In my April 31st presentation on Stockcharts, I begin by walking you through the Economic Modern Family: (Russell 2000, Retail ETF (NYSE:XRT), Biotechnology ETF (NASDAQ:IBB), Regional Banking ETF (NYSE:KRE), Transportation ETF (NYSE:IYT), Semiconductor ETF (NYSE:SMH)) using nothing but the price.

I use trend lines and channels I learned from my days trading on the Commodities Floor.

The theme is to pretend we live under a rock and only see price.

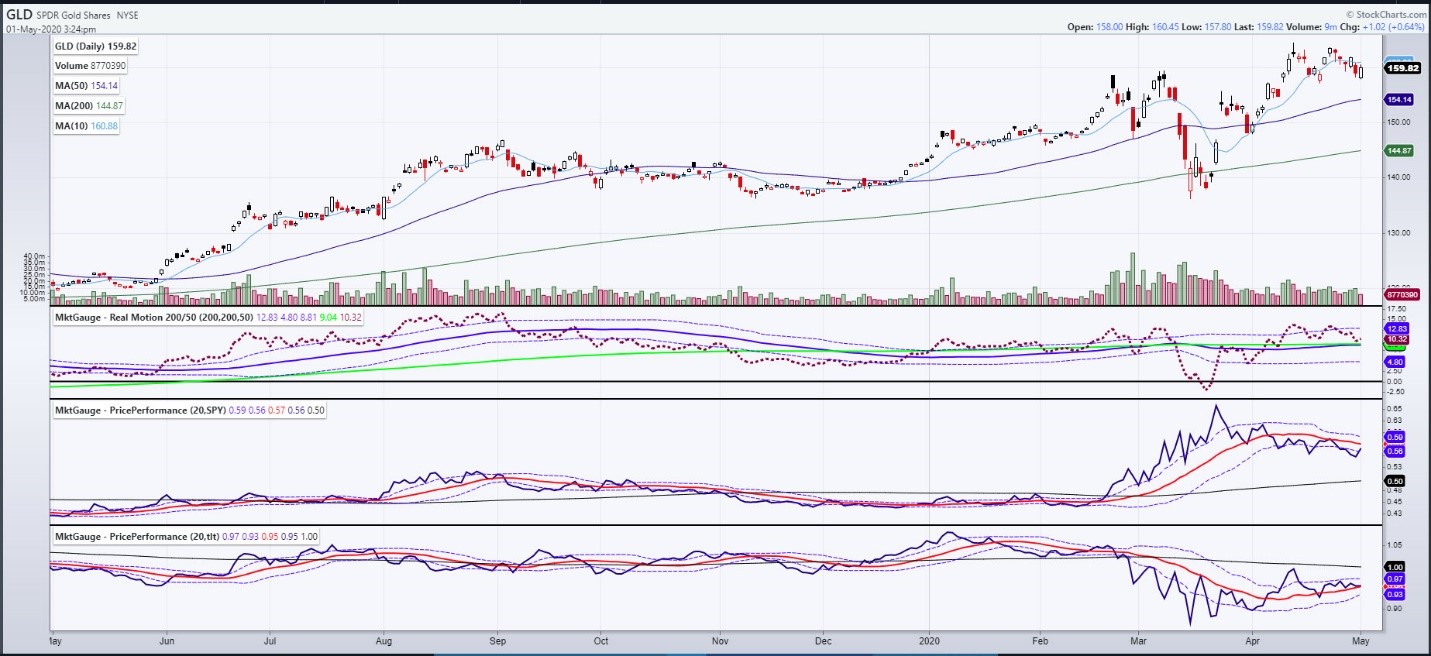

From there, I use Marketgauge’s proprietary momentum and price-performance indicators to examine a few potential inflationary instruments such as gold (the chart you see).

Looking at the gold chart with even fresher eyes than on the presentation, momentum picked up, while the price found support at Friday’s lows and closed green.

GLD (NYSE:GLD) began to outperform the S&P 500 (NYSE:SPY) on Friday but needs to do more, considering the nearly 3% decline in SPY and the .63% rise in gold.

The TLT or 20+ year-long bond continues to outperform the gold as well.

All in all, the recent price action in gold suggests a healthy correction in a bull phase and not a top unless the momentum indicators break below the 2 moving averages (green and blue on Real Motion).

With that said, it is the agricultural and soft commodities, along with the euro, that I am most excited about sharing with you.

And I do it with actionable information.

S&P 500 (SPY) 280 next support area and really the place this rallied from. Under 275 suspect

Russell 2000 (IWM) Held the channel line I feature on the video and the 50-DMA.

Dow (DIA) 234.70 support 240 resistance

Nasdaq (QQQ) 209.50 support 216-217 resistance

KRE (Regional Banks) Key as it failed the 50-DMA (37.25) but held 35.50 the 10-DMA

SMH (Semiconductors) 124.50 key support. 131 resistance

IYT (Transportation) Under 143.64 Friday low, trouble. Over 155 is the only way this returns to looking healthy

IBB (Biotechnology) Closed right on pivotal support at 120. Resistance 125

XRT (Retail) Held 35, where it needed to.

Volatility Index (VXX) Doji day above the 10 and 50-DMAs. Follow Friday’s range break

Junk Bonds (JNK) Back to an unconfirmed bearish phase and into support at 95.50

LQD (iShs iBoxx High yield Bonds) 127.20 support