XAU/USD Daily" title="XAU/USD Daily" height="242" width="474">

XAU/USD Daily" title="XAU/USD Daily" height="242" width="474">

Although my long term outlook for Gold is bearish, based upon the knowledge that the Federal Reserve are set to complete their QE (Quantitative Easing) process this year, after watching today’s US ADP employment report, I am curious to see whether Gold may be used as a safe haven in the coming days.

Today’s ADP employment report suggested that only 175,000 jobs were added to the United States economy in January. Analysts were expecting at least 185,000. This indicates that Friday’s NFP could be set to disappoint for the second month running, with January’s NFP equating to a dismal 74,000.

Right now, the disappointing employment reports are being attributedtowards the adverse weather conditions the US has suffered from since Christmas. Nevertheless, I am curious to see whether two disappointing employment reports could derail the strong economic progress that the US has shown in the past few months. If the adverse weather conditions affected job creation, then it is also possible that consumer expenditure and business optimism might also suffer.

Additionally, Janet Yellen has in the past confessed that she is a supporter of QE and indicated that she would like QE to stay, until the US economic future is absolutely certain. Bearing in mind the unexpected manufacturing slowdown on Monday, alongside the latest employment data, she may use this as a reason to delay a QE taper in March.If this is the case, then Gold will surely see an upturn in valuation.

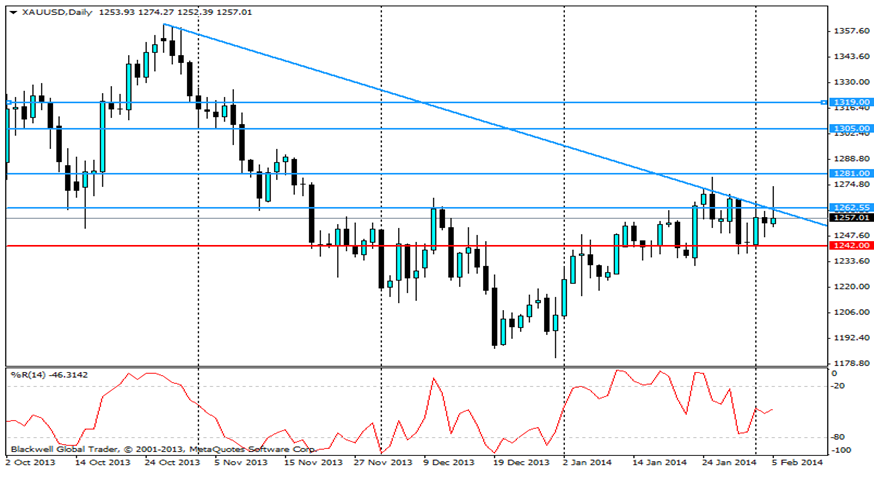

In reference to my technical observations for Gold, I can see that it is now approaching the 1266.00 resistance level. If Friday’s NFP does disappoint, which today’s employment report suggests might be the case, then 1281.00, 1305.00 and 1319.00 can be implemented as future resistance levels. According to the Williams Percent Range, upward movement is potentially on the horizon.

Overall, the USD has so far surprised me this week. After progressing rapidly and reaping the rewards of a QE taper and applaudable GDP expansion last week, I was expecting similar progress this week.

On the contrary, we have witnessed a noticeable slowdown in Manufacturing ISMs, a reduction in Factory Orders and today, a disappointing unemployment report. This suggests to me that Gold may be used over the coming days.