After a blistering start to the year we warned readers in March that several solar charts were showing warning signs that all was not well for this sector. As it turned out many solar names would fall 40-50% over the ensuing ten weeks:

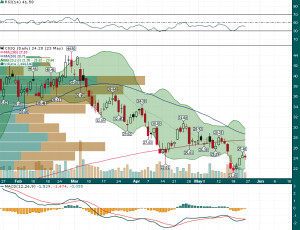

Canadian Solar Inc (NASDAQ:CSIQ)

GT Advanced Technologies Inc (NASDAQ:GTAT)

SolarCity Corporation (NASDAQ:SCTY)

Now it appears that the worm has turned once again for the solar sector and the correction has likely reached its conclusion:

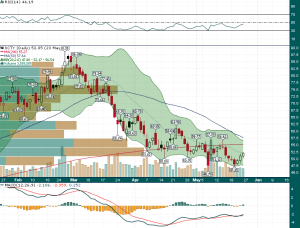

TAN Daily

Many solar stocks such as CSIQ and SCTY have aggressively broken out of basing patterns this week and the 5-year weekly chart of Guggenheim Solar (ARCA:TAN) highlights the considerable upside potential that this sector still offers longer term:

TAN 5-year Weekly

The fact that many solars have considerable short interest (GTAT 34% of float is shorted, SCTY 28% of float is shorted, SUNE 25% of the float is shorted) only adds fuel to the fire of the summer solar rally which is currently underway. While we like outright long positions in the above mentioned stocks, more conservative investors might consider a pairs trade of long TAN vs. short SPDR Energy Select Sector Fund (ARCA:XLE) (which also happened to be the most overbought sector heading into this week).