Abercrombie & Fitch Co. (NYSE:ANF) a specialty retailer of premium, high-quality casual apparel, is slated to report first-quarter fiscal 2017 results on May 25, before the market opens. Investors are eager to know whether the company will be able to post positive earnings surprise in the quarter to be reported.

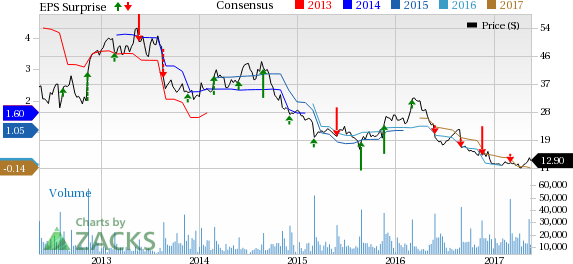

In the trailing four quarters, Abercrombie has underperformed the Zacks Consensus Estimate with an average miss of 30.7%. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The current Zacks Consensus Estimate for the first quarter is pegged at a loss of 72 cents compared with the loss of 59 cents reported in the year-ago period. We note that the Zacks Consensus Estimate loss of 72 cents for the quarter under review has widened by a penny in the past 7 days. Analysts polled by Zacks expect revenues of $651 million, down about 5% from the year-ago quarter.

Factors Influencing this Quarter

Abercrombie remains encouraged by the performance of its Hollister brand. Also, efficient cost management and constant focus on reviving its brands and enhancing performance, bodes well. Further, the company is trying its hands in the online world to boost sales. This is evident from its recent wholesale deal with Asia’s leading online fashion hub ZALORA, which will initially sell Abercrombie’s Hollister brand merchandise.

However, the company has been reeling under headwinds related to soft traffic trends in its U.S. flagship and tourist stores. Also, it remains prone to adverse currency movements, which are expected to persist and hurt fiscal 2017 results. Further, the company expects challenging comps in first-half fiscal 2017.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Abercrombie is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Abercrombie has an ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at a loss of 72 cents. The company’s Zacks Rank #3 increases the predictive power of ESP. However, we need to have a positive ESP to be confident about outperforming the estimate.

Abercrombie & Fitch Company Price, Consensus and EPS Surprise

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Papa Murphy's Holdings, Inc. (NASDAQ:FRSH) has an Earnings ESP of +12.50% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Best Buy Co., Inc. (NYSE:BBY) has an Earnings ESP of +10.00% and a Zacks Rank #2.

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +2.86% and a Zacks Rank #2.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Papa Murphy's Holdings, Inc. (FRSH): Free Stock Analysis Report

Original post