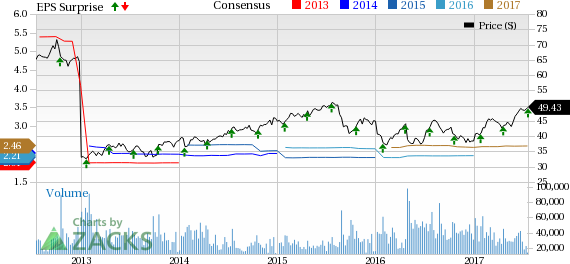

Abbott Laboratories (NYSE:ABT) reported second-quarter 2017 adjusted earnings from continuing operations of 62 cents per share, 3.3% higher than the Zacks Consensus Estimate and up 12.7% year over year. This adjusted quarterly number also remained ahead of the company’s guidance range of 59 cents to 61 cents.

Reported earnings for the quarter came in at 15 cents per share, way below the year-ago number of 40 cents.

Second-quarter worldwide sales came in at $6.63 billion, up 24.4% year over year on a reported basis. This quarterly figure also remains slightly ahead of the Zacks Consensus Estimate of $6.62 billion.

On a comparable operational basis (adjusting the impact of foreign exchange, certain acquisitions and divestments), sales increased 2.9% year over year in the reported quarter.

Quarter in Detail

Abbott Labs operates through four segments – Established Pharmaceuticals Division (EPD), Medical Devices, Nutrition and Diagnostics.

EPD sales were up 4.1% on a reported basis (up 3.5% on comparable operational basis) to $1,021 billion. There was a positive impact of 0.6% on the back of currency fluctuations. Sales in key emerging markets increased 5.8% (up 4.6%), driven by strong growth in Russia, China and several countries across Latin America. However, this positive effect was partially offset by the impact associated with implementation of a new Goods and Services Tax (GST) system in India.

The Medical Devices business sales spiked 89.2% on a reported basis to $2.59 billion. However, on a comparable operational basisexcluding the impact from the favorable resolution of a third-party royalty agreement last year, sales increased 3.2%.

Cardiovascular and Neuromodulation sales soared 189% on a reported basis (up 0.9% on comparable operational basis) on growth in Electrophysiology, Structural Heart and Neuromodulation. Vascular product sales were up 6%, while Structural Heart business grew 9.1% year over yearon a comparable operational basis.

Diabetes Care sales improved 18.7% on a reported basis (up 21.3%), driven by double-digit international sales growth, led by continued consumer uptake of FreeStyle Libre — the revolutionary continuous glucose monitoring system of Abbott Labs.

Nutrition sales slipped 0.6% year over year on a reported basis (up 0.5% on a comparable operational basis). Unfavorable foreign exchange impacted sales by a marginal 1.1%. Pediatric Nutrition sales increased 2.5% on a comparable operational basis. Adult Nutrition sales however, decreased 2% on a comparable operational basis.

Diagnostics sales rose 3.8% year over year (up 5.4% on a comparable operational basis). While Core Laboratory sales increased 6.1%, Point of Care Diagnostics sales grew 8.9%, both on a comparable operational basis. Molecular Diagnostics sales were down 4.1% as strong growth in the infectious disease testing business was partially offset by the planned scale-down of the genetics business.

2017 Guidance

Abbott Labs raised its full-year 2017 guidance. The company forecasts earnings per share from continuing operations to remain within the range of $1.03 to $1.13 from earlier range of 92 cents to $1.02. Adjusting certain net specified items for the full year, the adjusted earnings per share from continuing operations are expected to stay within a band of $2.43-$2.53 (earlier guidance was $2.40-$2.50). The current Zacks Consensus Estimate is pegged at $2.47, at the midpoint of the projected range.

Our Take

One more time, Abbott Labs successfully exceeded the Zacks Consensus Estimate on both earnings and sales front. We are optimistic about the company’s strong and consistent EPD and Medical Devices performance. However, these strong performances were to some extent offset by sluggish Nutrition business.

However, the company stands to benefit from the recently completed acquisition of St. Jude Medical, which has already started offering it an industry leading pipeline across cardiovascular, neuromodulation, diabetes and vision care. Looking forward to achieving synergy benefits, the company has raised its 2017 outlook buoying investors’ confidence on the stock.

In 2017, the company plans to execute its existing operating model which focuses on selling portfolio in core therapeutic areas. This will lead to the creation of unique channel opportunities in differentiated relationships with physicians, retailers and pharmacies, looking to offer a complete line of solutions to treat prominent local health conditions. Also, Abbott Labs has plans to beef up its development capabilities with an expanded EPD innovation center in India.

However, India’s transition to new tax system has significantly hampered growth during the reported quarter. Per the company, if this transitory impact of a new GST could be eliminated, the total EPD sales would have grown in the high-single digits in the reported quarter.

Abbott Labs currently carries a Zacks Rank #2 (Buy).

Stocks to Consider

Better-ranked medical stocks are Mesa Laboratories, Inc. (NASDAQ:MLAB) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . Notably, INSYS Therapeutics sports a Zacks Rank #1 (Strong Buy), while Mesa Laboratories and Align Technology carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Mesa Laboratories has a positive earnings surprise of 2.84% for the last four quarters. The stock has added roughly 8.9% over the last three months.

INSYS Therapeutics has long-term expected earnings growth rate of 20%. The stock has rallied around 24.3% over the last three months.

Align Technology has expected long-term adjusted earnings growth of almost 24.1%. The stock has surged roughly 34.5% over the last three months.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Abbott Laboratories (ABT): Free Stock Analysis Report

Mesa Laboratories, Inc. (MLAB): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research