On August 15, 2017, I had the privilege of interviewing Bill Sandbrook, President and CEO of U.S. Concrete (NASDAQ:USCR), a producer of ready-mixed concrete and aggregate products for domestic construction projects. I am relatively new to this industry, so I prepared by listening to earlier interviews, reviewing USCR’s latest earnings results for Q2 2017, and listening to the earnings call for that report (I also read through the transcript of that call). Mr. Sandbrook was also gracious in providing for me an abbreviated education on the concrete industry. Interested readers should review a detailed investor presentation that U.S. Concrete posted on May 31, 2017. The material below summarizes and paraphrases Mr. Sandbrook’s responses to my questions except where otherwise noted.

The concrete business and metrics of success

Concrete is not the same everywhere: concrete depends on where you operate in the country. Quality, specifications, intensity, delivery, and availability of raw materials all differ. Rural areas are not the same as metro areas. These factors are all components of success for a ready-mix concrete producer. The market is unconsolidated and producers are numerous: a mix of family-owned operations and multi-nationals. Each company targets a different part of the market and different industries: sidewalks, basketball courts, roads, data centers, construction, etc… These mix of factors and targets also dictate company strategies and margin profiles.

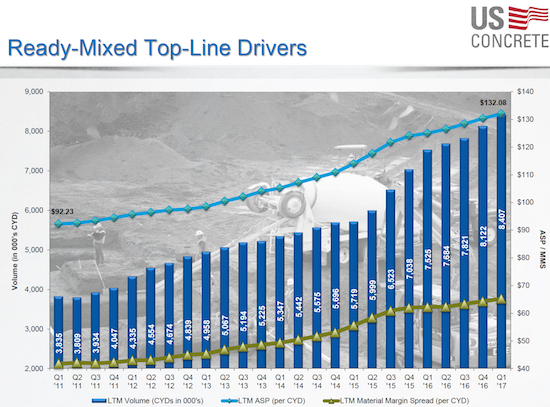

USCR is the only publicly traded company that focuses on concrete and some vertical integration. Other companies focus on either aggregates (definition: inert granular materials such as sand, gravel, or crushed stone) or cement (definition: material used to bind sand into concrete). USCR is not your average ready-mix company. For example, a 9% EBITDA (definition: Earnings Before Interest, Taxes, Depreciation and Amortization) margin is typically considered good in the industry. In the last quarter, USCR achieved a 15.5% EBIDTA margin due to its consolidation strategy through acquisitions. The company has raised prices for 25 straight quarters and has achieved 26 straight quarters of year-over-year revenue growth.

U.S. Concrete (USCR) has driven on-going increases for its financial performance. Quarter-by-quarter, pricing, volume, and margins have risen.

USCR has built out a very robust and dense plant network in some of the most difficult areas to operate in the country. USCR has 17 plants in New York City and operations in the San Francisco Bay Area, Dallas, Texas and the Washington, DC metro area. USCR operates in unionized environments on both coasts and navigates strict work rules and high wages. High-rise buildings are bread and butter for USCR, and they deliver high margins. USCR also specializes in hard-to-perform, high profile infrastructure projects like the Oakland Bay Bridge.

These are projects that a small local operator may not have the ability to service given they require a large footprint. There will never be another concrete plant permitted in San Francisco. USCR has an impenetrable franchise there. Moreover, all the high-rise construction must be earthquake proof and requires special formulations. Manhattan is also a solid franchise, almost like its own moat, given it is an island where bridge tolls can get prohibitively expensive for smaller operators.

USCR has a value proposition unmatched by its competitors. The company can become the largest procurer of raw materials in a region because the product cannot travel far. A large buyer of raw materials gains a lot of leverage and can control costs better. Traffic congestion in metro areas can impede an inefficient and poorly stocked truck fleet. When construction laborers are earning $80/hour, a contractor cannot afford to have these workers idling in a high-rise waiting for concrete. So contractors do not take risks on poor servicing. They do not care about traffic; they pay for continuous concrete delivery. These needs play into USCR’s strengths.

Here is how USCR summarized its strategic positioning in the investor presentation:

U.S. Concrete (USCR) has a well-developed and sustainable strategy.

Acquisition strategy

Going forward, USCR’s acquisition strategy is focused on aggregates which are a higher margin product. Aggregates can be used for self-consumption and protecting the company from outside pricing. USCR currently has 17 aggregate operating facilities. USCR’s longer-term plan is to continue to grow in existing markets and to find a new region that replicates the advantages of its current set of markets. The investor presentation describes a “robust” set of deal opportunities: the ready-mixed concrete market is worth $30B with 2,200 producers and 6,500 ready-mixed concrete plants.

The U.S. economy

USCR plans on continued economic growth – more of the same is likely. This is the slowest and yet the longest recovery in U.S. history. People were hopeful for Washington to deliver – there was great optimism, including for infrastructure spending – but no one thought 3.5% or 4% growth was credible. What has happened is a continuation of the long and slow recovery. USCR uses the same sources for understanding the economy as everyone else: Dodge Data and Analytics (construction) and the Census Bureau for population growth.

The supply of sand (I asked about what appears to be a growing global shortage of sand – something I previously thought was impossible!)

Mr. Sandbrook could not speak for the global sand market, but he provided info on USCR’s markets in the U.S.

There is no sand crisis in South Jersey (the source of sand for the NYC operations): all of it is sand. Long Island also has plenty of sand but regulations and resident populations restrict supply. So in this region sand is a dwindling resource and finite with significant price increases. The pricing pressure is one of the reasons USCR bought a sand and gravel operation in South Jersey. USCR mines the sand, drives it about 5 miles to a loading facility in Delaware Bay, and then tows it to dock in NYC. Delivering by truck is too prohibitive price-wise. Parts of California are also restrictive – limited geological availability and difficult permitting. A lot of (U.S.) sand supply problems are due to permitting and the difficulty of opening new reserves.

The Washington DC / Virginia market

USCR has operated in the DC/Virgina region for 10 years. Mr. Sandbrook is very bullish on this market. Two years ago, USCR bought two plants near the Dulles airport in the Route 66 corridor. The market has difficult operating conditions (USCR’s specialty). As an example, it took four years to permit, acquire, and construct the property. A plant in Lorton, VA expanded capacity for the region. The expansion and growth in this market comes from the growing importance of the Federal government that provides expanding opportunities for lobbyists and special interests. Their high salaries produce high disposable income in the area.

High short interest – noticing that 34% of USCR’s float is sold short, I asked Mr. Sandbrook what do these shorts not understand about USCR?

Shorts misunderstand the following:

- 26 straight quarters of revenue growth.

- 25 straight quarters of pricing growth.

- USCR’s capability for differentiated margin expansion.

- That in a cyclical business with significant market share, a company can hold onto pricing power for longer.

- The barriers to entry that USCR has developed.

Concluding thoughts

USCR enjoys the benefits of a strong and promising competitive position that looks quite sustainable. So an investment in USCR is mainly a bet on the continued economic recovery in the U.S. Any infrastructure development that comes out of Washington should act as an additional booster as the company is not currently counting on that spending to meet its expectations.

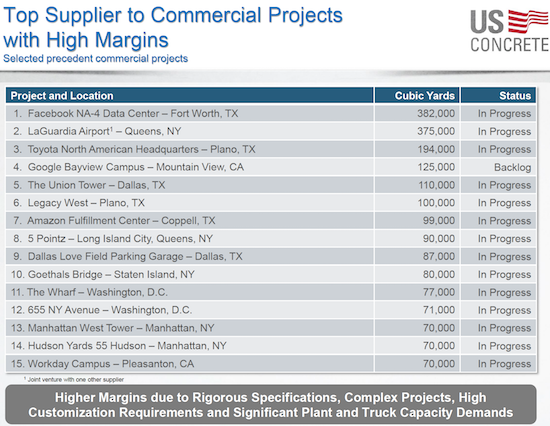

The list of projects USCR takes on is indicative of the company’s strong ability to deliver:

U.S. Concrete (USCR) is clearly a highly-trusted and highly desired supplier of concrete for extremely important projects.

Overall the company has a good spread in its business and is not overly reliant on a specific customer or region. For 2016, the top 15 customers were 19% of USCR’s revenue. Starting with the 51st largest customer and down to the rest these customers constituted 65% of revenue. Regionally, New York/New Jersey/DC is 38% of revenue. Northern Texas is 27%. Northern California is 23%. Western/Southern Texas is 10%. The rest includes the U.S. Virgin Islands.

USCR leads the ready-mix concrete industry average with annually increasing margins from 2011’s 45.9% to 2016’s 49.2%. Over that time, the industry has essentially remained flat from 44.4% to 45.0%. The gap on return on capital is even larger. For the company as a whole, return on capital has grown from 3.4% to 13.7% from 2012 to 2016 with annual increases while the industry has grown from 2.2% to 6.1%.

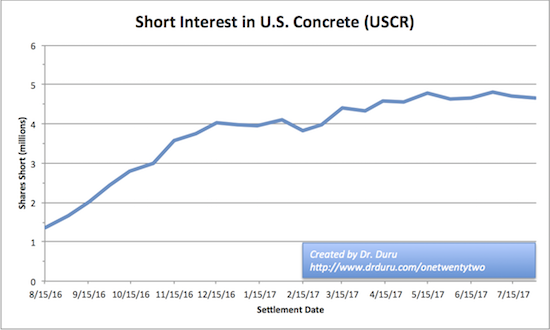

Alongside this strong financial performance, USCR brings a mixed valuation. On a trailing basis, USCR has a very expensive P/E ratio of 49.4. On a forward basis, the P/E ratio is 14.8. So meeting earnings expectations is key to the USCR story. The price/sales ratio is an attractive 1.0. The price/book ratio is a lofty 5.8. Cash and cash equivalents increased 259% over the past 6 months. Total assets increased 28.5% over this time period. Total long-term debt increased 50.9%. Total liabilities increased 33.4%. The ratio of assets to liabilities is 1.2, the same as 6 months ago. The first 6 months of 2016, USCR ran a net loss of $13.5M. I have to assume that was part of the story that motivated shorts to ramp up bets against USCR.

Short interest against U.S. Concrete (USCR) steadily increased in the second half of 2016. After a short period of stabilization, shorts increased their bets for another two months.

Shorts were doing relatively well until the U.S. Presidential election kicked USCR back into gear. A fresh breakout this summer has re-confirmed the long-term upward trajectory in USCR that has been in place since the trough in 2011/2012 (right around the time the housing market bottomed out). With USCR at fresh all-time highs, I assume shorts are now betting that the streak of performance from the U.S. economy and/or USCR is coming to an end sometime soon.

U.S. Concrete (USCR) broke out earlier this summer to a new all-time high.

USCR has come a long way since it emerged from bankruptcy in 2010. Bill Sandbrook became CEO in August, 2011, and the rest is history just looking at the stock chart. I wish I had paid more attention at that time because USCR has turned into the classic post-bankruptcy, post-restructuring money-making investment described in “You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits

After such a run-up, jumping in at these levels can feel like flailing arms to catch a speeding train. The good news is that USCR’s business is performing quite well and can continue to ride the economy from here. From a technical perspective, there is a handy stop-loss for traders under $72 which could flag that the (investing) story has taken a turn downward. Investors should look to hang in there at least to the bottom of the last trading range (around $58). In the meantime, I will be looking for a dip during this seasonally weak period for stocks to jump back into USCR.