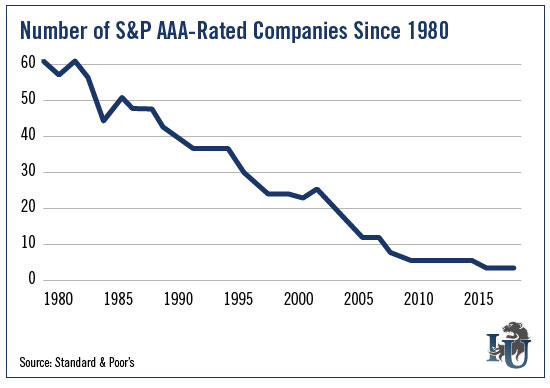

America’s corporations have a credit problem. Today’s chart makes that point very clear...

As you can see, AAA credit ratings are going extinct. Since 1982, the number of U.S. nonfinancial corporations with the coveted best-of-the-best rating has plummeted from 61 to just two.

The latest company to get the axe? Exxon Mobil (NYSE: NYSE:XOM).

Exxon Is Booted From the Club

Standard and Poor’s gave Exxon the boot last week when it downgraded the company’s credit rating one notch to AA+.

It’s a big blow for Exxon. The company had held its pristine AAA rating since 1949.

But low oil prices have taken a toll on its balance sheet.

In the downgrade, S&P pointed out Exxon’s growing debt levels and the fact that its dividend payments and share repurchases “substantially exceeded” Exxon’s free cash flow.

The market’s reaction? Exxon shares finished the day up 0.3%.

Clearly no one was surprised to hear the oil behemoth is having issues with debt. As we’ve reported, oil and gas companies have been defaulting left and right.

But the bigger question is... Why have so many of the country’s largest corporations fallen off the AAA list?

The most obvious reason is that credit quality - across the board - is heading south. But that doesn’t tell the whole story.

Low Rates... Low Ratings

In the past, AAA-rated companies paid the lowest interest rates on debt. That’s rarely true anymore - and when it is, the difference is negligible.

The era of low interest rates has leveled the playing field.

More and more companies are deciding it isn’t worth it to keep their balance sheets immaculate at the expense of growth.

They have funded their momentum with ultra-cheap debt. And in many cases, their shareholders have reaped the benefits.

My Lack of AAA Rating Hasn’t Hurt Me None

In all, four major corporations have been stripped of their AAA ratings since the Great Recession. And from an investor’s perspective, all have done well.

S&P yanked Berkshire Hathaway (NYSE:BRKa)’s AAA designation in 2009. Neither the company nor its shareholders suffered. In fact, after the S&P cut its credit rating, Berkshire Hathaway saw its borrowing costs actually fall.

The company’s stock is up 137.32%.

General Electric (NYSE: NYSE:GE) also lost its AAA crown in 2009. Its borrowing costs fell, too. In the years since, the stock has risen nearly 281% with dividends reinvested.

It was a similar story for Pfizer (NYSE: NYSE:PFE). Its stock has risen 144.67% including dividends.

Payroll services provider Automatic Data Processing Inc. (NYSE: NASDAQ:ADP) received its downgrade in 2014 after it decided to use $700 million from the spinoff of its auto-dealers services unit to buy back shares. Since the cut, shareholders have enjoyed gains of 35.65% with dividends reinvested.

Impact on Exxon

Exxon’s downgrade won’t impact its share price. And it’s highly unlikely that Exxon will have any problems borrowing money. It won’t pay significantly higher interest rates, either.

In fact, despite the cut, Exxon still has a stronger credit rating than any of its competitors.

Now the question is, how long will the remaining two AAA-rated firms keep their ratings... and if they lose them, will anybody care? In this era of ultra-low interest rates, the rules of money have changed.

P.S. These are unprecedented times in the markets. While it’s our view that - long term - U.S. stocks move in only one direction (up), we understand a lot of readers are feeling anxious.