North Chicago, IL-based AbbVie Inc. (NYSE:ABBV) is best known for its autoimmune disease drug, Humira. AbbVie’s flagship product Humira is approved for several indications like rheumatoid arthritis (moderate to severe), moderately to severely active polyarticular juvenile idiopathic arthritis, active psoriatic arthritis, active ankylosing spondylitis, Crohn’s disease (moderate to severe), ulcerative colitis (moderate to severe), axial spondyloarthritis, pediatric Crohn’s disease, chronic plaque psoriasis (moderate to severe), and hidradenitis suppurativa (moderate to severe. Other key products include Imbruvica (cancer) and Viekira Pak (hepatitis C virus (HCV) treatment).

Humira, is a major contributor to AbbVie’s top line. While Humira will remain the key growth driver at AbbVie, the coming quarters will see investor focus remaining primarily on pipeline updates.

Meanwhile, the Pharmacyclics acquisition has diversified AbbVie’s product portfolio with the addition of Imbruvica.

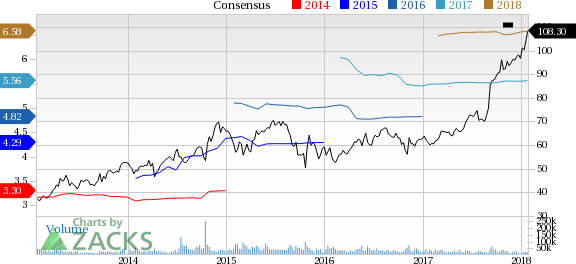

AbbVie’s performance has been impressive, with the pharmaceuticals company delivering positive surprises in the three of the past four quarter while recording in-line earnings in the other. The average earnings beat over the last four quarters is 1.12%.

Currently, AbbVie has a Zacks Rank #3 (Hold), but that could definitely change following the company’s earnings report which was just released. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: AbbVie's fourth-quarter earnings came in at $1.48 per share, beating the Zacks Consensus Estimate of $1.44.

Revenues: AbbVie posted revenues of $7.7 billion, which marginally beat the Zacks Consensus Estimate of $7.6 billion.

Key Stats: Humira sales came in at $4.9 billion, up 12.3% year over year excluding currency impact. Fourth-quarter Imbruvica net revenues were $708 million, up 38.7% year over year.

2018 Outlook: AbbVie updated its outlook for 2018. The company raised its adjusted EPS in the range of $7.33 to $7.43 compared to $6.37–$6.57 expected previously. The Zacks Consensus Estimate is currently pegged at $6.58 per share.

Share Price Impact: Shares rose more than 3% in pre-market trading.

Check back later for our full write up on this AbbVie earnings report.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

AbbVie Inc. (ABBV): Free Stock Analysis Report

Original post

Zacks Investment Research