Rebuffing the demands from an activist investor, ABB Ltd. (NYSE:ABB) has decided to hold on to its Power Grids business. The company insists that revamping the division instead would unlock more value for shareholders, compared to floating, spin-off or sale of the business.

The Swiss engineering giant believes that it can capitalize on budding industry trends like smart grids and linking renewable energy production to consumers.

ABB’s Restructuring Plans

Chief Executive – Ulrich Spiesshofer – has been divesting underperforming businesses regularly since he took the helm over three years ago. Spiesshofer has raised nearly $2 billion in proceeds from such activities.

Last month, ABB took the first major step in the strategic evaluation of its massive Power Grids division. The company has decided to sell its global high-voltage cable system business to NKT Cables in a deal worth about $934 million.The deal is part of ABB’s active portfolio management and will make the core power grids business simpler, stronger, and more focused.

However, the company decided against letting the Power grids business go. Instead, it stated that it will continue to streamline and transform the unit under its own ownership.

The company also intends to consolidate all of its brands globally, over a period of two years. In the process, ABB will fine tune the structure and scope of some of its divisions as well. Further, it raised its targeted cost savings (under a plan launched last year) by 30% to $1.3 billion. It also announced plans last week to buy back up to $3 billion of its shares from 2017 through 2019.

ABB said it will continue its active portfolio management plan, including strategic acquisitions as well as divesting non-core businesses. Importantly, ABB indicated that the restructuring will likely include a strong shift toward digital offerings.

The Standpoint of Activist Investors

Per The Wall Street Journal, two of ABB’s top shareholders — Swedish activist fund Cevian Capital and U.S.-based Artisan Partners — were urging the company to spin off its Power Grids business. The company claims that this step will streamline operations and raise shareholder value.

The fact remains that Power Grids is the least profitable of ABB's divisions, due in part to its participation in low margin projects. Tough competition has also put downward pressure on prices of products like transformers, thus hurting margins.

However, the business is now forming partnerships in order to share the risk on projects. Also, it is focusing more on product supply rather than engineering, procurement and construction management services. Consequently, the unit’s profits have partially recovered this year, helped by improved project execution.

Partnership Deals

The Power Grids business signed three important deals last week. It inked a partnership deal with engineering and construction firm Fluor Corporation (NYSE:FLR) . The deal was signed to cater to the growing needs of power grids worldwide for safe, dependable and state-of-the-art electrical substations. Through the strategic partnership, ABB and Fluor will execute large turnkey engineering, procurement, construction (“EPC”) electrical substation projects.

Further, ABB formed an agreement to partner with Aibel to deliver offshore wind integration solutions. Per the contract, Aibel will be responsible for turnkey EPC services for the design, construction, installation and commissioning of the offshore platforms, while ABB will focus on high voltage direct current technology.

Per ABB, the two new alliances, in addition to greater focus on higher-margin consultancy services and software, will help increase the unit’s margin target to 10-14% (up from a previous target of 8-12%).

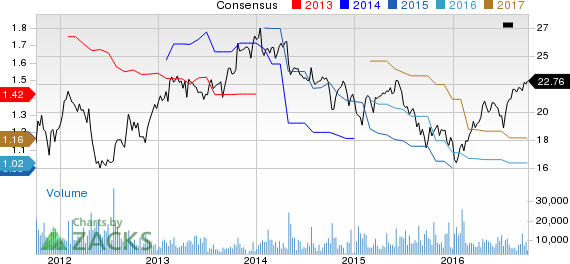

ABB LTD-ADR Price and Consensus

ABB also announced a strategic partnership with Microsoft Corporation (NASDAQ:MSFT) , to shore up its capabilities in the industrial internet market, by combining cloud technology with industrial digital technology.

Such strategic alliances form a core pillar of ABB’s Next Level strategy to drive growth.

Wrapping Up

ABB’s decision to retain the Power Grids unit reflects the company’s conviction that the business can gain significantly from the worldwide shift from a centralized fossil fuel power system towards renewable energy. This will boost demand for complex electricity distribution systems, thus unlocking huge growth opportunities for the unit.

However, ABB could now be under pressure to improve the performance of Power Grids business fast.

Other Stocks to Consider

Another company in the same space as ABB is AO Smith Corp. (NYSE:AOS) . This commercial and residential water heating equipment manufacturer has a robust earnings beat history, with an average positive earnings surprise of 6.3% over the trailing four quarters, beating estimates all through.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

MICROSOFT CORP (MSFT): Free Stock Analysis Report

FLUOR CORP-NEW (FLR): Free Stock Analysis Report

ABB LTD-ADR (ABB): Free Stock Analysis Report

SMITH (AO) CORP (AOS): Free Stock Analysis Report

Original post