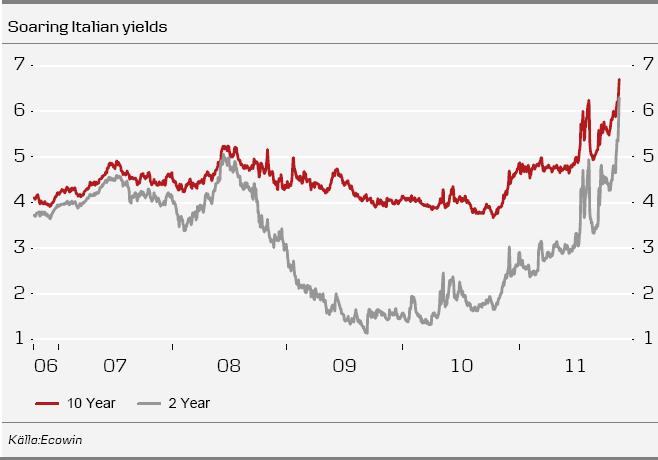

Wednesday 9 November is worth remembering: it may have been the day when the eurozone’s debt crisis became acute. Markets’ distrust in Italy’s (mis-) management of its public finances was evidenced by Italian yields soaring above the important 7% level and the whole curve from 2 to 30 years trading flat. 7% is the level at which other PIIGS countries had problems financing themselves on the market and were forced to get help from the EU. Short term it is probably only interventions from the ECB that can prevent rates from continuing to rise. However, the ECB has signalled that this is not a long-term solution and that the only way forward is to rebuild confidence in fiscal policies in the countries concerned.

Since the Riksbank announced its monetary policy decision on 26 October, the debt crisis has accelerated as it now, in addition to Greece, also involves the considerably bigger Italy and who will take over after Berlusconi. The Riksbank’s view about the debt crisis has so far been pretty cautious and the bank basically only assumes that the debt crisis will dampen economic growth prospects for the next couple of years to some extent. In our view, however, recent developments suggest that there is an increasing probability that the financial crisis is getting out of control and that a considerably more accentuated development in financial markets cannot be excluded. Several Riksbank board members, i.e. Ingves, Nyberg and Wickman-Parak, argued for a quite gradialistic approach to the debt crisis in the October Minutes: since it is impossible to forecast how it will develop, the common view appears to be that it should be handled as it evolves. We believe that all of them would agree that financial developments have been worse than anticipated.

There is, however, a number of other factors to consider. One is that major central banks have made considerable revisions to the economic outlook: Fed has cut its 2012 GDP forecast by more than 1 percentage point to 1.7 % y/y and ECB’s Draghi said that EMU is entering a “mild recession” at the press conference when it announced its somewhat surprising rate cut. It seems likely that the Riksbank will take this ad notam, which should put some downward pressure on Riksbank’s global forecast despite the fact that it actually cut the growth outlook slightly in the forecast that is only two weeks old.

It is hardly surprising to see some quite weak data in the EMU area, but what surprised us is that German manufacturing has taken a severe hit over the past couple of months. It deserves to be mentioned as this is likely to impact prospects for the Swedish export industry. The chart below illustrates the fact that German manufacturing new orders dropped just shy of 8% during the June-September period. It is hard to believe that the situation has improved in October given the financial turmoil. Also, PMI data for the eurozone already show that activity is declining. Moreover, the global trade monitor suggests that international trade has come to a standstill.

To mention something positive, US data have shown some gains recently. For example, the manufacturing industry appears to cope better than in other places (ISM above 50 and new orders holding up well so far), ECRI’s weekly leading index has turned up and train transportation has gained some strength again.

On the home front, both industrial and service production were “strong” in September and this suggests that Q3 GDP growth was probably quite OK, we estimate growth about 0.5% q/q / 3.5% y/y. But the important question here is really the Q4 outlook. Using NIER’s confidence survey and PMI as a starting point it is quite obvious that the Swedish economy is losing momentum quickly. It is not only related to manufacturing, but also evident in other parts of the economy: confidence is falling sharply in construction, private services, retail trade and at consumers, implying that it is a widespread decline. Based on these data, where all sectors except construction are weaker than normal, our conclusion is that GDP growth is slowing considerably.

It is obvious that the situation has become much tougher for consumers as retail sales have been weak. To some extent this is explained by the mild autumn having a negative impact on clothing sales. Nonetheless, a more worrying labour market outlook, still high interest rates and a cooler property market have all contributed to dampening the spending mood.

Finally, one should note the surprisingly weak outcome for October inflation (0.3 percentage points below our own and market’s forecast for both CPI and CPIF). A closer look reveals that it is not a matter of a sharp deviation in a single price component (for example clothing) but rather a widespread (11 out of 15 components) and weaker price development that we expected. We take it as an indication of quite general downward price pressure in the retail sector. It is worth noting that inflation thereby deviates considerably from Riksbank’s only two-week old forecast: CPI turned out at 2.9% y/y (Riksbank forecast 3.3% y/y) and CPIF at 1.1% y/y (Riksbank forecast at 1.6% y/y). No doubt, this means there is a downward pressure on inflation that casts strong doubts about Riksbank’s repo rate forecast.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Whiff Of 2008

Published 11/14/2011, 12:04 AM

Updated 05/14/2017, 06:45 AM

A Whiff Of 2008

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.