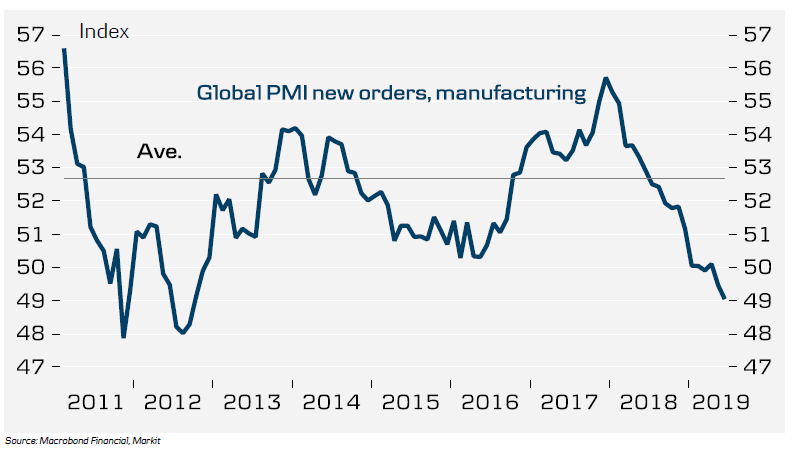

The global business cycle continued to deteriorate in June, as PMI new orders and OECD leading indicators fell further.

The weakness is driven, in particular, by soft investments, while private consumption has held up better supported by robust real income growth.

Geographically, the most weakness is found in euro area manufacturing, not least in German manufacturing orders. However, China has also softened again and US manufacturing indicators point to an industrial recession.

A few rays of light are to be found in the US MacroScope model and US financial conditions impulse, which point to some improvement in H2. However, the latest tariff increases provide a headwind that will weigh in the short term.

Contents

Global overview

- US

- Euro

- China

- Japan

- Other

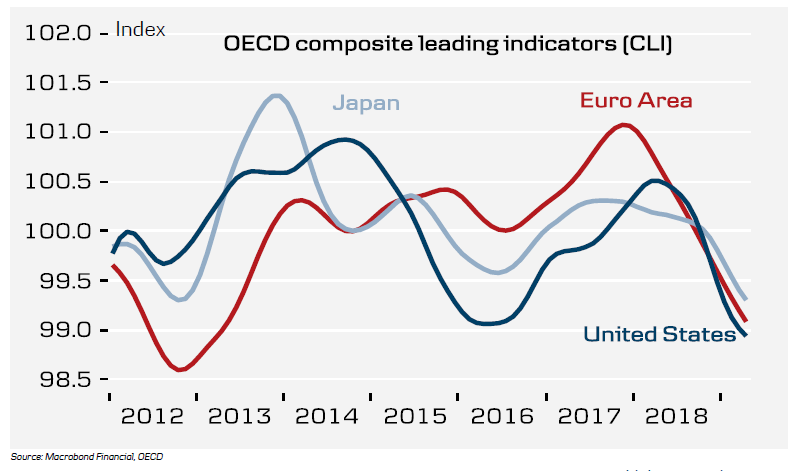

OECD leading indicators – levels

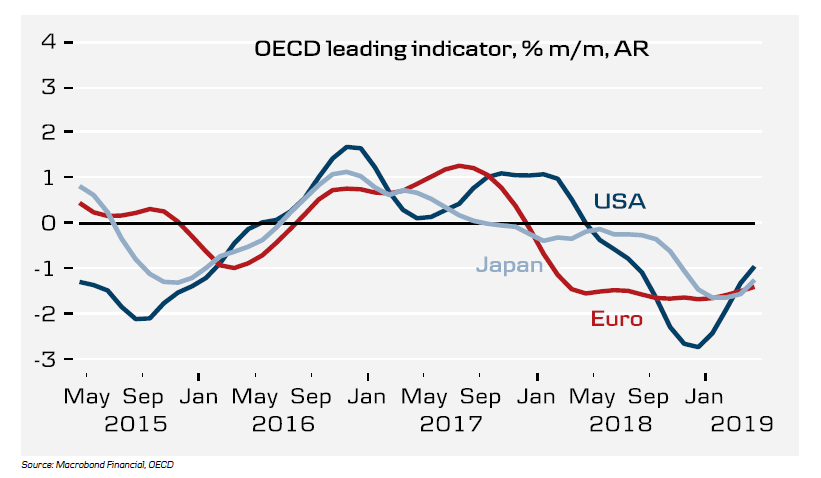

OECD leading indicators – monthly momentum

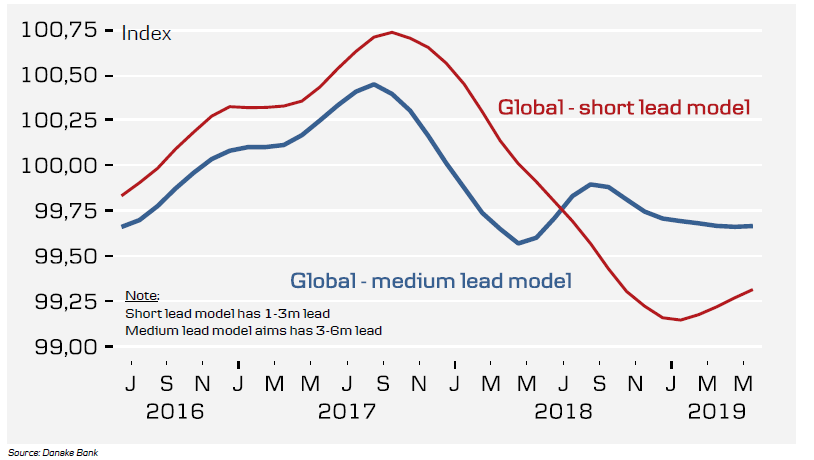

Global MacroScope models

(for OECD Composite Leading Indicators – CLI)

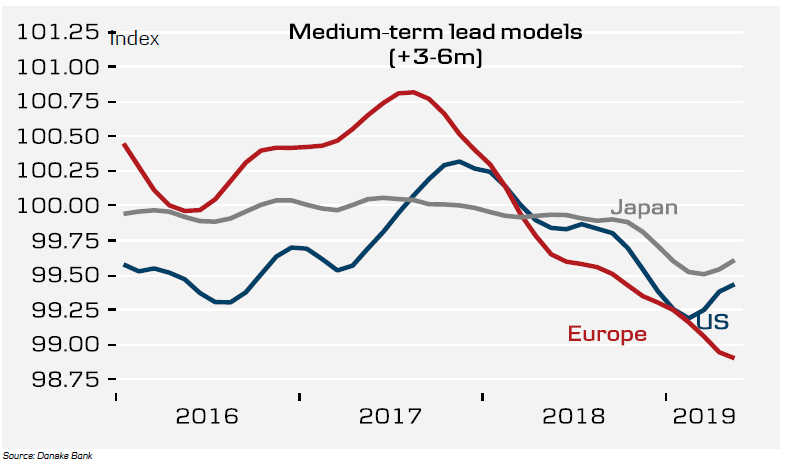

MacroScope medium lead models – across regions

(for OECD Composite Leading Indicators – CLI)

Global PMI

To read the entire report Please click on the pdf File Below..