Australia just celebrated setting a (modern era) world record for the longest string of quarters without a recession. Yet Australia’s economic backdrop appears to be wavering. This week’s labor force survey could provide a critical point of relief or pile on yet more concern.

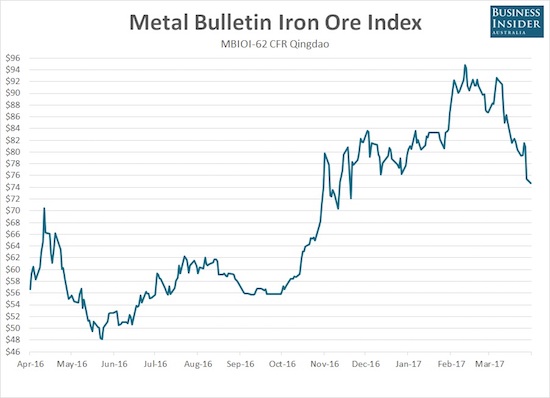

Iron Ore’s Latest Plunge

I begin with iron ore – Australia’s most important export. The price of iron ore has taken a wild ride since it bottomed in late 2015. Over the past year in particular, the price of iron ore has been subject to brief periods of abrupt and sharp price spikes and declines. The current decline is the most extended in a year. At this point, iron ore has essentially wiped out all its gains since the U.S. Presidential election (yet one more price that has completely reversed its post-election move).

A fresh plunge for iron ore has taken it off a multi-year high and returned it to early November levels.

The Australian Dollar

The recent peak in iron ore coincided with a peak in the Australian dollar (FXA). Surprisingly, the subsequent decline in the commodity-dependent currency has not been particularly vicious. The Australian dollar even managed to stage a very sharp relief rally against the U.S. dollar after the Federal Reserve increased its interest rate in mid-March. Yet, the technical damage is clear, especially against the U.S. dollar (AUD/USD).

The Australian dollar has confirmed a double-top against last year’s resistance versus the U.S. dollar with two breakdowns through 200DMA support.

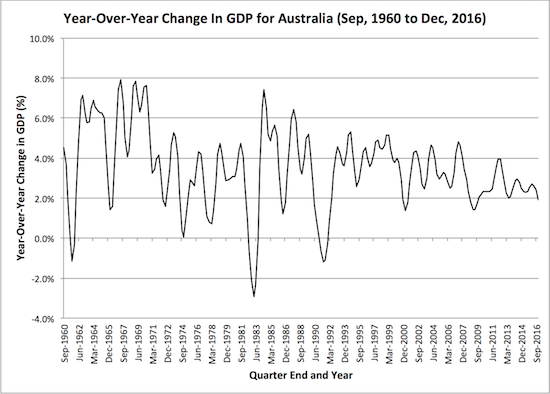

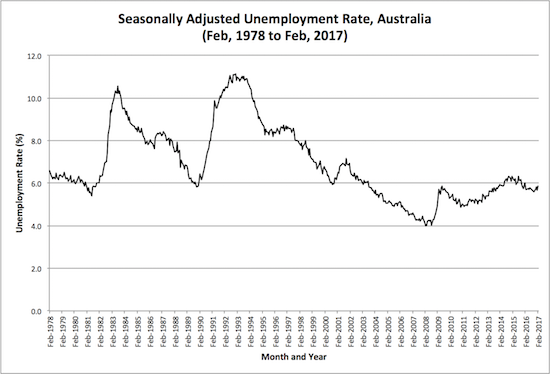

GDP and Unemployment

The decline in iron ore does not bode well for economic reports in coming months…especially since economic reports during iron ore’s massive surge failed to boost the economy. Neither unemployment nor GDP in Australia seemed to benefit. In fact, while unemployment ticked downward slightly, overall GDP growth seemed to worsen a bit.

The peaks in GDP for Australia have steadily declined since the mid-1980s. While most industralized countries would celebrate 2% annual GDP growth, Australia’s performance since the 2012 peak looks relatively sobering.

Australia’s unemployment rate never made a full post-financial crisis recovery. From 2014 to 2015, unemployment actually set a new post-crisis high and now sits at the former post-crisis peak.

I was quite surprised to see how the sharp recovery in iron ore failed to translate into better aggregate economic performance for Australia. I have to guess that a declining iron ore price could facilitate a notable worsening of the economy.

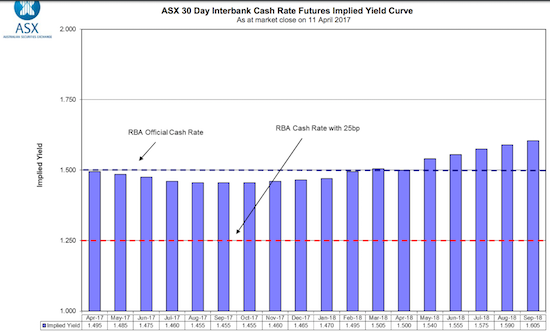

Interest Rate Expectations

It is certainly premature to claim that Australia might finally slam itself into a recession. For example, market expectations for interest rates from the Reserve Bank of Australia are pointing slightly upward by next year.

No worries ahead? Financial markets essentially expect the Reserve Bank of Australia to hold rates steady until a slight uptick late in 2018.

A Troubling Housing Market

If there is anything in particular to worry about in the Australian economy, it is housing. In its April Monetary Policy Decision, the RBA finally shined a spotlight on a potential housing bubble without using the dreaded B-word.

“Conditions in the housing market continue to vary considerably around the country. In some markets, conditions are strong and prices are rising briskly. In other markets, prices are declining. In the eastern capital cities, a considerable additional supply of apartments is scheduled to come on stream over the next couple of years. Growth in rents is the slowest for two decades.

Growth in household borrowing, largely to purchase housing, continues to outpace growth in household income. By reinforcing strong lending standards, the recently announced supervisory measures should help address the risks associated with high and rising levels of indebtedness. Lenders need to ensure that the serviceability metrics that they use are appropriate for current conditions. A reduced reliance on interest-only housing loans in the Australian market would also be a positive development.”

This statement contains so many troubling elements that are somewhat reminiscent of the housing bubble and crash in the U.S. during the financial crisis. Australia’s Eastern capital cities are the ones experiencing brisk price increases in their respective housing markets. Yet, the swelling supply of apartments and historic slowdown in rent growth are sure signs that the housing market is becoming or has become extremely over-valued. This valuation disconnect is all the more dangerous given households are loading up on debt at a pace well beyond the growth in their incomes. Moreover, they are using interest-only loans to squeeze down their (early) monthly payments to something they can afford. Interest-only loans were rampant in the U.S.’s most over-valued housing markets during the bubble days. Australian authorities are increasing regulatory measures to try put the clamps on the situation, so this is a key difference with the U.S. situation where lack of proper oversight allowed mortgage markets to run wild and free with distorted incentives. Yet, it is not clear yet whether regulators will succeed. The RBA is unlikely to resort to rate hikes given the wavering conditions in the overall economy.

Parting Words

All-in-all, the economic picture in Australia is worrying and suggests that the Australian dollar has topped out for the time being. I like shorting the currency on rallies (or in the case of AUD/JPY, following a breakdown below 200DMA support). As I noted in an earlier post, I am very keen to watch the Australian dollar versus the Japanese yen (AUD/JPY) as a key tell on the health of the Australian dollar…and financial markets as a whole.

Be careful out there!

Full disclosure: no positions