Investing.com’s stocks of the week

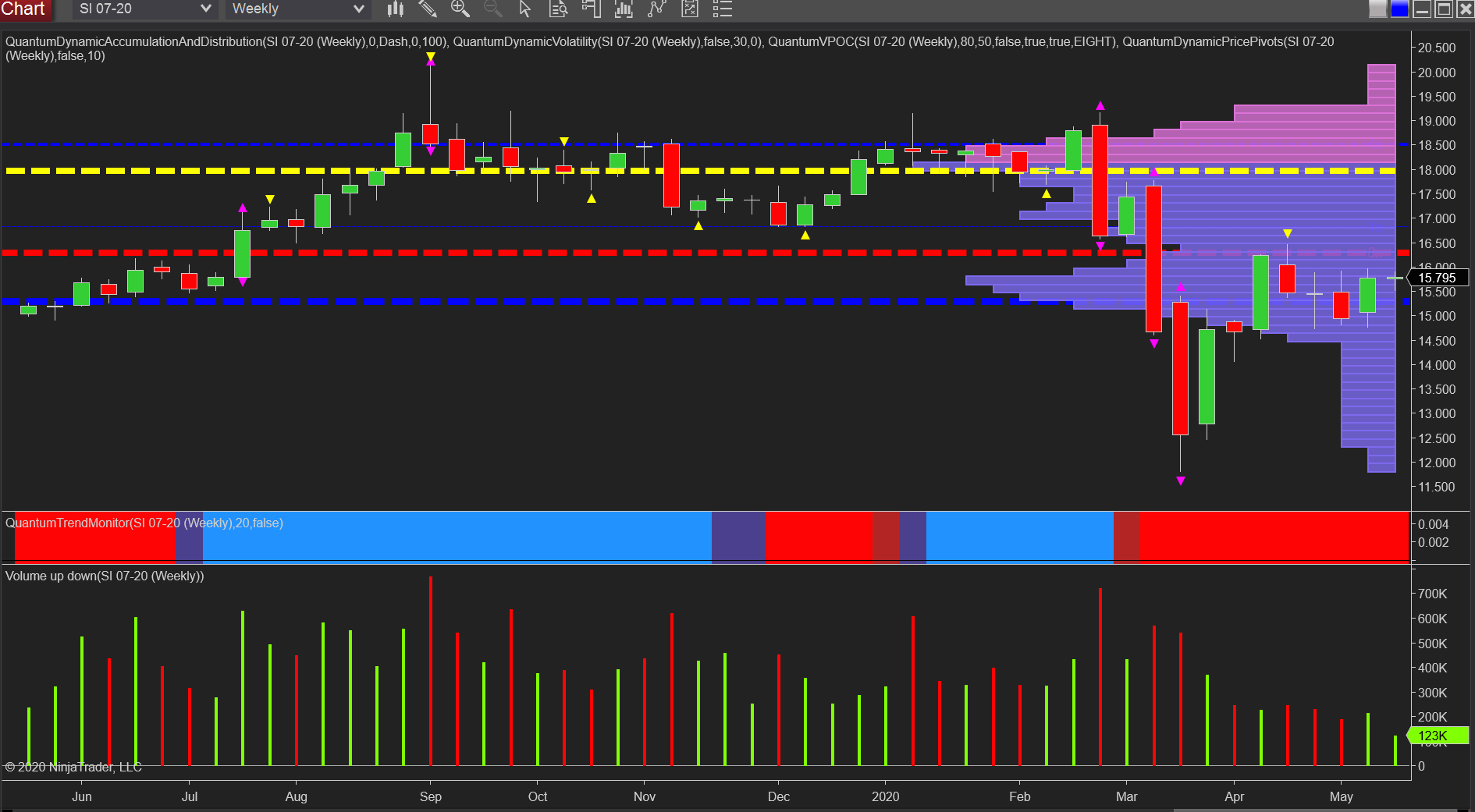

It’s a hard road higher for Silver, and despite gold remaining bullish, the updraft from its illustrious partner is not helping to drag the industrial metal along with it which is now waterlogged in severe technical levels on the weekly chart.

First, we have the histogram on the volume point of control with extensive volume extending through to the VPOC itself at $18 per ounce, and it is only once we clear $19 per ounce and beyond, volume falls away significantly. As such, the volume resistance now ahead between the current level of $15.81 per ounce and $19 per ounce presents a solid barrier and one where price action will only advance if supported by solid buying. Next, we come to price based resistance displayed on the accumulation and distribution indicator and here we have a further significant level at $16.30 per ounce denoted with solid red dashed line. The line thickens each time a level is tested and holds and so gives a clear visual on the strength of each level and as we can see, this has been tested 8 times and is therefore extremely strong, and yet another barrier to progress higher for silver. Finally, we also have the VPOC itself marked with the yellow dashed line and once again, as price reaches this level we can expect congestion to follow.

So tough times ahead for silver if it is to rally along with gold and break through to the $19 per ounce region and beyond, and for this to be achieved buying volumes will need to increase as price rises much as they did in the summer of 2019.