Here is a trillion (dollar) reasons why the US economy is likely to hold up until elections: between now and then, Yellen is likely to drain the Treasury General Account (TGA) and unleash a wave of almost $1 trillion liquidity on markets and the economy.

In a second, I am going to walk you through the mechanics of the TGA drainage and its impact on markets.

But before we do that, it’s important to take a step back and reflect on this: mastering the mechanics of the various monetary plumbing operations like QE, QT, fiscal deficits, RRP and TGA refill/drainage will provide you with a sizeable edge as a macro investor over the next decade.

Nominal incomes are growing at 6%, and real GDP is cruising nicely at around 2%.

The labor market still holds okay, and there are no clear signs of broad economic weakness.

How can we square this with one of the most aggressive hiking cycles in history which brought Fed Funds above 5% for almost a year and counting?!

The answer lies in private sector balance sheets and fiscal stimulus.

Higher interest rates generally slow down economic activity: corporates and households face higher debt servicing costs and therefore they must cut capex/hiring/spending to allocate more resources to debt servicing.

Lower spending = the economy slows down.

In other words: higher rates tend to negatively affect the liability side of private sector balance sheets.

But what if this time that’s going to take much longer, and in the meantime the opposite is happening?

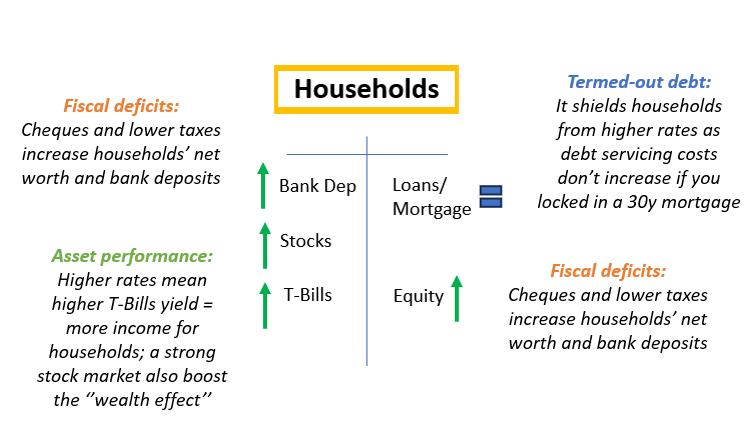

Here is a very simple, stylized household balance sheet: bank deposits, stocks, and T-Bills on the asset side and loans or mortgages plus net worth (equity) on the liabilities side.

What’s been happening lately?

- Continued fiscal stimulus: cheques and lower taxes increased the private sector net worth;

- Higher rates provide an additional income boost: households and corporations can park money at 5% T-Bill yields and harvest the benefits of higher rates;

- Higher rates are not affecting debt servicing: Fed Funds at 5% are less scary if households run on 30-year fixed mortgages and corporates have termed out their debt.

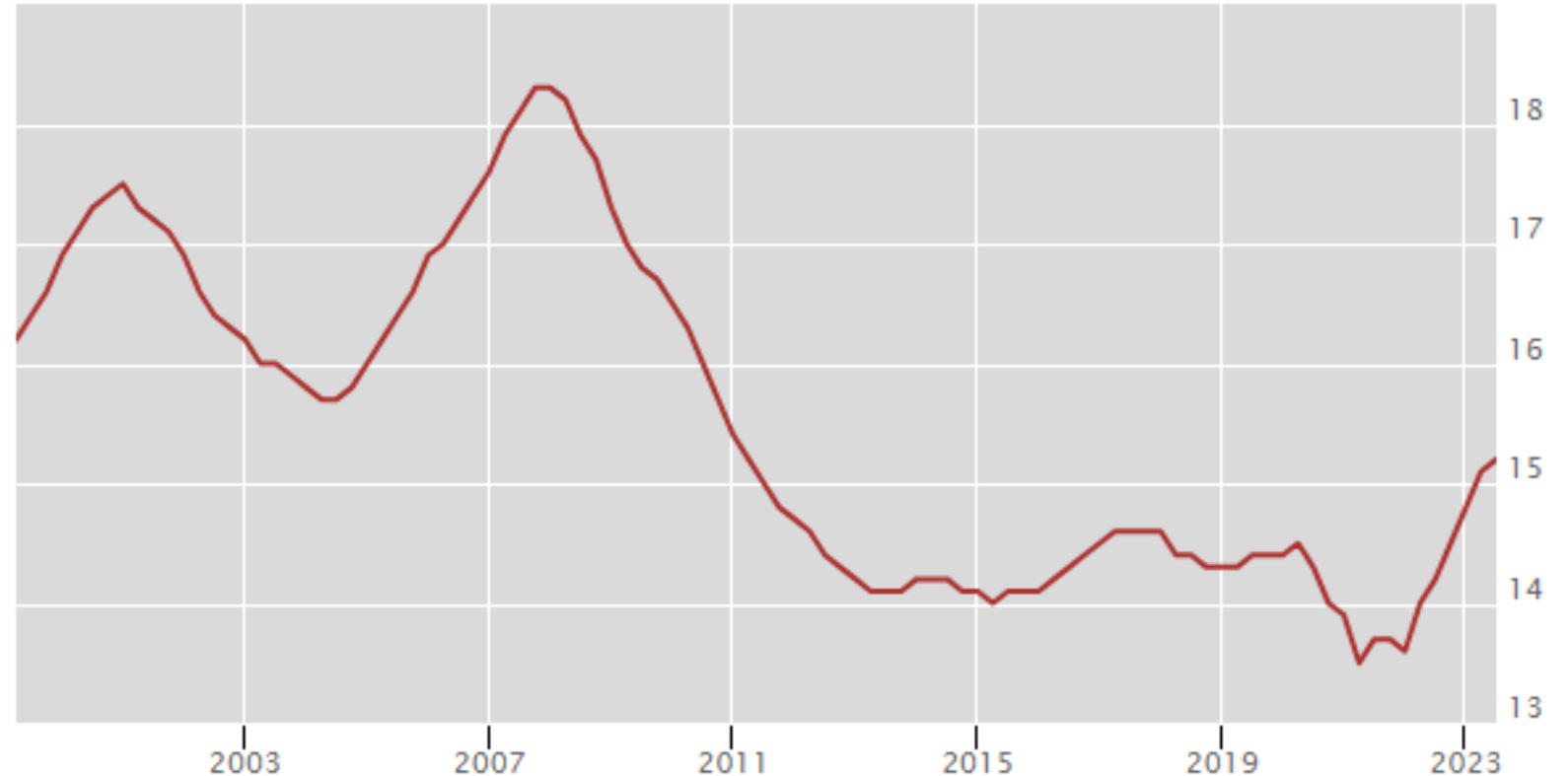

Here is how the US Private Sector Debt Service Ratio looks like today: yes it’s going up but slowly if you compare it to the fast and vicious Fed hiking cycle.

The main reasons for this slow pass-through are:

A) Long-dated mortgages and corporate borrowing, meaning very slow refinancing cliffs hitting households and corporates so far;

B) A low share of floating rate mortgages and corporate loans which limit the pass-through from higher Fed Funds;

So, if the private sector is temporarily shielded from higher borrowing costs but enjoying the benefits of higher interest rates and continued fiscal injections

one could make the funny argument that higher rates are stimulative?!

Such ‘’creative’’ arguments are generally heard at local tops in market and economic euphoria: soft landing headlines were popular in the second half of 2007, and with 5% 10-year yields in October 2023 we had a CNBC special on why yields were headed to 13%.

But it’s hard to fight back against the private sector balance sheet plus the fiscal argument presented above.

In particular, while you can make the counter-argument that sooner or later the refinancing cliffs will start to bite and debt servicing costs will ultimately increase it’s much harder to fight against the fiscal largesse point.

And that’s why today I’ll present a trillion (dollar) reasons why this economic and market regime might continue for another 6 months until the US election kicks in.

Over the next 6 months, we might experience (another) huge liquidity injection in markets and the economy!

How?

By having Yellen drain the Treasury General Account (TGA).

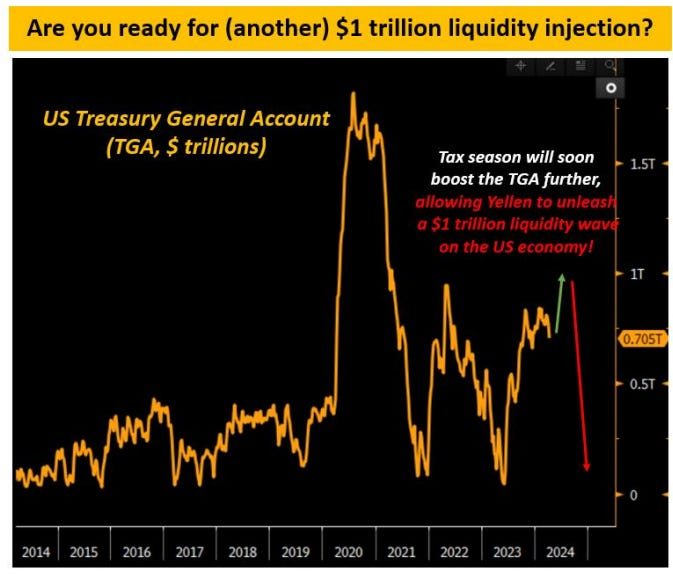

You can think of the Treasury General Account (TGA) as the checking account the US Government holds at its bank - which is the Federal Reserve. Every time the US government has accumulated excess money through taxes or bond issuance that it doesn't intend to immediately channel into spending, they will park it at the TGA account at the Fed.

As you can see from the chart above, the TGA generally sits around 250-350 USD billions and it occasionally increases towards USD 1 trillion only to be subsequently drained back to its standard size. After the ongoing tax season, Yellen will soon have around USD 1 trillion in the TGA - that's quite high, and hence we should expect a drainage to follow.

On top of it, the US debt ceiling suspension only lasts until the end of 2024 and at some point the US will ''run out of room'' to issue new bonds which means the only way to facilitate spending will be through using the money sitting in the TGA – great political cover to move ahead with a TGA drainage.

But why does draining the TGA matter that much for markets and the US economy?

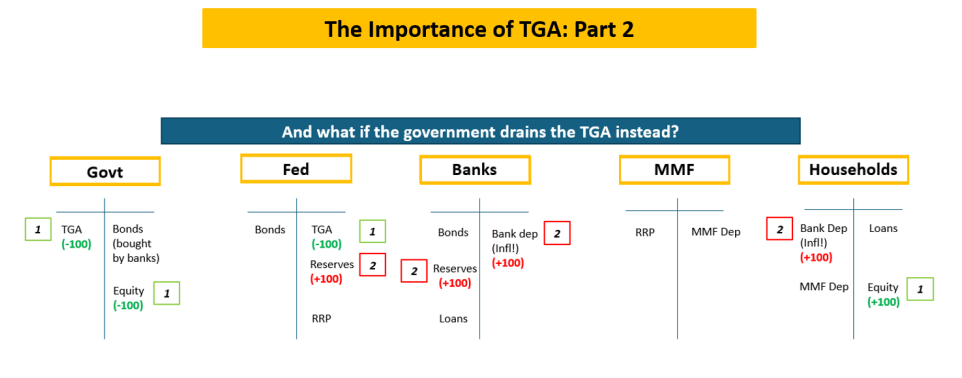

That's because draining the TGA is akin to throwing fresh money at the economy (similar to deficit spending) and also adding new liquidity to the interbank system (similar to QE).

Borrowing a slide from the TMC Monetary Mechanics Course, we can follow the process step by step:

- Step 1: the government drains down its TGA at the Fed, hence lowering its equity position but injecting this fresh new money in the real economy (= households’ net worth goes up!)

- Step 2: households now have more money in the form of bank deposits, which end up in the banking system and hence banks also sit on a larger amount of reserves; the Fed’s balance sheet squares with less TGA perfectly offset by a higher amount of reserves (= interbank liquidity goes up!)

So now you see how powerful this monetary mechanics combination is?

The US will be simultaneously printing real-economy money and financial money at the same time, and it will be doing so while real GDP is at 2%+ and core inflation at 3%.

And what happens when you throw fuel on the fire?

Conclusions

The US economy is still running at a robust nominal growth pace because its private sector is temporarily shielded from higher borrowing costs while it’s enjoying the benefits of higher interest rates and continued fiscal injections.

‘‘Temporarily’’ remains the key word here, because ultimately the negative effect of higher borrowing costs will bite once the refinancing cliffs become more real.

But Secretary Yellen might be planning to extend the ‘‘temporary’’ window until the elections through a crucial monetary plumbing exercise.

Draining the Treasury General Account and hence throwing almost $1 trillion of liquidity and stimulus into markets and the real economy!

So, all eyes on the upcoming Quarterly Refunding Announcement at the end of April to get to know what Yellen is up to.

This is a clear example of how mastering the mechanics of the various monetary plumbing operations like QE, QT, fiscal deficits, RRP and TGA refill/drainage will provide you with a sizeable edge as a macro investor over the next decade.

***

Disclaimer: This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.