Small company stocks are down roughly 25% YTD. They’re down closer to 30% from their lofty November 2021 heights.

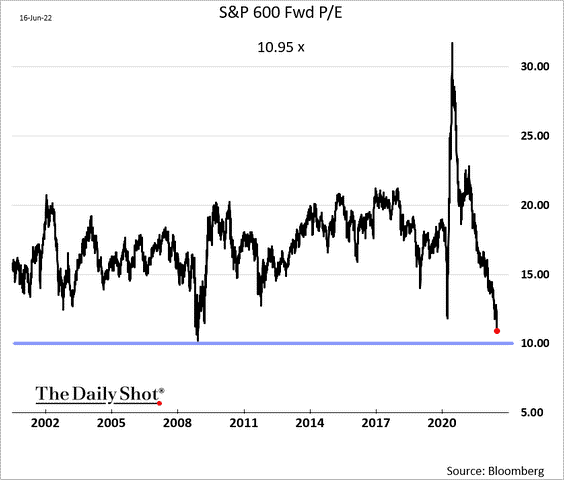

That’s making some folks, including myself, take a second look at overlooked smaller companies listed on the exchanges. On some measures, in fact, small-caps may be starting to look attractive.

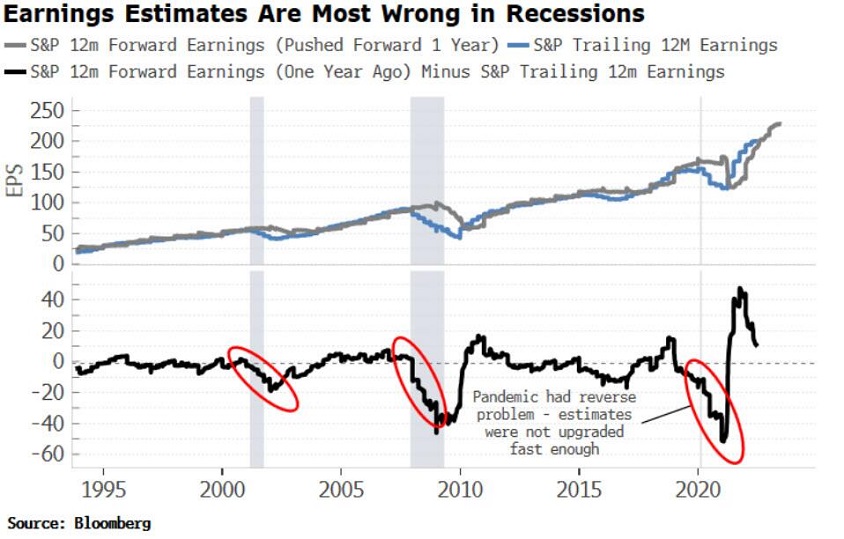

Here’s the problem. Forward earnings “guestimates” tend to be more accurate in times of economic well-being. On the other hand, when recessionary pressures exist, expected earnings 12 months into the future rarely sync up with actual earnings.

Consider the chart below. The black line hovers around zero during periods of economic growth. In recessions, however, actual earnings turn out to be much poorer than what had originally been anticipated. (See the red ovals.)

With revisions to small company profits looming, the “E” in price-to-earnings ratios will push the PE valuations higher. Small company stocks will not be nearly as cheap.

Granted, small caps may be getting closer to an “investable bottom.” Yet, even after significant depreciation, they’re a far cry from bargains.