MORE ECONOMIC DISAPPOINTMENT FROM JAPAN SEES USD/JPY PERCHED OMINOUSLY ABOVE THE PSYCHOLOGICAL 100 LEVEL.

The urgency of Japans extra budget and the limits of Quantitative Easing were starkly revealed yesterday as the Japanese economy unexpectedly showed 0% GDP growth in the June quarter of 2016. This followed an anaemic growth of 0.5 % in Q1. Market expectations had been for 0.2 percent growth. The slowdown was broad-based as both private consumption, and government spending slowed sharply. Capital expenditure and exports also declined.

This highlights the huge mountain the Abe administration has to climb to break two decades of low consumer confidence and deflation. Indeed whilst all the work has been done on the first two of Abe’s “three arrows,” namely monetary and fiscal stimulus on steroids. We have seen an abject failure on the 3rd arrow, namely structural readjustment of the Japanese economy. Most particularly the labour market, vested monopolistic interests (read farming), protectionism (read farmers again), and most importantly measures to offset the demographic time bomb of a rapidly ageing population. (read immigration)

The saying goes “two out of three ain’t bad,” but in this case, two out of three isn’t good enough. The data above and the tepid reception to the extra budget has led to perhaps an inevitable grinding rally in the JPY as funds are repatriated home. Probably into boxes under the bed!

Admittedly not all of this is Japan’s doing. The Fed is clearly wringing its hands over rate hikes, and it is doubtful this week FOMC minutes will shed any more hawkish light on this. We are now moving full swing into a US Election, and I find it hard to believe the Federal Reserve will hike into that. This has seen the USD come under renewed pressure against most currencies with commodities rallying strongly in USD terms. China stimulus talk and zero interest rates across the world mean hard pressed Japanese savers are repatriating.

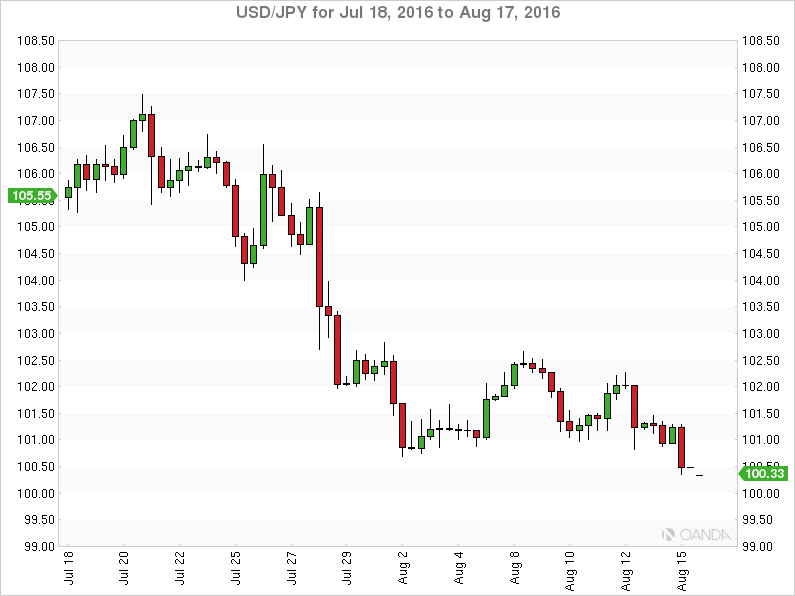

USD/JPY

Today this sees USD/JPY hovering above the psychological 100 level at 100.35 as I write. Most JPY crosses are also under pressure.

USD/JPY has daily support at 100.50 which is looking shaky at the moment. This is followed by 100.00 and then Brexit lows around 99.00.

Resistance is at 101.25 and then 102.00.

The big question is whether the BoJ will overtly intervene on behalf of the MoF at the later levels. I would expect a lot of “watching markets closely” comments from both. However, I feel that large-scale intervention is unlikely given the general risk-on USD negative sentiment out there.

Things aren’t much better on a variety of other JPY charts out there.

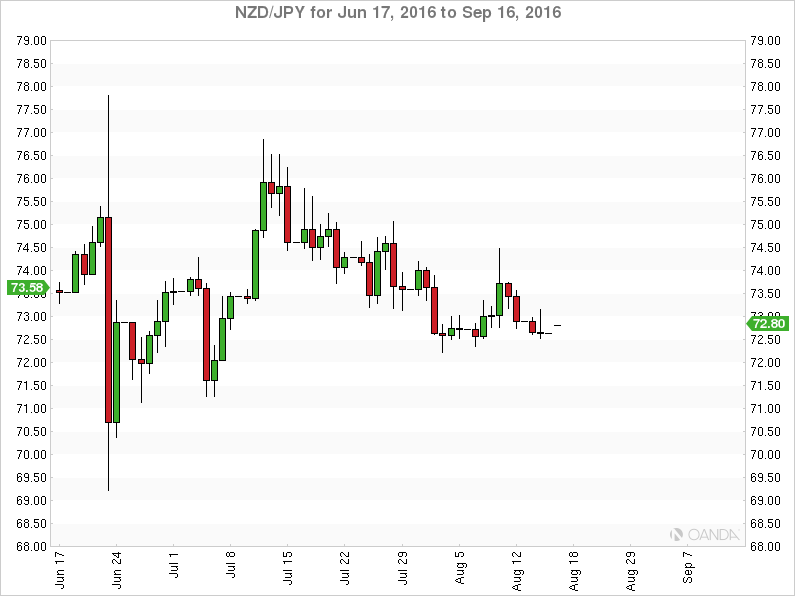

The triangle tells a 1000 words. Resistance at 77.70, 78.50 and then 78.65 top of the triangle.

Support at 77.15 bottoms of the triangle a break of the triangle targeting the 75.00 area.

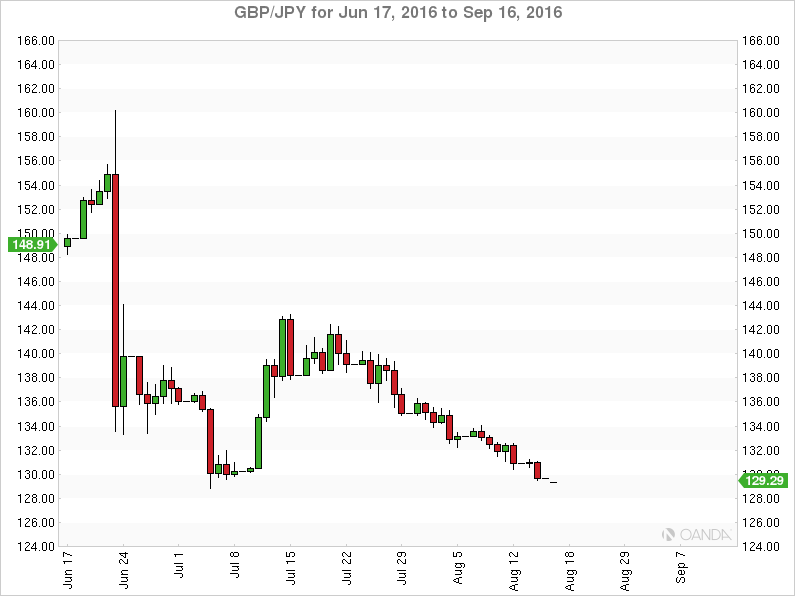

Last support is the Brexit low of 128.75 on the daily chart. Clear air below. The only redeeming thing being the extreme short positioning in GBP/USD out that may save the day for GBP/JPY.

Carry traders rule the roost here for now as the Kiwi’s status as the only G10 with a meaningful yield see the 72.00 area continue to be supported.

In a broad 72.00/78.00 multi-month range. A daily close under 71.25 would be needed to signal more downside ahead.

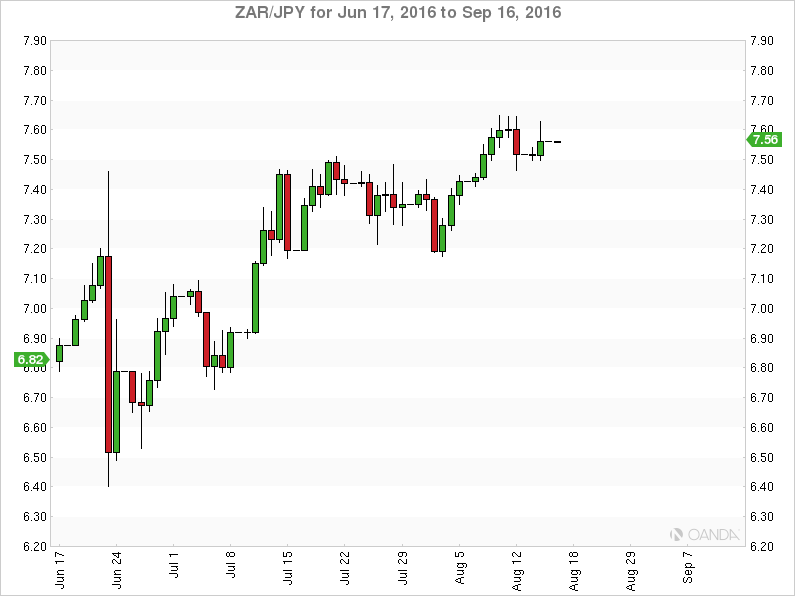

Another favourite carries trade trading sideways as post municipal election euphoria sees ZAR no longer the ugliest horse in the glue factory. This has saved the cross (like NZD/JPY) as USD/ZAR falls and leaves it nicely tucked up in its (mostly) 7.0000 to 7.7000 multi-month range.

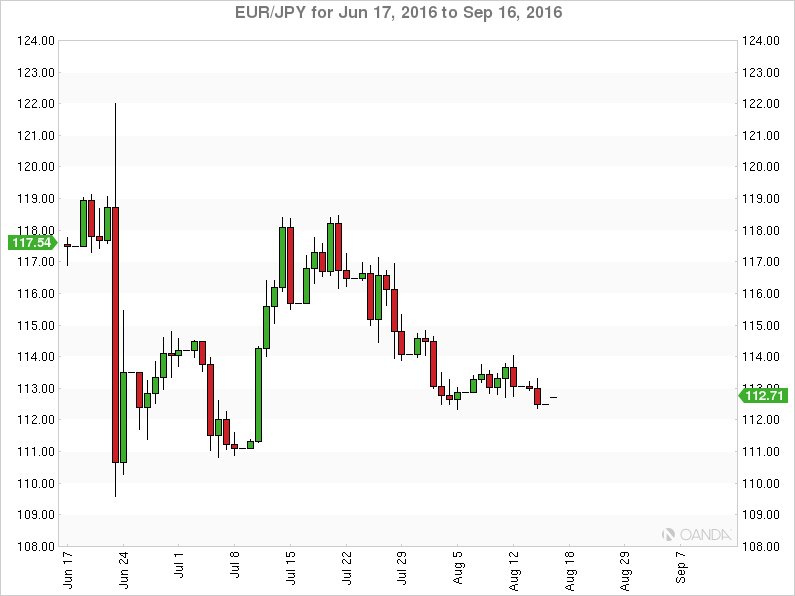

Things are so glossy here on the negative interest rate/ negative interest rate cross. EUR/JPY has daily support here at 112.40, 111.15 and then post-Brexit low at 109.55. Multiday tops at 113.50 are resistance followed by 114.00.

Overall some significant carry trades are marking time, but the majority of XXX/JPY is looking soft on the charts. The market will be closely watching global USD sentiment for further clues in the near term, with the Japanese authorities doing the same no doubt as we approach a Brexit lows.