The success of the SEK82.5m rights issue which was oversubscribed leaves AAC Microtec well positioned to continue to pursue the growth opportunities in the small satellite market. The company has had four satellites deployed so far this year and order activity appears robust. However, there is of course a dilutive effect from the rights which we have reflected in our estimates. We will update our numbers further alongside the H119 results on 22 August 2019.

Rights issue adjustment to earnings

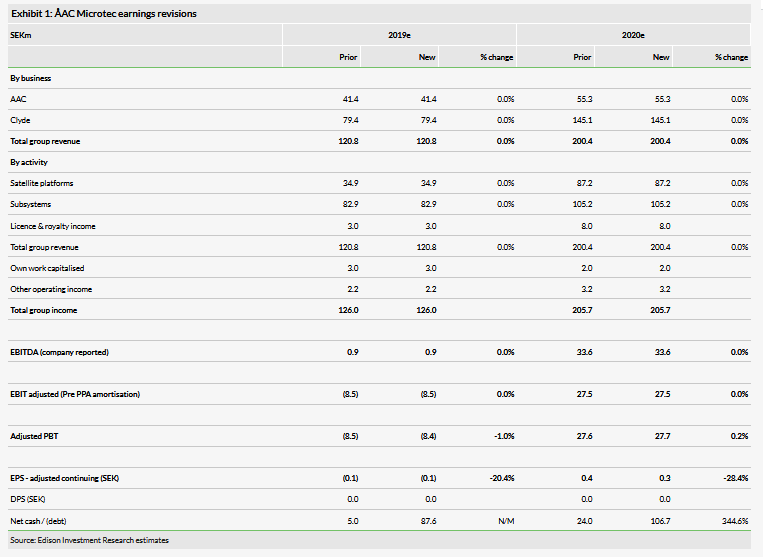

The successful two-for-five rights issue at SEK3.0 per share raised SEK82.5m for AAC Microtec before issue costs. The funds raised provide working capital flexibility for the company’s continued growth, as well as pursuing other “New Space” M&A opportunities should they arise. We assume the cash raised has only a modest benefit on interest income, so the dilutive effect on EPS in FY20 is around 28%. We have also adjusted all historic and the current year EPS to reflect the notional bonus element of the issue, as is normal practice.

Small satellite market remains busy

Half a century after NASA put a man on the moon, advances in micro-technology and computing are driving the small satellite revolution. AAC Clyde Space is well positioned to benefit from the growing trend in the deployment of constellations of nanosatellites in low earth orbit to replicate applications previously limited to larger geostationary earth orbit satellites. So far in 2019, AAC Clyde Space has deployed four satellites and order development appears encouraging for both satellite platforms and subsystems. We would expect the first batch order for constellations to be won before the year end, given the proposed schedules of existing customers. We will of course reassess prospects when the company reports its H119 results.

Valuation: move to profitability envisaged

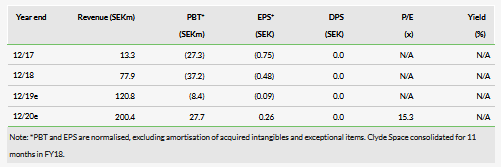

We still expect AAC Microtec to deliver positive cash flow and earnings in FY20, but this is contingent on booking initial constellation orders before the end of 2019, as well as successful recruitment of appropriately qualified staff. Based on our current estimates, ÅAC is trading on an FY20e P/E of 15.3x, which given anticipated volume growth in the next decade appears undemanding.

Business description

Based in Sweden, ÅAC Microtec is a world leader in nanosatellite end-to-end solutions, subsystems and platforms after merging with Clyde Space in Scotland. The merged company also supplies a range of technology components to other small satellite manufacturers globally.

Investment summary

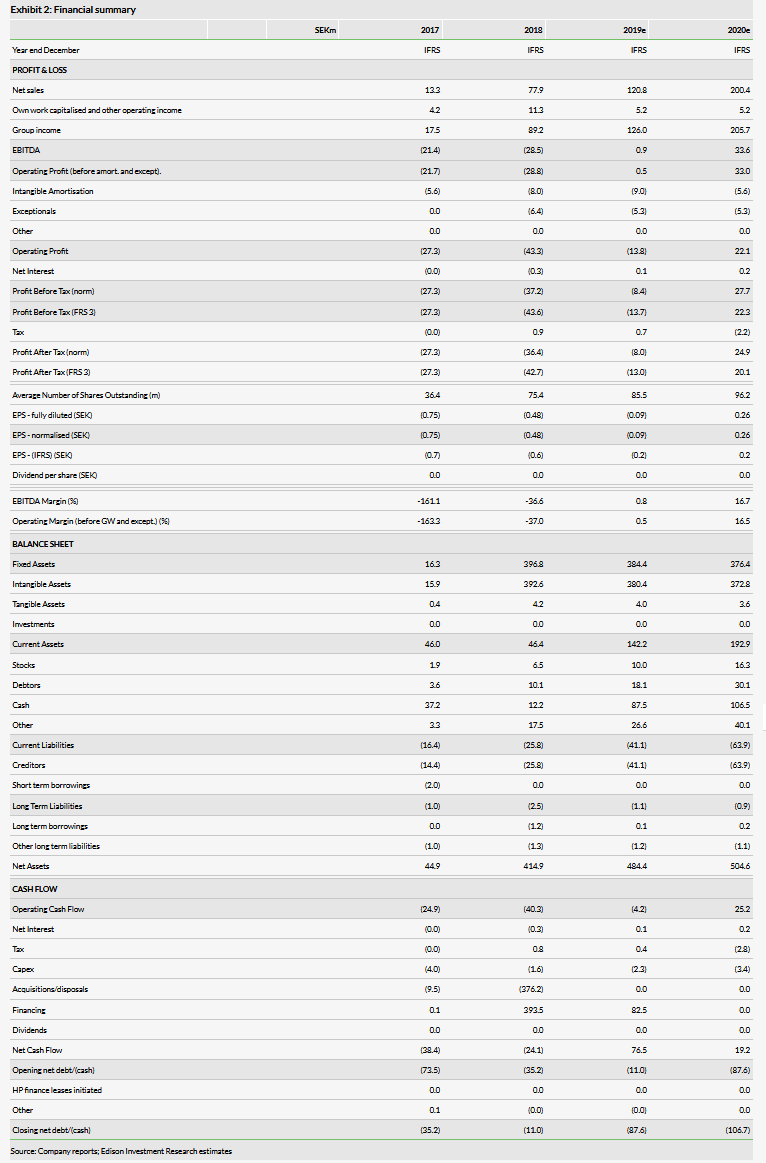

Our underlying operating estimates are unchanged at present. We will review these following the interim results on 22 August. The rights issue does bolster cash balances and we have assumed a modest amount of interest income as a result from these additional funds, slightly improving PBT in both years of the forecast. Of course, the weighted average number of shares increases and the earnings per share also reflect the notional bonus element of the rights issue. As is practice, the historic per share estimates are also adjusted by the theoretical ex-rights price (TERP) adjustment factor for the bonus element. Our revised estimates are shown below.

The company is expected to report H119 results on 22 August 2019.

The four deployments so far in 2019 are:

On 18 January 2019 ALE-1 was launched form Uchinoura Space Centre in Japan on a Japanese Epsilon-4 rocket. It is the first aircraft for ALE Co. AAC supplied the Sirius TCM mass memory module incorporating telemetry and telecommand functionality for communication interface with ground station services.

After being assembled in under six months, the IOD-1 GEMS in-orbit demonstrator (3U) was launched on 17 April 2019 by launch provider Nanoracks on an Antares rocket from NASA Wallops in Virginia, US. It was delivered to the International Space Station from where it will be placed into orbit. Orbital Mission Systems (OMS), the customer, expects to demonstrate miniaturised weather observation technology proving additional data to complement information from larger institutional satellites. OMS plans a constellation of such satellites as part of its GEMS (Global Environmental Monitoring Satellites) programme. It was also the first spacecraft commissioned by the UK’s Satellite Applications Catapult satellite to be deployed as part of the in-orbit demonstration (IOD) programme funded by Innovate UK and the UKSA (UK Space Agency) and led by the Catapult.

On 5 May 2019, York Space Systems in the US successfully launched its first S-Class satellite, which includes AAC’s Sirius avionics subsystems manufactured under a licence signed in FY18. These include on-board computers, mass memory and power system. Further S-Class satellites on order are due for launch in FY19 and FY20.

NSLSat-1 was launched on a Soyuz rocket from Vostochny Cosmodrome in Russia on 5 July 2019 and AAC Clyde Space has confirmed that subsequent contact had been made and all systems were performing as planned. The first 6U nanosatellite built by AAC Clyde Space, NSLSat-1 is the initial deployment in what is expected to be a constellation of 80 satellites for NSLComm of Israel. It provides high throughput data transmission at speeds of up to 3Gbps. It is an example of AAC Clyde Space’s ‘space as a service offering’ end-to-end mission service package that includes mission design, satellite manufacture and data supply.

In addition to these deployments, other notable milestones during Q219 include:

The signing of an agreement to deliver data according to the ‘space as a service’ concept to ORBCOMM Inc of the US, valued at c SEK54m over five years.

SEK4.7m order from Loft Orbital Solutions of the US for Sirius avionics for its Payload Interface & Control Unit for expected delivery in H219.