OPEC, the oil cartel known as the Organization of the Petroleum Exporting Countries, will hold an informal meeting in Algiers, Algeria this coming week (September 28, 2016). On Friday, September 23, headlines declared that Saudi Arabia and Iran were unable to reach agreement on production caps after two days of preparatory talks in Vienna, Austria. This news was the presumed cause of oil’s sharp decline on Friday. The United States Oil (NYSE:USO) lost 3.2% for the day. The United States Gasoline (NYSE:UGA) lost 1.3%.

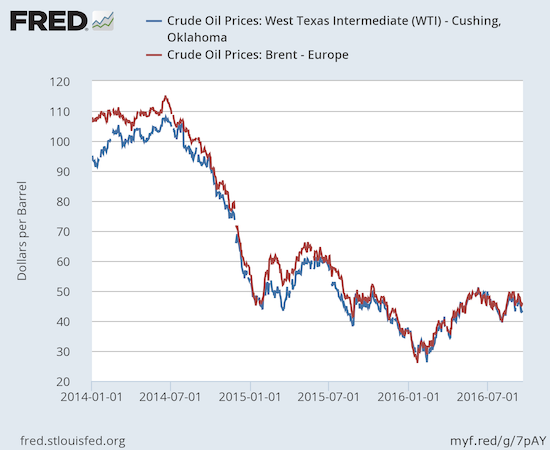

Since peaking in June for the year, United States Oil (USO) has followed its 200DMA, and now 50DMA, downward.

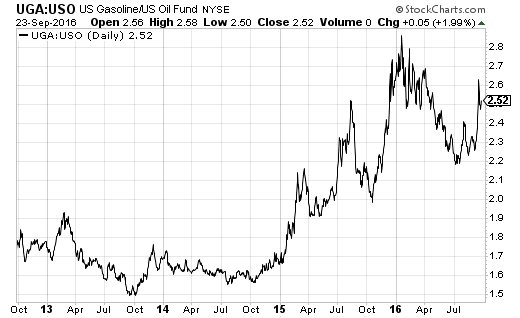

United States Gasoline (UGA) is struggling to hold onto a breakout above resistance at its 200-day moving average (DMA).

As soon as I saw the headlines, I decided to execute a change to my USO vs UGA pairs trade that I meant to do, ever since I noticed UGA’s breakout above its 200-day moving average (DMA) (see chart above). I locked in my profits on UGA shares and held onto the USO puts. This leaves my pairs trade profitable for now with a more dynamic strategy going forward. I believe UGA is supported by the spike in gasoline prices in the Southeast after a pipeline burst in Alabama.

This incident is of course not something I anticipated in my trade. As a presumably one-off event, I think it makes sense to lock in profits in anticipation of an imminent drop in UGA in coming days or weeks. I will buy UGA right back on the next good dip because I think the fundamental premise of the USO vs UGA pairs trade remains intact.

Indeed, the UGA vs USO ratio is finally rallying as I had first anticipated in early August. I still think it will eventually cross 3.0. Friday’s much larger loss for USO versus UGA was another reminder of the out-performance UGA can experience when geopolitical events move the price of oil.

UGA is once again out-performing USO

As a reminder, my USO puts expire in April, 2017, so I have plenty of time to make additional adjustments if necessary – for example, oil rallies along with gasoline prices. For now, I expect oil to continue drifting toward $40 and perhaps lower. I see little reason for oil bullishness in the near future, although ritual anticipation of market manipulation from the official OPEC meeting November 30th could spark periodic snap rallies on the latest related rumors and headlines.

Be careful out there!

Full disclosure: hedged position on USO with call and put options

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI