When they start to move it is hard to stop them. Big, weighty with lots of momentum, the transports are the blood of the economy. Flowing over the road, sea and airway they give the pulse of economic activity. Since December the iShares Transportation Average (NYSE:IYT) has been moving steadily higher with the broad market. But toward the end of February it started to roll over. Problems?

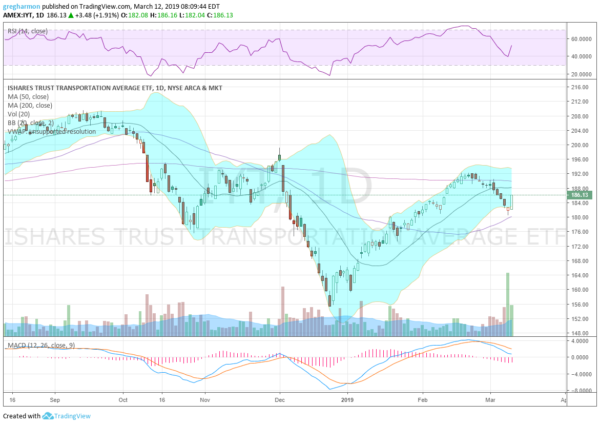

The chart below shows the price action over the last 6 months. Notice that the recent top, a lower high, occurred as it touched the 200-day SMA. A weaker top. But look closer and you will see some real strength. The momentum indicators were flashing overbought signals in February.

And after a 3 week move lower they had reset that momentum. The RSI held in the bullish range on its pullback and the MACD remained positive. These are signs of a digestive move rather than a reversal. The price found support over the 50-day SMA at the end of last week and printed a Hammer candle, a possible reversal.

Monday that confirmed with a strong move higher. Momentum also jumped Monday. Continuation may mean the next leg higher with a move over the February high confirming a target on a Measured Move to 219.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.