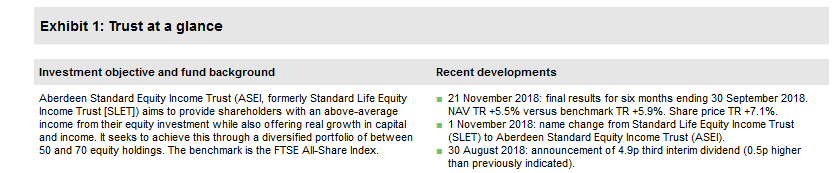

Aberdeen Standard Equity Income Trust PLC (LON:ASEI) (formerly Standard Life Equity Income Trust [SLET]) has been managed by Thomas Moore since November 2011. He is bullish on the long-term outlook for the trust as the yield on the portfolio is the highest since the end of the global financial crisis in 2009, suggesting UK share prices are discounting a recession or another global crisis. The manager says that ASEI’s holdings – chosen from across the market cap spectrum – can be classified in one of three ‘buckets’: global yield (c 40% of the portfolio), domestic opportunities (c 30%) and uncorrelated value (c 30%), and he is finding good opportunities in all three. The trust’s revenue was higher than projected in FY18, leading to an annual dividend increase of 12.3%, which was much higher than the 7.5% compound annual growth rate over the last five years.

Investment strategy: Unconstrained approach

ASEI’s portfolio is constructed on a bottom-up basis, without reference to the benchmark FTSE All-Share index. Moore and his team undertake thorough fundamental research, including analysis of a company’s corporate governance track record, seeking undervalued companies with strong cash flows that can support higher dividend payments. The manager is finding good opportunities in smaller-cap companies; currently, around two-thirds of the portfolio is invested outside of the large-cap FTSE 100 Index. Gearing is permitted in a range of 5% net cash to 15% net gearing (14.3% at end-December 2018).

Market outlook: Equity valuations are supportive

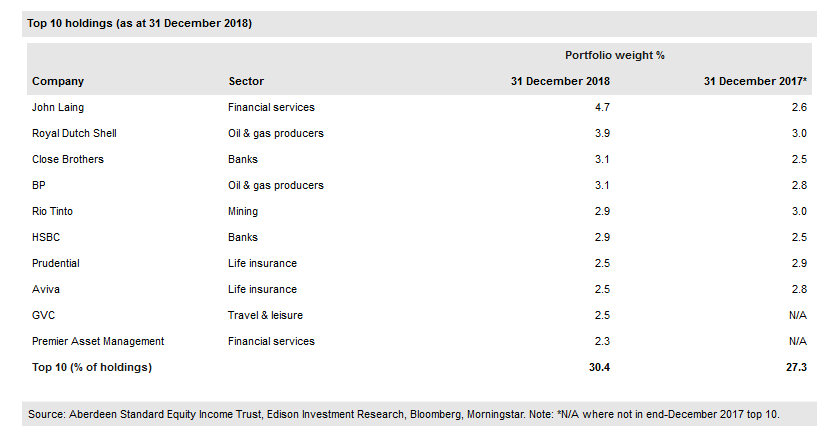

While macro uncertainties exist for UK investors, such as the ongoing Brexit negotiations, so far corporate earnings remain relatively robust, meaning share price weakness has led to more attractive valuations. In absolute terms, UK shares are trading on a lower forward P/E multiple than other developed regions, and their discount to global shares is considerably wider than the five-year average; this backdrop may provide an opportunity for investors with a longer-term perspective.

Valuation: Growing dividend and above-average yield

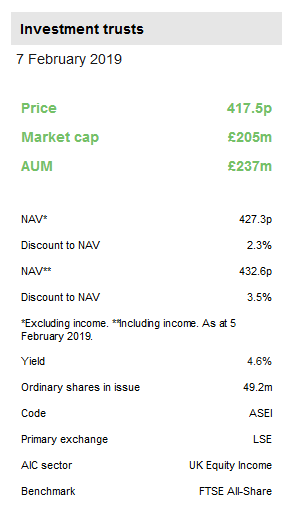

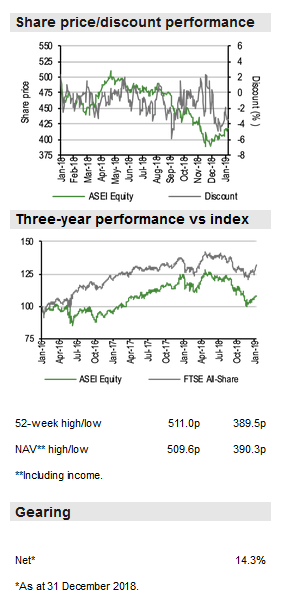

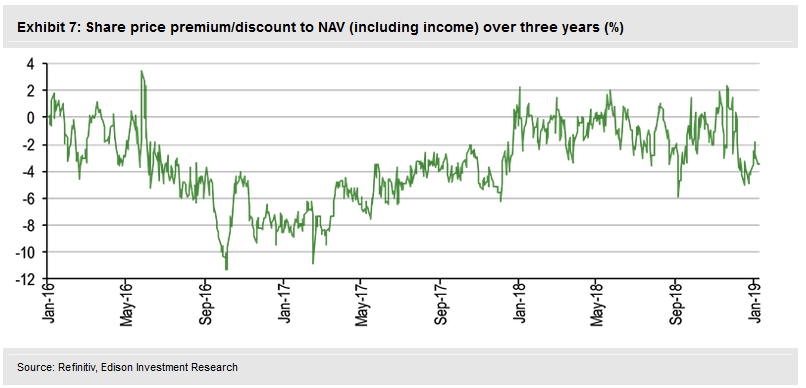

ASEI’s current 3.5% share price discount to cum-income NAV compares with the range of a 2.4% premium to a 5.9% discount over the last 12 months. Its average discounts over the last one, three, five and 10 years are 1.1%, 3.3%, 2.6% and 3.6% respectively. The trust has a progressive dividend policy and its annual distribution has increased in each of the last 18 consecutive years. Based on its current share price, ASEI offers a 4.6% dividend yield, which is above the majority of its peers in the AIC UK Equity Income sector.

Market outlook: Sell-off creating opportunities

Exhibit 2 (LHS) shows the performance of UK indices (large-, mid-, small-cap and AIM) over the last five years. While they have each followed different paths, it is interesting to note all four measures have delivered broadly the same returns over the whole period. During 2016 and 2017, investors in UK equities enjoyed above-average total returns, but 2018 proved to be an environment of much greater stock market volatility as a result of both international and domestic factors. Rising US interest rates as the Federal Reserve works towards normalising its monetary policy and escalating trade tensions are affecting global economic growth, while in the UK, uncertainty around Brexit negotiations is depressing sentiment and curtailing activity. UK equities look relatively attractively valued compared with other developed regions (Exhibit 2, RHS), trading on the lowest forward P/E multiple (a 13.3% discount to global equities versus a five-year average discount of 4.4%) and offering the highest dividend yield by quite some margin. While the investment backdrop remains uncertain, investors with a longer-term perspective may consider that current valuations provide a good opportunity to benefit from any future upturn in economic activity.

Fund profile: Unconstrained UK equity investment

ASEI was launched in 1991 as the Morgan Grenfell Equity Income Trust. Following a change in the manager, the trust was renamed Standard Life (LON:SLA) Equity Income Trust in 2005. Following the merger between Standard Life and Aberdeen Asset Management in August 2017, the board elected to change the trust’s name to Aberdeen Standard Equity Income Trust (ticker ASEI – effective from 1 November 2018). Since May 2012, ASEI has been managed by Thomas Moore (co-manager since November 2011), who follows an index-agnostic approach to investment, aiming to generate above-average income with real (above-inflation) growth in capital and income from a diversified portfolio of UK equities (typically 50–70 holdings). The board believes this unconstrained approach can deliver good long-term returns and sustainable dividend growth. ASEI continues to have a significant overweight in financials, at c 45% of the portfolio compared to c 25% in the benchmark FTSE All-Share Index. Investment guidelines allow a maximum 10% of NAV in a single position, and the aggregate top 10 holdings may not exceed 50% of NAV. Gearing is permitted in a range of 5% net cash to 15% net gearing (14.3% at end-December 2018 versus a historical average of c 10%). The board measures ASEI’s performance against four key performance indicators: NAV total return versus the FTSE All-Share Index; its premium/discount to NAV versus the unweighted average discount of the funds in the AIC UK Equity Income sector; dividend growth versus RPI inflation; and ongoing charges compared with comparator investment vehicles.

The fund manager: Thomas Moore

The manager’s view: UK equity valuations are very attractive

Moore says that ASEI’s unconstrained approach means the trust reaches parts of the market that may not be accessible to other funds. He notes that during 2018, dramatic share price moves led to a tough period of performance for the trust, which continued into the end of the year. Global share prices performed poorly in October and December as there were concerns over economic growth and the Federal Reserve continued to raise interest rates. There was an escalation in the US/China trade dispute, while investors also focused on the lack of progress in Brexit negotiations, the Italian budget and Germany narrowly avoiding recession. The manager explains that ASEI’s portfolio was poorly positioned for this backdrop, where large-cap defensive stocks performed far better than mid- and small-cap stocks. However, he is confident in the trust’s long-term prospects, noting that the weakness in ASEI’s holdings in Q418 was primarily sentiment driven, rather than a result of negative individual company news. This is supported by Aberdeen Standard Investments’ house view that the global economy is experiencing a mid-cycle slowdown, rather than coming to the end of the upcycle.

The manager says the trust is generating strong revenues, which he expects to continue in 2019 and 2020; he notes that historically, revenue estimates have proved to be too conservative. His confidence in ASEI’s revenue generation is based on attractive company valuations. Moore adds that the yield on the portfolio is the highest since the end of the global financial crisis in 2009, suggesting a recession or global crisis would be required to justify current low valuations. The manager highlights the relationship between initial valuations and subsequent total returns: data show that the correlation between a company’s dividend yield and subsequent 10-year total return is c 75%. ASEI has exposure to a number of stocks where valuations are so low and dividend yields so high that Moore is confident in their long-term total return potential. He says that at some point, there will be a recoupling between dividends and share price performance.

ASEI’s holdings can be grouped into three ‘buckets’:

Global yield – this is c 40% of the portfolio and includes resources, industrials and financials with global exposure, such as Ashmore, HSBC and Prudential (LON:PRU). The manager looks for companies with a high and sustainable return on equity and attractive valuations; he notes that there is no shortage of ideas in this ‘bucket’, and if there is a disorderly Brexit, he expects these stocks to perform relatively well.

Domestic opportunities – this is c 30% of the portfolio, including stocks in the homebuilding, retail and support service sectors. Moore says these stocks have been out of favour due to Brexit uncertainty, but he is viewing share price weakness in certain companies as attractive opportunities. The manager cites retailer Dunelm, which recently released positive results led by its online business; its share price has rallied meaningfully from its lows in mid-December. Moore believes that once the Brexit fog clears, companies can start to move forward.

Uncorrelated value – this is c 30% of the portfolio and includes companies that do not belong in one of the other two ‘buckets’, such as John Laing Group, which typically generates a return on equity of 15–20%, and Sabre Insurance. The manager comments that people will still need car insurance, regardless of the Brexit outcome.

Moore says it is easy for people to become caught up in the negative Brexit headlines. Looking at the GFK UK Consumer Confidence indices, the perception of the economic outlook is very weak, similar to during the Eurozone crisis in 2011 and the global financial crisis in 2008. However, the measure of households’ current financial situation remains high, similar to 2000, so there appears to be a gap between perception and reality. The manager also notes strength in the Asda Income Tracker, high levels of UK employment, and wage growth running at 3.5%, well ahead of inflation, which he says imply the UK consumer is not in bad shape.

Moore admits his bullish outlook on the UK stock market is a minority view, as there have been big outflows since H116 from both retail and institutional investors. He says this could continue, as the UK appears to be the most hated global equity market. However, if there is a sensible Brexit conclusion, the manager comments that the UK market should be a good place to invest with a longer-term view, given it has plenty of good companies, there is good corporate governance, rule of law and a decent education system.

Asset allocation

Investment process: Unconstrained, bottom-up stock selection

Moore continues to employ the Focus on Change strategy, seeking companies with improving cash flows that will support higher dividend payments, and those with attractive valuations and the potential for a rerating in response to improving fundamentals. Companies considered as possible investments undergo thorough fundamental analysis; an assessment of a firm’s corporate governance track record is an increasingly important element of the research process, as evidence shows that companies aligning their interests with those of shareholders have the potential to deliver above-average total returns. Given the manager’s unconstrained investment approach, sector allocation is a function of individual stock selection, and the trust’s exposures vary significantly versus the benchmark. The manager is able to avoid areas of the market that he considers unattractive.

ASEI’s position sizes reflect Moore’s level of conviction, based on a company’s management team, its strategy, prospects and valuation. He can draw on the wide resources of the Aberdeen Standard Investment team, whose members collectively undertake more than 3,000 company meetings each year. The manager is aware that sometimes the best opportunities are in smaller companies that may be under-researched in the market. Risk is monitored using a proprietary risk modelling system, which includes pre-trade analysis.

At end-December 2018, around two-thirds of ASEI’s portfolio was invested outside of large-cap FTSE 100 companies. Moore explains that companies within the portfolio, in aggregate, generate around 50% of their revenues domestically and 50% overseas. This is a higher percentage of domestic business than the benchmark FTSE All-Share Index, which is skewed by a number of mega-cap international companies. As a result of the manager’s unconstrained approach, the trust may go through periods of relative underperformance versus the benchmark.

Moore explains that following the merger between Aberdeen and Standard Life, the combined UK equity (ex-small cap) team is made up of 16 portfolio managers and analysts, which is the largest since 2002. All FTSE 350 companies (ex-investment trusts) are under coverage and have live valuation targets. Moore stresses the importance of considering where the team’s views are non-consensus, in terms of identifying companies that have the potential to outperform over the long term.

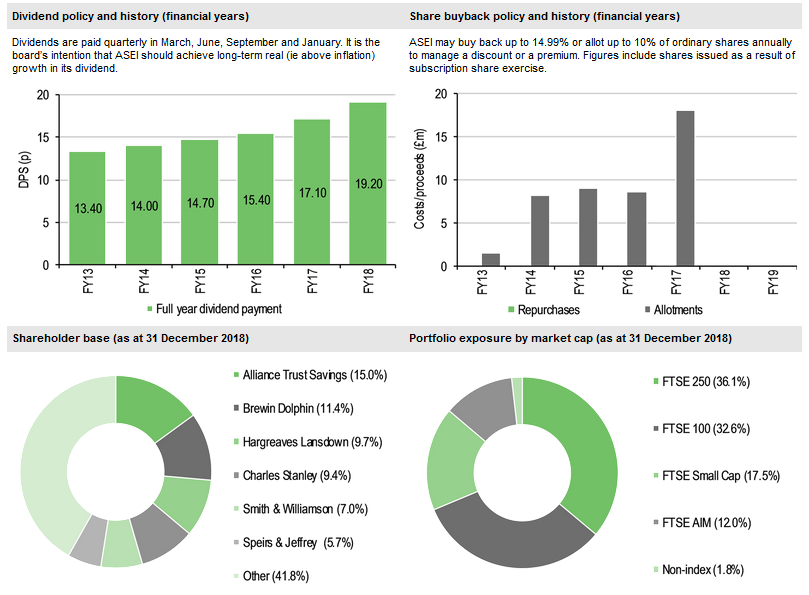

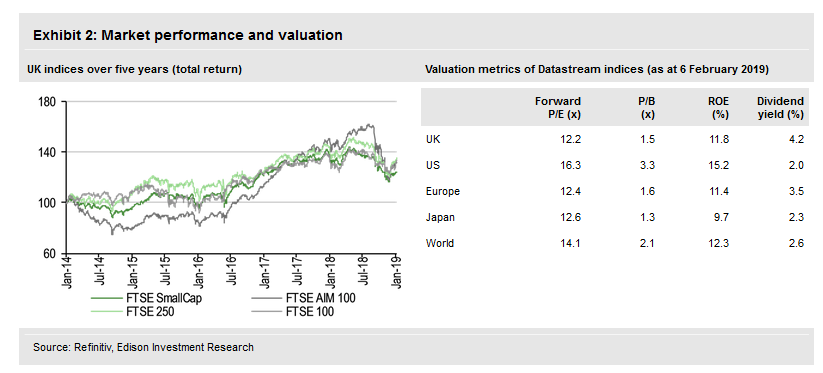

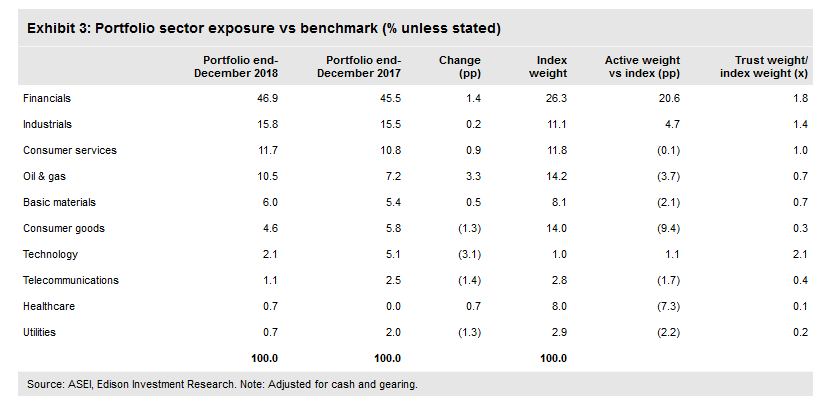

Current portfolio positioning

At end-December 2018, ASEI’s top 10 positions made up 30.4% of the portfolio. This represented an increase in concentration compared with 27.3% a year earlier; eight positions were common to both periods. In terms of sectors, ASEI’s exposure compared with the benchmark is broadly similar to 12 months ago, with a significant (c 20pp) overweight exposure in financials and a c 10% underweight position in consumer goods. In absolute terms, the largest changes are a higher weighting in the oil and gas sector (+3.3pp) and a lower exposure in technology (-3.1pp). Portfolio turnover has been trending lower, and the average holding period is now around four years.

Moore highlights ASEI’s c 10% exposure to the oil & gas sector, which compares to zero exposure in mid-2016. He notes that the major integrated companies are generating higher levels of free cash flow due to improved efficiency and capex discipline; as a result, he is confident the firms will be able to increase their dividend payments. ASEI has five holdings in the sector: BP (LON:BP) and Royal Dutch Shell (LON:RDSa), which both have dividend yields above 6%; energy services firm Wood Group, which has a track record of dividend growth; Diversified Gas & Oil, which is a small US natural gas play with high free cash flow growth; and Tullow Oil (LON:TLW), a new position in 2018, which has dividend growth potential due to a rising free cash flow profile.

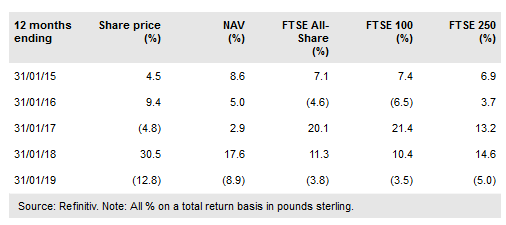

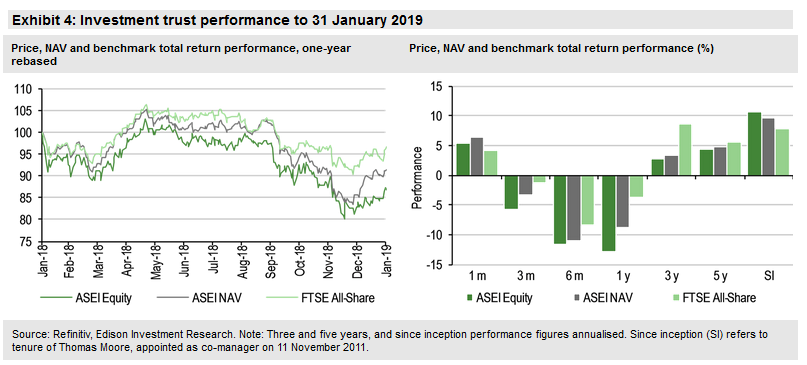

Performance: Outperforming over the long term

During FY18 (ended 30 September), ASEI’s NAV and share price total returns of 5.5% and 7.1% compared with the benchmark’s 5.9% total return. Financial services provided the largest positive contribution, including AFH Financial and Premier Asset Management, which benefited from continued positive inflows. The manager highlights these two companies as high-growth, attractively valued smaller-cap stocks within the portfolio. Inter-dealer broker TP ICAP (LON:NXGN) was the largest performance detractor; it delivered a profit warning due to higher-than-expected costs following the merger between Tullett Prebon and ICAP’s voice broking business. During FY18, there was a wide divergence in the performance of growth and value stocks. The manager explains that this was detrimental to ASEI’s results given its valuation-based investment approach. Moore also notes that companies delivering results below consensus expectations were heavily penalised, compared to more modest share price moves for over-achieving firms.

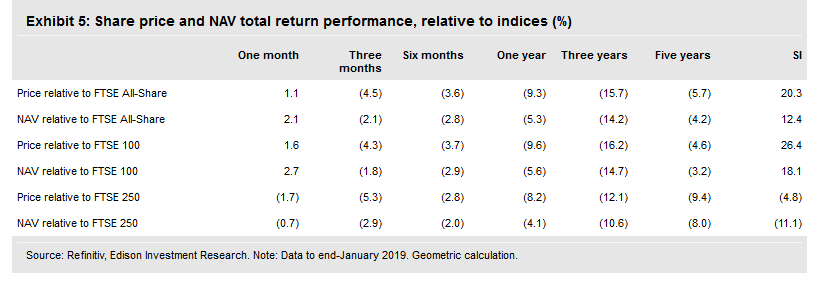

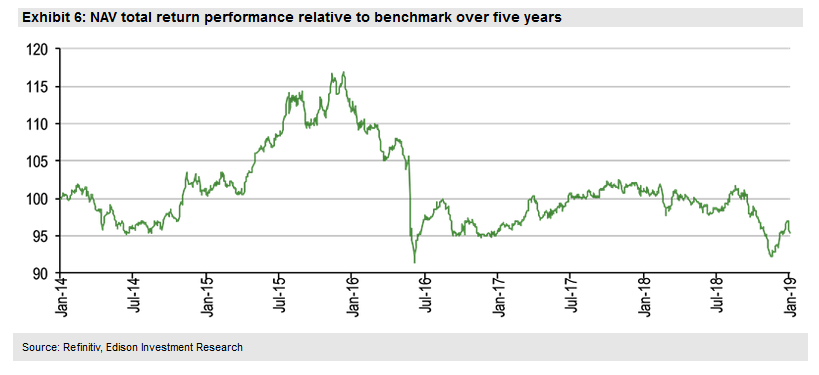

Since Moore was appointed as ASEI’s co-manager on 11 November 2011, he has generated NAV and share price annual total returns of 9.7% and 10.7% respectively, which are ahead of the benchmark’s 7.9% total return. The trust’s relative performance over shorter periods has proved to be more problematic – the shares of companies with domestic operations were particularly weak following the Brexit vote and, more recently, ASEI has been negatively affected by the general stock market volatility that characterised the last quarter of 2018, and the outperformance of highly valued growth stocks. A large negative contributor to performance in recent months has been the trust’s gearing during a falling stock market.

Discount: Trading in a narrow range

Since the end of 2017, ASEI has broadly traded in a narrow range of a 2% premium to a 4% discount. The current 3.5% share price discount to cum-income NAV compares with the 1.1% to 3.6% range of average discounts over the last one, three, five and 10 years.

Capital structure and fees

ASEI is a conventional investment trust with one class of share. There are currently 49.2m ordinary shares in issue. Historically, it had a £30m gearing facility with Scotiabank (Ireland), but this was repaid on 17 December 2018. The trust now has a five-year £40m (£30m drawn) revolving credit facility with Banco Santander (MC:SAN) at a rate of Libor+1%, with an option to increase the loan up to £60m if required. At end-December, ASEI had net gearing of 14.3%.

Aberdeen Standard Investments receives a tiered annual management fee of 0.65% on the first £250m of total assets, and 0.55% on the amount above this level. The fee is charged 70% and 30% to the capital and revenue accounts respectively, reflecting the board’s expectation of the split of ASEI’s long-term returns between capital and income. In FY18, ongoing charges of 0.87% were in line with the prior financial year.

Dividend policy and record

ASEI pays dividends quarterly in March, June, September and January. The total FY18 distribution of 19.2p per share was 12.3% higher than 17.1p paid in FY17 and was 1.15x covered by income. Due to a higher-than-forecast level of revenue during the financial year, it was also 0.5p higher than the indicated 18.7p. The annual increase is well above the 7.5% compound annual rate growth over the last five years (versus 6.0% for the FTSE All-Share index), and also higher than the annual rate of UK inflation over the period. ASEI has now increased its distribution for the last 18 consecutive years. During FY18, ASEI’s earnings per share were 22.06p, which was a 14.7% increase year-on-year, despite a considerable reduction in special dividends received over the period. The manager explains there have been higher dividend payments from the majority of ASEI’s holdings, and he has also been investing in companies with higher-than-average dividend yields. At end-FY18 (taking the final dividend payment into account), revenue reserves stood at 16.5p (+20% year-on-year, and equivalent to c 0.9x the last annual dividend), providing the resources to smooth dividend payments during periods of lower revenue generation.

The board anticipates that the FY19 dividend will be at least 20.2p, which would represent a 5.2% increase versus FY18. Based on its current share price, ASEI offers a 4.6% dividend yield, which compares favourably with the majority of its peers in the AIC UK Equity Income sector.

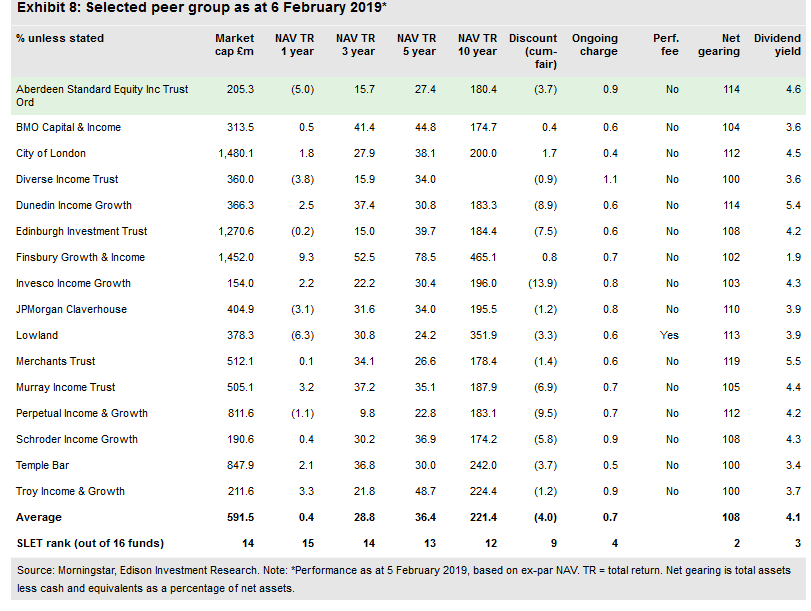

Peer group comparison

Exhibit 8 shows the 16 largest funds in the AIC UK Equity Income sector, with market caps above £150m. ASEI’s NAV total returns are below average over all periods shown. The rankings over the last one and three years primarily reflect a poor period of performance following the UK’s European referendum, and the trust’s cyclical exposure, which was affected by stock market volatility in 2018. ASEI’s discount is narrower than the average and its ongoing charge is modestly above average, although no performance fee is payable. The trust has an above-average level of gearing and an attractive dividend yield, which is 0.5pp above the mean, ranking third out of 16 funds in the selected peer group.