The ETF industry has gained immense popularity over the past two decades, growing by leaps and bounds. There are currently over 1,600 exchange traded products listed in the U.S., with almost $1.9 trillion in assets under management.

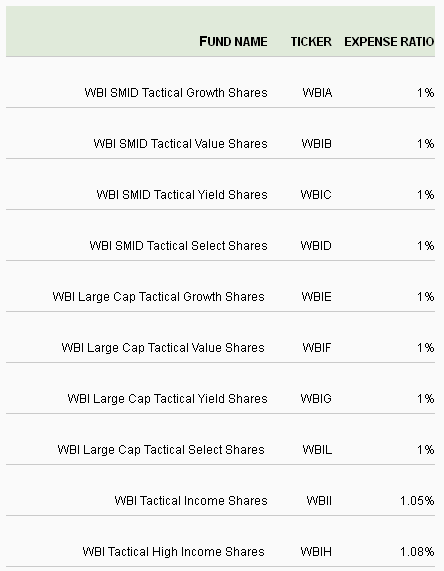

Attracted by this popularity, new players are joining this space with the latest -being the Absolute Shares Trust, the ETF arm of Millington Securities. The issuer has recently launched 10 new actively managed ETFs that are to be sub advised by WBI Investments, an affiliate of Millington Securities.

As per the SEC filing, the newly launched funds seek to follow an absolute return approach to investment management, seeking to provide attractive returns, while minimizing volatility and risk.

The issuer seeks to apply quantitative computer screening to select fundamentally strong stocks with attractive growth opportunities and uses technical analysis to decide the appropriate time for purchase. Moreover, the fund follows a strict stop loss approach and sells a particular security if its price falls below a particular acceptable price range.

The products will invest in multiple asset classes including domestic and foreign securities, as well as equities (such as common stocks, preferred stocks, rights, warrants, convertibles, ETFs and MLPs) and debts (such as U.S. and foreign treasuries, junk bonds and ETNs).

Also, the funds invest in the entire market capitalization of securities (small, mid and large caps) and might use options strategy on stocks as well as on indices.

The issuer seeks to apply the above strategies for all the 10 funds, which are mentioned below:

The issuer follows a unique methodology to select stocks with sound fundamentals and also applies technical analysis to determine the timing of stock purchase.

These unique features might facilitate these multi-asset funds to garner more assets going forward. However, the - the active management approach renders the funds quite expensive.