It is pretty much impossible to read the financial press without hearing about the “inevitable” Fed rate increase. And of course, “everyone knows that”,

a) the Fed will raise rates and that,

b) this will trigger [insert your worst fear here].

Now I am not making any predictions here myself. I mean on the one hand, with short-term rates hovering around 0% and having done so for some time now, yes, a rise in interst rates does seem fairly inevitable at some point. Still, having been around the block a time or two all I can say is that when “everyone knows” that Event A is sure to happen and that when it does then Event B is sure to follow, well, let’s just say that “things” have a way of not following the script.

Still, it might make sense to start thinking about a potential hike in interest rates. So let’s look at one hypothetical play using options on ticker ProShares UltraShort 20+ Year Treasury (ARCA:TBT), an ETF that trades the inverse of the long-term treasury bond times two (i.e., if the long-term treasury bond falls by 1% ticker TBT should rise roughly 2%).

(Courtesy AIQ TradingExpert)

IMPORTANT NOTE: I am not offering what follows as a “recommendation”, only as an example of one, er, three ways to play.

Trade #1: Near-the-Money Bull Call Spread

The first trade is a close-to-the-money bull call spread buying the Dec 43 call and selling the Dec 48 call.

Figure 2 – TBT Dec 43-48 Bull Call Spread

(Courtesy www.OptionsAnalysis.com)

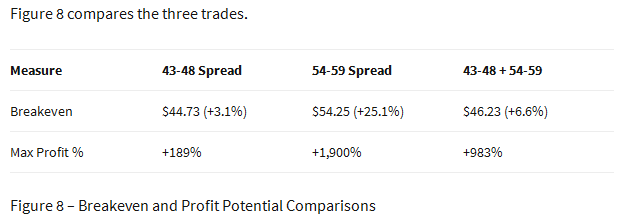

The good news for this trade is that TBT needs only to rise 3%+ in order to exceed its breakeven price of $44.73. The bad news is that the profit potential is capped at 189% even if rates (and by tension ticker TBT) were to rise substantially.

Trade #2: Far-Out-of-the-Money Bull Call Spread

The second trade is a far out-of-the-money bull call spread buying the Dec 54 call and selling the Dec 59 call.

The good news for this trade is that the profit potential is +1,900%. The bad news is that the breakeven price (at December expiration) is 25% above the current price (although a rise in TBT in the near term might create a profit opportunity).

So from these two examples a trader has to either choose “Higher probability and lower profit potential” or “Lower probability and higher profit potential”. But before “choosing” let’s look at one alternative.

Trade #3: Combining Near and Far Bull Call Spreads

This trade simply involves entering both trades simultaneously in a ratio of 6-to-1 (in other words buying 6 Dec 54-59 spreads for every 1 Dec 43-48 spreads purchased).

As you can see this creates a trade that has a reasonably obtainable breakeven price of $46.23 and substantial profit potential of +983%

Summary

I feel the need to point out the fact that I am not necessarily claiming that right this very minute is the time to get bullish on TBT. It’s been pretty weak for quite some time. But, a) it is sort of near support (maybe) and, b) an interest rate hike is “inevitable” right? (I mean “everyone knows” that – or at least so I am told…repeatedly, ad nauseum, day in and day out, thanks for the update, you can stop now thanks you…..).

Also, I am not claiming that trades 1, 2 or 3 are actually great trades. They are merely examples of limited dollar risk ways to play higher interest rates. Trade 3 offers a tradeoff between reasonable probability (a 6.6% move in TBT is quite often child’s play) and outstanding potential profitability (+983%)

So there are three basic questions for any trader to ask and answer:

1) Will interest rates rise?

2) If rates will rise, how soon will they rise?

3) If rates will rise, how far will they rise?

Depending on your own answers to these questions, the proper course of action for you might be to:

a) Buy a near-the-money bull call spread on TBT

b) Buy a far-out-of-the-money bull call spread on TBT

c) Combine to spread as shown in Figures 5 and 6

d) Take no action at all