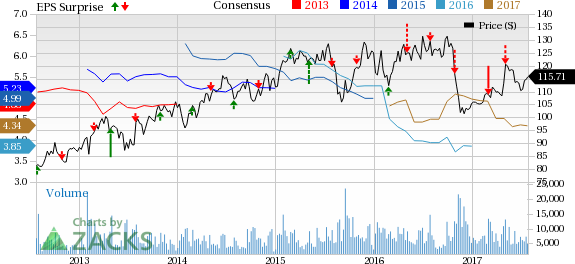

World’s largest brewer Anheuser-Busch InBev SA/NV (NYSE:BUD) , also known as AB InBev, missed the earnings estimate of analysts polled by Zacks for the sixth straight quarter, when it posted second-quarter 2017 results. The company’s bottom-line also declined year over year. Moreover, revenues also missed the estimate after beating the same in the trailing two quarters. Lower-than-expected earnings performance in the past few quarters has hurt the stock in the past one year. AB InBev’s stock has declined 8.2%, wider than the industry's marginal decline of 0.4%.

The lower-than-expected bottom-line result can largely be attributed to persistent weakness in Brazil and negative impact of mark-to-market adjustment. In fact, the company stated that Brazilian economy is recuperating at a slow rate. Nonetheless, management remains positive about Brazil’s performance in the long run, as it anticipates recovering revenues in the country, this year itself.

Q2 Highlights

Normalized earnings per share of 95 cents decreased 10.4% from $1.06 earned in the year-ago quarter and also lagged the Zacks Consensus Estimate of $1.14.

Revenues for the quarter advanced 31.2% to $14,182 million but missed the Zacks Consensus Estimate of $14,434 million. Further, the company registered organic revenue growth of 5.4% on the back of a 4.1% rise in revenues per hectoliter (hl) on a constant geographic basis. This improvement resulted from ongoing revenue management and premiumization in markets like Western Europe and China, along with robust performance by superior brands. Further, revenues per hl advanced 3.6% on a reported basis.

Moreover, consolidated revenues for the company’s three global brands, namely Budweiser, Corona and Stella Artois, increased 8.9% in the reported quarter. Global brands revenues for the quarter comprised 16.6% growth at Corona, a 6.6% rise in Stella Artois and a 5.7% upside at Budweiser.

Total volumes inched up 1%, including a 2.1% increase in the beer volumes. Gains from volume growth in South Africa, Mexico and Australia were offset by volume declines witnessed in Columbia, Brazil and the U.S.

Cost of sales escalated 28.9% year over year to $5,444 million, while organically the same increased 3.2%. Organic cost of sales per hl rose 1.3% due to negative foreign currency translations, partly compensated by synergies, efficiencies and procurement savings. On a constant geographic basis, cost of sales per hl increased 2.2%.

The company’s normalized earnings before interest, taxes, depreciation and amortization (EBITDA) surged 33.5% year over year to $5,354 million, while growing 11.8% on an organic basis – on the back of cost synergies and robust top-line growth. This was partially curbed by the increased cost of sales. EBITDA margin expanded 70 basis points (bps) to 37.8%, while organically, the same increased 238 bps.

Other Developments

Management stated that it is well on track with SABMiller’s integration, and realized synergies worth $335 million in this regard, during the second quarter.

Also on Apr 12, the company announced that it has concluded the sale of its indirect stake in Distell Group Limited to Public Investment Corporation (SOC) Limited in order to win the South African Competition Tribunal’s sanction for its deal with SABMiller (LON:SAB).

Outlook

Following the quarter, management reiterated previously issued outlook for 2017. Owing to greater volatility in some of its core regions, AB InBev still projects revenues growth in 2017 to be backed by robust growth of global brands and its commercial plans, including revenues management initiatives.

For 2017, AB InBev continues to expect cost of goods sold per hl, on a constant geographic basis, to increase in the low-single digits range, in spite of adverse currency movements and premium brand growth. Selling, general and administrative (SG&A) expenses are estimated to remain flat, driven by savings in overhead costs that will be reinvested to boost strength of its brands. Management now expects normalized effective tax rate for 2017 in the range of 22–24%, compared with previous expectation of 24–26%.

Additionally, AB InBev anticipates incurring nearly $3.7 billion as net capital expenditure for 2017. Also, the company expects dividend growth to be modest in future.

AB InBev currently carries a Zacks Rank #3 (Hold).

3 Hot Picks in the Beverage – Alcohol Space

Heineken NV (OTC:HEINY) , sporting a Zacks Rank #1 (Strong Buy), has long-term earnings per share growth rate of 8.9%.You can see the complete list of today’s Zacks #1 Rank stocks here..

The Boston Beer Company, Inc. (NYSE:SAM) has reported better-than-expected earnings in the trailing three out of four quarters, with an average beat of 30.6% and it carries a Zacks Rank #2.

Constellation Brands Inc. (NYSE:STZ) , with long-term earnings per share growth rate of 18.2%, flaunts a superb earnings surprise history. The stock carries a Zacks Rank #2.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Constellation Brands Inc (STZ): Free Stock Analysis Report

Anheuser-Busch Inbev SA (BUD): Free Stock Analysis Report

Heineken NV (HEINY): Free Stock Analysis Report

Boston Beer Company, Inc. (The) (SAM): Free Stock Analysis Report

Original post

Zacks Investment Research