Every year for the past 3 years, scores of pundits have predicted the demise of high yield bonds. Reasons have included record low yields for the asset class, an imminent rise in interest rates, questionable balance sheets, recession, inflation and overvaluation.

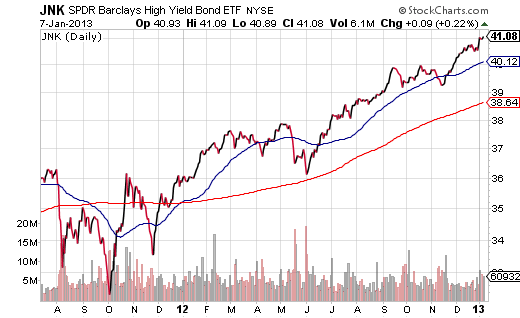

In spite of gloomy forecasts, Morningstar revealed that high yield bonds have averaged 10.5% annually over the past 3 years. Perhaps ironically, this fact in and of itself is causing many to recommend abandoning funds like SPDR High Yield Corporate Bond (JNK).

Granted, the Federal Reserve’s bond-buying policies have inflated a Treasury bond balloon. Should the world lose confidence in the U.S., our currency or our economy, the balloon could deflate or burst…and that would send diversified high yield corporates into a tailspin.

Of course, the very same occurrence would almost assuredly smack down everything on the income spectrum; price declines would occur in convertibles, preferreds and dividend stocks. In fact, an undesirably rapid rise in rates would probably hurt common stocks of all sizes and shapes, since the U.S. economy would fret the loss of consumer spending power.

In other words, a massive sell-off in high yield bonds is unlikely to occur in a vacuum. If and when the markets do not like this particular asset class, the event would be precipitated by one of two general scenarios: (1) Investors sell intermediate Treasuries and intermediate-term investment grade corporates, causing yield spreads to contract and all income producers to fall in price, or (2) Investors sweat the global economy causing a sell-off in risk assets like common stocks; high yield bonds would be dumped, though decline less than stocks.

While the scenarios may be realistic, central banks around the world are still committing to conventional and unconventional easing. Moreover, the powerful tailwind is not destined to disappear overnight. It follows that any popping of a bond bubble would be seen in simple-to-monitor charts.

Is SPDR High Yield Corporate Bond (JNK) overbought? Sure, in the same manner that all risk assets are currently at the higher end of Relative Strength Index (RSI) readings and currently sitting at high single-digit percentages above 200-day trendlines. Nevertheless, until key trendlines or stop-limit loss orders hit, I would not sell existing high yield corporate bond ETF positions.

Putting cash to work is another matter. If intermediate-term high yield corporates pull back, I’d consider an allocation. Absent that, I am more intrigued by income producers that aren’t necessarily “oversubscribed.” Market Vectors Preferred Ex Financials (PFXF) with its approximate annual distribution yield near 6.0% fits the bill.

Another reasonable asset is shorter-term high yield corporates. For example, the Guggenheim BulletShares 2017 High Yield Corporate (BSJH) is a diversified basket that you can expect to mature in 2017. The SEC 30-day of 5.0% is likely to perform as a cash flow generator with limited volatility.

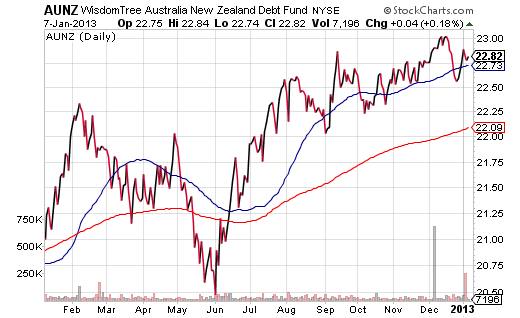

Finally, for those who believe that the safest debt in the world may reside in Australia and New Zealand, there’s the WisdomTree Australia and New Zealand Debt Fund (AUNZ). The 2.9% distribution yield alone may not seem all that appealing to yield hunters. On the other hand, modest capital appreciation in these country’s currencies could easily provide an attractive total return.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Abandoning High Yield Bond ETFs? Rethink Your Premises

Published 01/08/2013, 02:42 AM

Abandoning High Yield Bond ETFs? Rethink Your Premises

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.