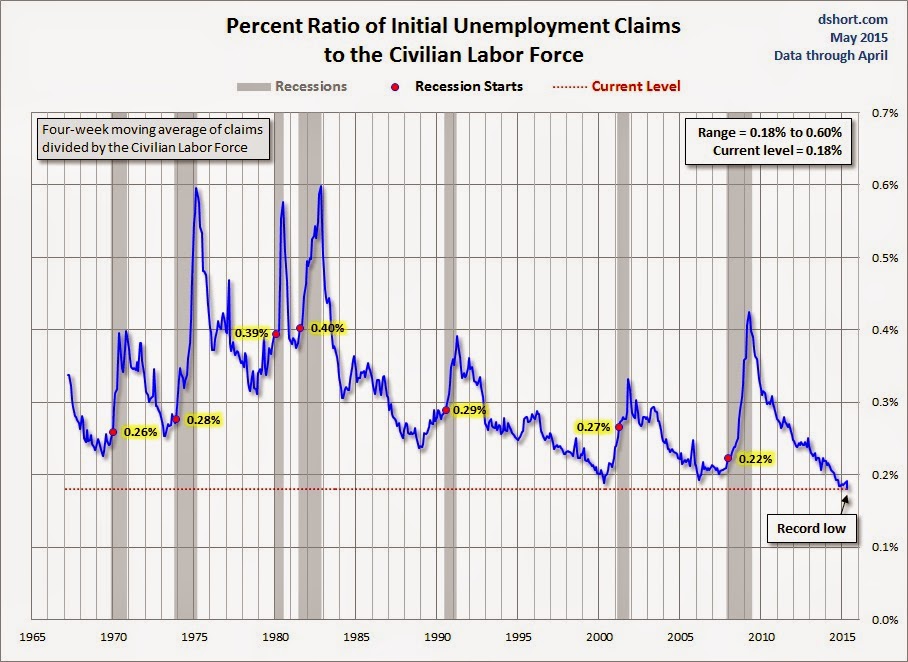

The markets staged a risk-on rally on Friday, sparked mainly by the Goldilocks not-too-hot-not-too-cold Jobs Report. I was reviewing some figures and charts on the weekend and saw this chart on Doug Short's weekly unemployment claims page. I couldn't help but ask, "Is this as good as employment can get in this economic cycle?"

To be sure, unemployment claims were lower in the late 1960s and early 1970s, but if you were to normalize claims by the size of the labor force, a difference picture appears. The unemployment claims to civilian labor ratio is at all-time-lows!

The record low could be attributable to problems with the participation rate, which has shrunk the size of the labor force. Nevertheless, these charts are highly suggestive that there isn't a lot of labor slack, which could prompt the Fed to be more aggressive in normalizing interest rates.

When viewing the US economy through the weekly claims prism, this analysis presents a scary thought for the prices of risky assets.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.