Another sunny day ahead for gold bugs as the precious metal continues to rally and is now returning to test the $1800 per ounce level which has proved difficult to breach in the past few weeks.

Whilst some have been surprised by this move higher the reversal in trend was something I highlighted in my post of the 11th May with the annotated chart showing where the buyers had stepped in. As always with volume price analysis it is a question of whether price and volume are in agreement or disagreement. If they are in agreement, then all is well and the price action continues. However, if they are in disagreement, we need to understand why and what the analysis reveals. And in this case, the answer was clear with the metal moving lower but with a narrow spread candle on high volume which was repeated the following day. So why is this a ‘disagreement’? The answer is simple. Had volume and price been in agreement here, the price candle should have had a wider range and down. Instead, it was a narrow spread and down. What this means is the selling pressure was being absorbed by the buyers and so we expect the price to rise, particularly as this was repeated the following day and from which we can conclude the big operators had stepped in to buy and are likely to take the price higher in due course. You can read the full analysis here:

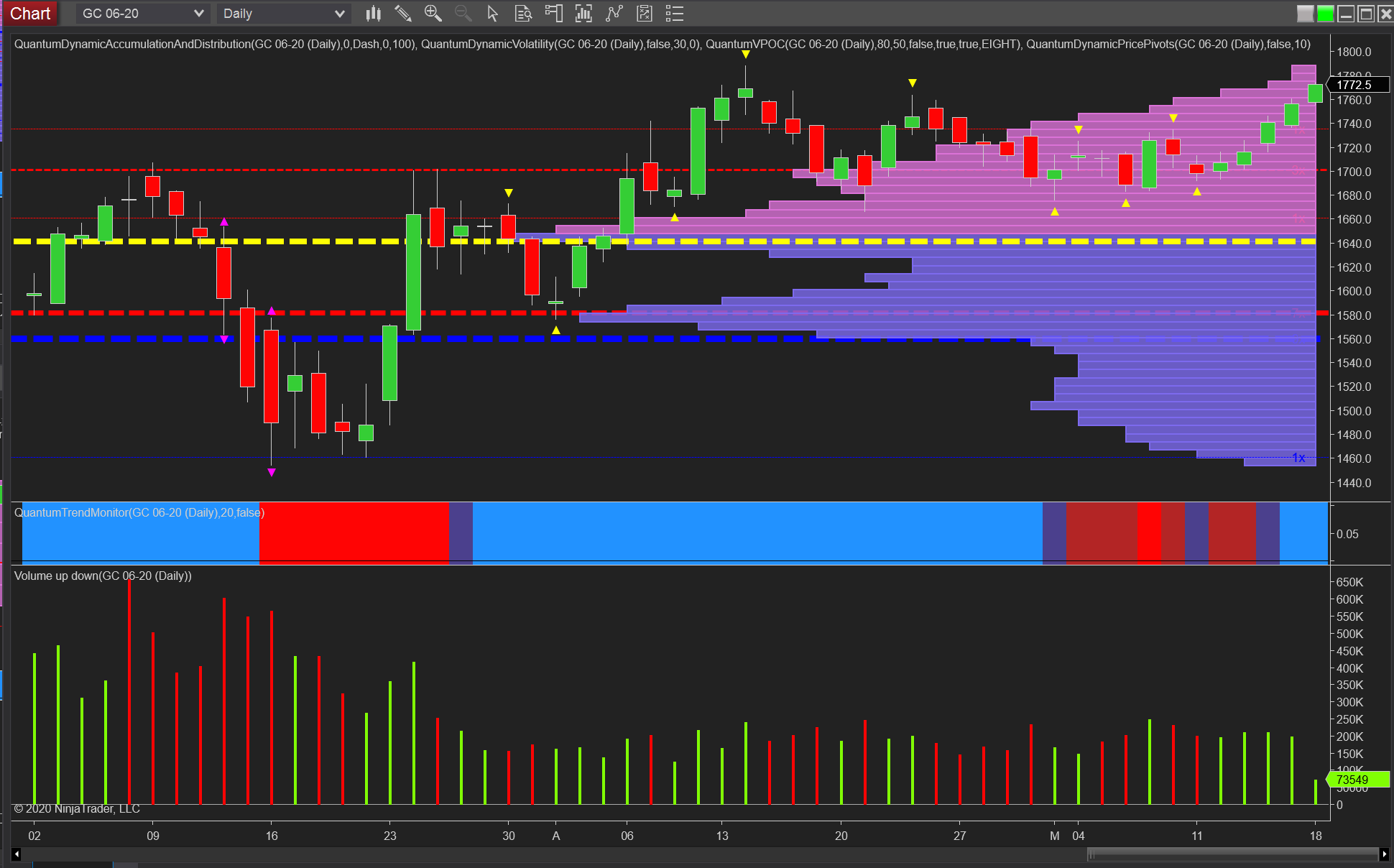

So where is gold heading next? The good news is the volume on the VPOC histogram to the right of the chart is falling away steadily which means progress higher is more straightforward with less volume-based resistance and the key is for gold to take out the recent high of $1788.80 per ounce posted in April, before attacking the psychological $1800 per ounce area. Longer-term, inflation is likely to be a significant driver for the metal as food and other staples are driven higher following the pandemic.