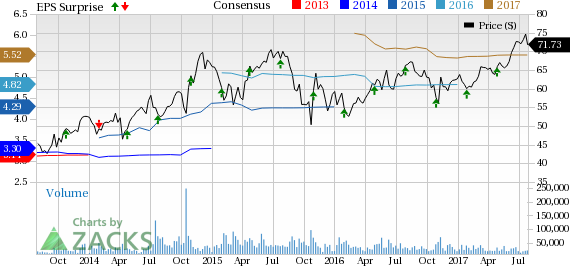

AbbVie Inc. (NYSE:ABBV) reported better-than-expected results in the second quarter of 2017. The company surpassed both earnings and sales expectations.

In the year so far, AbbVie’s shares have rallied 11.8%, thus favorably comparing with the industry’s increase of 9.9%.

The biopharmaceutical company reported second-quarter 2017 earnings of $1.42 per share that marginally beat the Zacks Consensus Estimate of $1.40 per share by 1.4%. Earnings grew 12.7% year over year.

The company posted revenues of $6.94 billion in the reported quarter, which again narrowly surpassed the Zacks Consensus Estimate of $6.93 billion. Revenues also increased 8% year over year. On operational basis, revenue increased 8.9%.

Quarter in Detail

Key drug Humira recorded sales growth of 14.9%, on an operational basis, with revenues coming in at $4.72 billion. Sales in the U.S. increased 18% to $3.2 billion. Humira sales in the ex-U.S. market were up 9.1% on operational basis and 5.5% on reported basis to $1.52 billion. Growth across all three major market categories drove the upside despite increasing competition from new classes of drugs as well as indirect biosimilar competition in international markets.

Second-quarter net revenue from Imbruvica stood at $626 million, up 42.6% year over year. U.S. sales of Imbruvica were $528 million, up 37.6% compared to the year-ago figure. AbbVie recorded $98 million of international profit-sharing with Johnson & Johnson (NYSE:JNJ) .

Other products that delivered an impressive performance include Duodopa, showing revenues of $81 million, up 16% on operational and 12.7% on reported basis. Another product called Creon reported revenues of $196 million, up 9.5% on both operational and reported basis.

HCV product Viekira recorded sales of $225 million, down 14.4% sequentially. Sales were also down on operational and reported basis by 45.9% and 46.4%, respectively, due to intense pricing and competitive pressure in the HCV market.

Adjusted SG&A expenses dipped 2.2% to $1.41 billion while R&D expenses escalated 21.6% to $1.21 billion in the quarter. Adjusted operating margin was 44.6% of sales in the reported quarter.

2017 Outlook

AbbVie reiterated its previously issued outlook for 2017. The company maintains its adjusted EPS in the range of $5.44–$5.54, thus reflecting year-over-year growth of 13.9% at the mid-point.

Zacks Rank & Key Picks

AbbVie currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the health care sector are Eli Lilly and Company (NYSE:LLY) and Sanofi (NYSE:SNY) , both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Eli Lilly’s earnings per share estimates inched up from $4.11 to $4.14 for 2017 and from $4.35 to $4.49 for 2018, over the last 30 days. The company’s shares have shot up 12.9% so far this year.

Sanofi’s earnings per share estimates increased from $3.18 to $3.24 for 2017 and from $3.30 to $3.38 for 2018, over the last 30 days. The company delivered positive earnings surprises in two of the trailing four quarters with an average beat of 5.10%. Shares of the company have risen 18.9% so far this year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Sanofi (SNY): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Original post

Zacks Investment Research