age-old capital stock. Monetary velocity increases as banks willingly lend to businesses on an expansion and capex replacement track. Consumer borrowing, fueled by optimism and solidified balance sheets, picks up again too. The Federal Reserve observes all this pick-up and holds off on tightening for fear of nipping a young recovery in the bud. Inflationary pressures gain to the point of becoming serious. Still the Federal Reserve holds off. Gold and gold sticks rise in anticipation of inflation getting out of control.

You know what though? Even the best case scenario for gold and gold stocks is still problematic and fraught with problems. If the economy is really improving, for example, there will be more attractive places to invest, and better plays on increased consumer and business spending. There will also be a mood of optimism that detracts from gold’s inherent value as a crisis play. And the cycle of progression from too-low inflation (what we have right now outside risk assets) to benign inflation to frighteningly high inflation is likely to take a long, long time to play out — we’re talking multi-year time horizon, i.e. much longer than the magical thinking “wake up and suddenly it’s inflationary” type assumptions current goldbugs desperately cling to.

…And the Worst Case Scenario

So the best case scenario for gold and gold stocks really isn’t that great. Note too that gold and gold stocks won’t really benefit from a return of macro-economic crisis, because gold has proven itself to be a speculative “risk on / risk off” asset just like any other. If risk assets across the board get whacked again, so too will the yellow metal. On a broad level gold and gold stocks are showing their true colors to be somewhat like those of the S&P 500 VIX Short-Term Futures ETN, (VXX) — a freaking horrible asset that is just better left alone in favor of other options in most circumstances.

The worst case scenario, on the other hand, is very, very ugly. It is not at all inconceivable gold prices could fall well back into triple-digits — below $1,000 per ounce — and maybe even as low as $700 per ounce on a mass-capitulation undershoot. Average production cost for gold miners is probably around a thousand bucks, and the more efficient miners are well below that. (Metals Focus analyst Oliver Heathman: “The bulk of mines are still profitable on a cash cost basis at $1,000 an ounce, but not on a prolonged basis.”) These mines have to keep producing to justify their costs, and as the US dollar strengthens and investment rationale softens, gold could simply outright collapse.

If you buy gold here, in other words, you aren’t buying at any kind of valuation floor. You are standing on a very thin crust of soil directly over a quicksand pit.

Drowning in North American oil

And then you have the oil factor…. consider the following:

The flood of North American crude oil is set to become a deluge as Mexico dismantles a 75-year-old barrier to foreign investment in its oil fields.

Plagued by almost a decade of slumping output that has degraded Mexico’s take from a $100-a-barrel oil market, President Enrique Pena Nieto is seeking an end to the state monopoly over one of the biggest crude resources in the Western Hemisphere. The doubling in Mexican oil output that Citigroup Inc. said may result from inviting international explorers to drill would be equivalent to adding another Nigeria to world supply, or about 2.5 million barrels a day.

Mexico’s landmark decision to open up its oil industry to foreign companies could be the nail in the coffin for gold bugs. What do Mexican oil and gold have to do with each other you ask? Mexico’s liberalization of its oil sector is part of a wider trend in new sources of oil supply, a trend that should put pressure on commodity prices and inflation. And there is nothing that gold hates more than low inflation. - Bloomberg, North America to Drown in Oil as Mexico Ends Monopoly

And this for good measure:

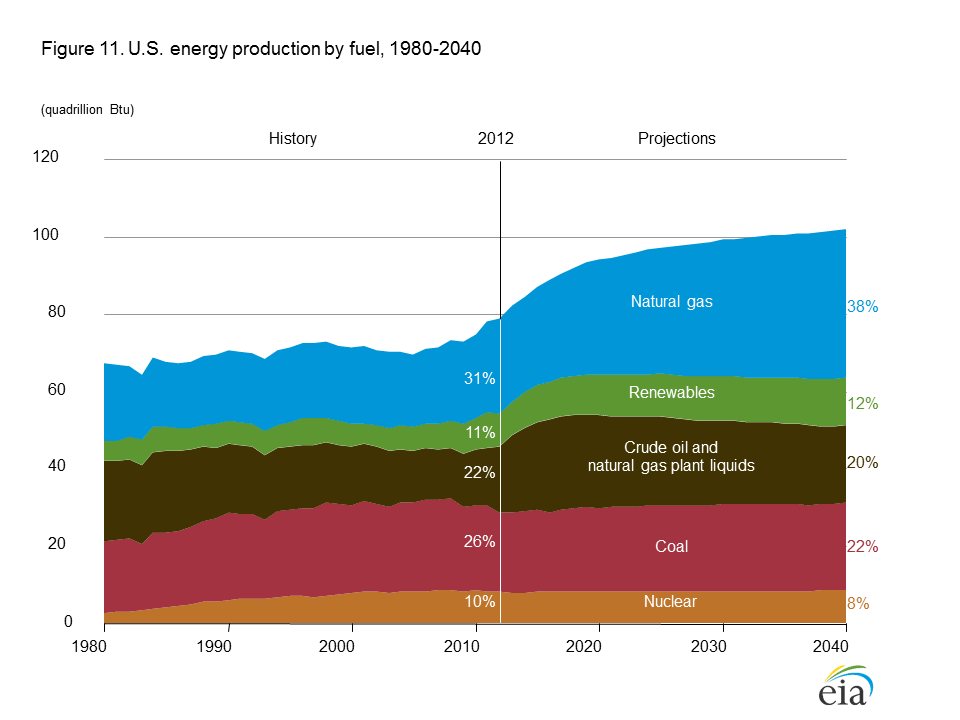

The U.S. is on track to reach records for crude-oil production by 2016, as hydraulic fracturing and horizontal drilling techniques continue to unlock oil in shale rock.

The renaissance in the oil sector feeds into the debate of whether the U.S. should allow crude oil to be exported freely. The U.S. has kept a lid on oil exports since 1973, when the Organization of the Petroleum Exporting Countries stopped selling crude to the U.S. in retaliation for its support of Israel in a war with Egypt and Syria.

The rising U.S. production “will weigh heavily on oil prices,” said Ed Morse, head of commodity research at Citigroup. He said he believes that in the second half of the decade the global benchmark price will be $15 a barrel below where it is now. - WSJ, US May Reach Records for Crude Oil Production by 2016

The Mexican oil rush is already on, with private firms banging on the doors.

Jose Antonio Prado, a former Pemex official, said of the recent measures: “The Mexican state will be able to incorporate private participants in projects that are already in force as well as new opportunities. I can’t tell you the amount of banks and investment funds coming from the U.S. and Europe that have been talking to us and are trying to have an expectation of what’s going to happen with the energy reform. All those guys are going to be in Mexico next year in various forms trying to seek new opportunities.”

As for the United States outlook, the EIA (Energy Information Administration) expects the U.S. to become a net exporter of crude oil by 2018.

Even in the Middle East, where the “geopolitical premium” has been constant in recent years, Iran is starting to look like a more reliable source of oil. Stabilization on the US-Iran axis also increases the odds of stable flow from Iraq, a major oil source. The deal between the U.S. and Iran regarding its nuclear program could lead to another million barrels of oil a day reaching the market in the medium-term.

Oil is a Form of Goldilocks Stimulus

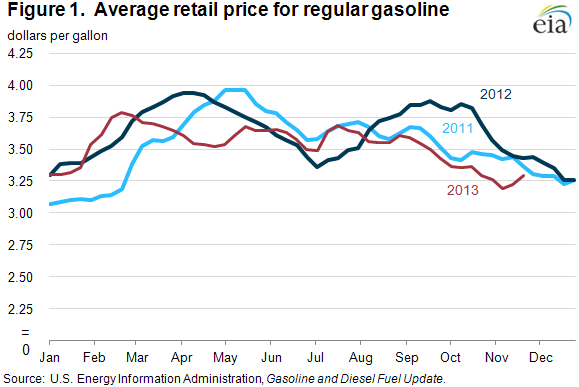

Think of oil as a form of goldilocks stimulus. The more oil that comes online, the better positioned the US becomes to deliver low-inflation economic growth. Cheaper oil means lower transport and production costs for US companies. Cheaper oil also acts as a stimulant to consumers via lower prices at the pump.

According to Deutsche Bank, a $10 fluctuation in oil prices translates to a 25 cent fluctuation in the retail price of gasoline. Each penny of increase or decrease in the price of gasoline equates to $1.4 billion in household energy consumption. A drop in oil prices to $90, or better yet to $80, would amount to a massive stimulus package for American consumers. Gasoline prices are already below where they were this time of year in 2011 and 2012.

What is so interesting about this “energy stimulus package” is that it should not have an inflationary effect — or at best a dampened inflationary effect — as increased consumer spending would be offset by declining energy prices.

In a way, this could be as close as the Fed and federal government ever get to a free lunch. A stimulus package which doesn’t raise inflation prospects or worsen the deficit, imagine that! The U.S.’ strength as an energy producer — and as eventual oil exporter — should also help push up the dollar, putting further pressure on oil and gold prices in a virtuous cycle.

Abundant energy is a game changer…

There are many ways in which energy is a game changer. The ability of the United States to add “energy superpower” to its long list of superlatives — agricultural superpower, technology superpower, demographic superpower, entrepreneurial innovation superpower etc — has a huge amount of embedded economic value.

In respect to gold specifically, the positive outlook for North American energy production increases the odds of a prolonged growth period without debilitating inflation — which is a completely HORRIBLE outcome for the pessimism-fueled precious metals complex.

…and a gold killer

What we are seeing here is essentially a “worst nightmare” confluence of scenarios for die-hard goldbugs like Sprott and co. who are waiting for the US system to implode and the economic world to end. What all of these pessimists have consistently underestimated, or overlooked completely, is the net value of American wealth as juxtaposed against American debt… and in respect to physical and intellectual assets, not to mention agricultural and energy assets, the United States is the richest country in the history of the world, perhaps by a factor of ten. The Federal Reserve may be run by bumblers and Washington populated by fools, but the core strength of the US economic position is so strong, not even the bumblers and the fools could truly dent it.

Growing awareness of this reality could be a nail in the coffin for gold, with the extremely bullish North American energy outlook not just slamming that coffin shut, but dumping it in a six-foot hole and backing a dumptruck full of dirt on top. If you’re long gold or gold stocks out of hope, consider your hope lost.

Disclosure: This content is general info only, not to be taken as investment advice. Click here for disclaimer