Dutch divestment

AAP Implantate AG, (AAQG) has successfully executed the sale of the contract manufacturing business for €18m. This will allow aap to increasingly focus on the key growth areas of trauma and bone cements. Performance of these business units should become more transparent, with the cash facilitating both internal and potentially external high-growth opportunities to now be more actively pursued. Our forecasts are under review pending full details of the transaction implications, expected with FY13 results on 31 March.

Executing on strategy to simplify and specialise

The Dutch-based contract manufacturing business (EMCM) has been sold to a private equity firm for €18m, representing 1.5x 2013 sales and around 9x EBITDA. aap had previously highlighted that strategic options for this business were being evaluated as part of the strategy to simplify the business and concentrate on the key growth areas of trauma, driven by Loqteq, and bone cements.

Pipeline patent: Every cloud has a silver lining

Beyond Loqteq, aap is working on a number of trauma pipeline opportunities, including silver-coated trauma plates to reduce infection and biodegradable magnesium implants for small bone fractures. aap recently received a “notice of allowance” in the US for the silver coating patent, implying that the USPTO will grant the patent. Data from the ongoing initial preclinical trial are expected in Q214 with potential market launch in 2015.

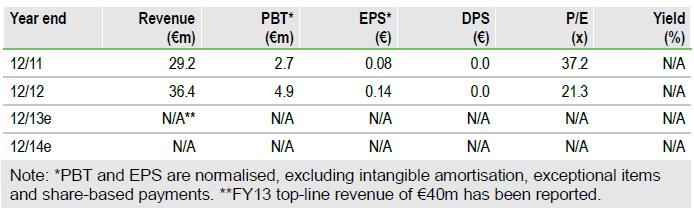

Financial forecasts withdrawn pending FY13 results

The financial implications of the EMCM divestment will be disclosed with FY13 results on 31 March. Previous 2014 guidance, with which we were in line, is no longer valid and we have withdrawn our financial forecasts. Reported top-line 2013 sales of €40m and EBITDA of around €7m are intact and in line with our previous forecasts, although €12m of EMCM sales will now appear as a discontinued operation. Adjustments to tangible and intangible assets will affect depreciation and amortisation, and hence 2013 EBIT, EBT and net profits.

Valuation: Withdrawn pending updated financials

Our previously published valuation was €100m or €3.3/share, based on 2012-15 revenue CAGR of 10% and a doubling of sales to around €80m by 2020, driven by Loqteq, with EBITDA margins expanding around 200 basis points over the next two to three years. Our financial forecasts are withdrawn pending FY13 results.

To Read the Entire Report Please Click on the pdf File Below