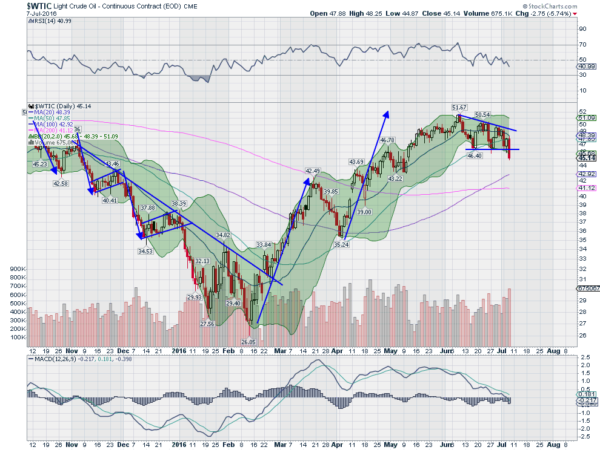

Crude oil has been on a tear higher since making a bottom in February. Once the Hammer candle on February 11th was confirmed higher the next day it has not looked back.

From a low of $26 per barrel it climbed to over $51, almost a 100% gain. There were basically two steps higher of equal length, first to $42.50 and then a pullback before the high at $51.67.

After such a move no one should be surprised to see a pullback. Technicians will look for a 38.2% pullback, a key Fibonacci ratio, that would bring it down to just under $42.

There is prior support in that area. And it is just above the 200 day SMA. Since the high in early June the price has been in a descending triangle, and it broke to the downside Thursday. This gives a target to $41.13, a penny above that 200 day SMA.

So there are many different forms of analysis creating a mosaic that is pointing to a move to the $41 to $42 area. If it gets there and finds support then you can consider it a digestive pullback in an uptrend.

Should it proceed further under $39 or retracing half of the move it will attract more bears, and under 35.25, just better than a 61.8% retracement you will start to hear calls for $25 per barrel again. For now, focus on the $41-42 area. And reversal above shows strength.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.