The latest sentiment data going around is gathering some buzz as some note that it shows that bearish sentiment is at 6 year lows. This data is used by many as a contrarian indicator and often to very profitable outcomes. I have used it for some very profitable trades as well.

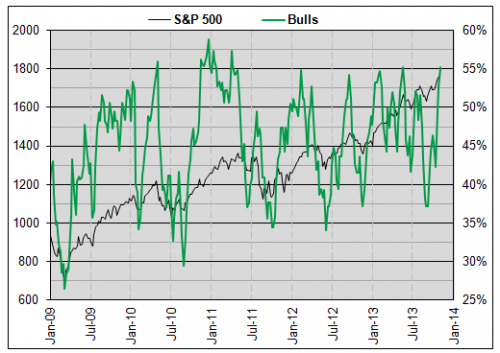

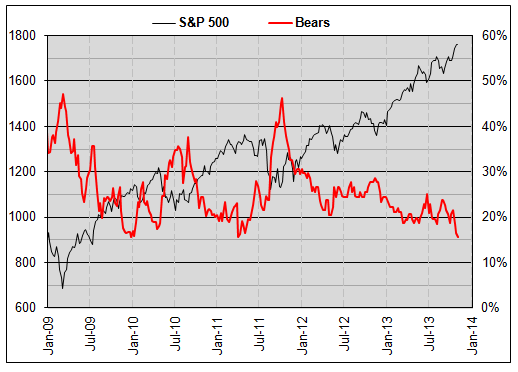

Here are the latest data from Investors Intelligence (II)

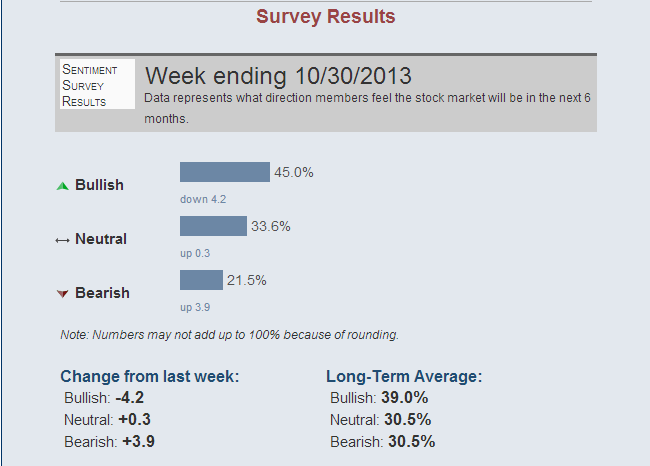

And retail data from the American Association of Individual Investors (AAII)

Both are pretty extreme. Well both are near the limits they have seem before. As my friend Ryan Detrick points out here though, many other indicators are pointing to the market continuing higher. How can this be?

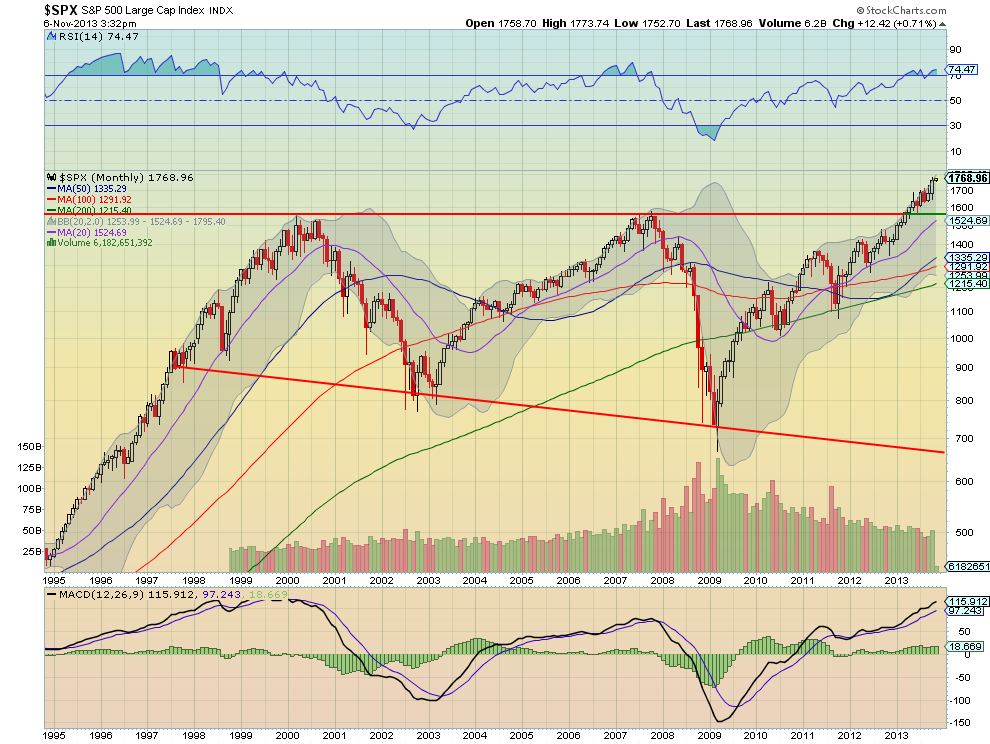

One possibility goes back to the very basics. When markets are rising many are bullish and when they are falling many are bearish. Trading on sentiment signals takes that a step further and looks at extreme measures of sentiment as an indication of a top or bottom. The process we are taught as technicians is that at the extremes the popular view is often wrong and signals a turn. The problem with applying that thinking is that it matters what you are calling extreme. To be more specific, the sentiment rule should be read as: At market extremes the sentiment for pushing the market further is often wrong. This also means that is it o for bullish sentiment to be high and rising in a bull market. The key missing piece in this current situation is that the market is not at extremes. Joe Fahmy on Yahoo Finance Breakout this morning did a great job of explaining this aspect. Look at the month chart of the S&P 500 below. It is just breaking out of a.

multi year range. You could have made an argument that it was at an extreme value when it was approaching the top of that range, but now, well beyond it we know that was wrong. So why is sentiment at the upper and lower bounds with the other market indicators signalling more upside coming? Perhaps, we are just in a strong bull market.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

About That Sentiment Data: Bearish Lows?

Published 11/07/2013, 01:24 AM

About That Sentiment Data: Bearish Lows?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.