Keep the change...

It’s a phrase that could mean nothing to future generations. The same is true for the expression “cold hard cash.” Our descendants may find “cold hard code” a more suitable descriptor.

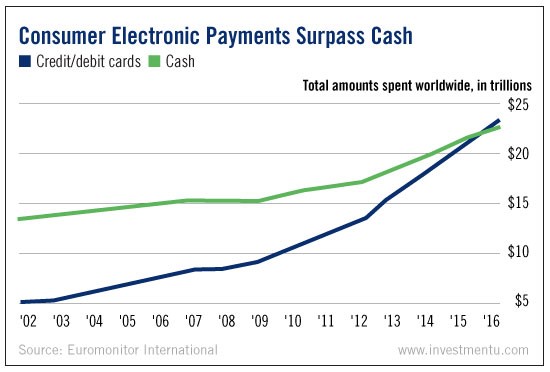

Today’s chart does all the explaining.

As you can see, we hit a big milestone in 2016. For the first time ever, consumers across the globe will spend more using debit and credit cards than they will using cash.

To be clear, we are talking about the amount of money changing hands - not the number of transactions. Around 85% of transactions still involve cash. But these are mostly small exchanges.

That may come as a surprise. When we look at nonconsumer-related transactions, electronic payments are already well above physical cash. But what makes this a real milestone is the fact the everyday people are finally falling in line.

We’ve decided we prefer the convenience of electronic payments over cash - and mobile wallets over leather billfolds.

As a result, physical currency has moved higher on the extinction list. And that may be good news - depending on who you ask.

Governments and banks are certainly in favor of - and pushing for - a digital-only payment system.

Why? First, because printing cash and keeping it in circulation is expensive. You have to create, process, verify, destroy, package and transport all those bills. It cost the Federal Reserve more than $575 million just to keep cash in circulation last year.

But for banks, the real attraction to abolishing cash is control.

We’ve written extensively about ultralow and negative interest rates. To sum it up, central banks have not been successful in jump-starting economies with lower rates. People are still cautious about spending their hard-earned money.

This is a monetary puppeteer’s worst nightmare. Low rates are supposed to encourage spending and investing. So if negative rates can’t do the trick, abolishing cash is plan B.

You see, if rates tick too far below zero, banks might need to start charging depositors to hold their money. This could cause people to pull out their cash - i.e., the last thing central banks want.

Major economists and former central bankers are pressing for a cashless society. Citigroup’s Willem Buiter and Harvard economics professor Ken Rogoff have both endorsed the idea.

Buiter recently stated that abolishing cash could “solve the world’s central banks’ problem with negative interest rates.”

Even scarier, a former Bank of England economist recently stated:

If notes and coins were abolished and the only way to hold money was through a government-controlled bank, there would be no escape.

The belief is that government-controlled accounts could allow banks to impose penalty rates on all cash and savings deposits. Then they could finally force people to spend.

Make no mistake, there is a war being waged on cash. If you value your freedom and privacy, you need to pay close attention. And, as the saying goes, the best defense is a strong offense.

So if you want to protect yourself, make sure you own a properly allocated mix of physical assets and equities. If you need help figuring out your ideal mix/strategy, check out the following...

Obviously, the death of cash is something we take very seriously. That’s why The Oxford Club (Investment U’s publisher) is hard at work developing a “Death of Cash Survival Plan” for readers.