AUD/USD has posted considerable losses in the Monday session. In North American trade, AUD/USD is trading at 0.6963, up 0.54% on the day. On the release front, there are no major U.S. events. The sole event is JOLTS Job Openings, which is expected to tick up to 7.50 million. Australia releases NAB Business Confidence, which has posted a flat zero for two straight months. On Tuesday, the U.S. releases Producer Price Index reports, while Australia posts Westpac Consumer Sentiment.

It was a rough week for the U.S. dollar, and the Aussie took full advantage, with gains of close to 1.0%. The U.S. economy continues to perform well, but nonfarm payrolls posted its second dismal reading in four months. In May, the economy created only 75 thousand jobs, down from 263 thousand a month earlier. Wage growth was unchanged at 0.2%, shy of the estimate of 0.3%. Despite these soft job numbers, the U.S. labor market is in strong shape, and the greenback could quickly bounce back.

The Federal Reserve also weighed on the greenback, with Fed chair Jerome Powell hinting that the Fed could lower rates later this year. The Fed has sounded neutral about its next rate move, but last week’s comments from Powell and FOMC member James Bullard were clear hints that the Fed is leaning to a rate cut. The CME Group has set the odds of a quarter-point cut in July at 67%, as the likelihood a rate cut later this year is growing.

AUD/USD Fundamentals

Monday (June 10)

- 10:00 US JOLTS Openings. Estimate 7.50M

- 21:30 Australian NAB Business Confidence

Tuesday (June 11)

- 6:00 US NFIB Small Business Index. Estimate 102.3

- 8:30 US Core PPI. Estimate 0.2%

- 8:30 US PPI. Estimate 0.1%

- 20:30 Australian Westpac Consumer Sentiment

*All release times are DST

* Key events are in bold

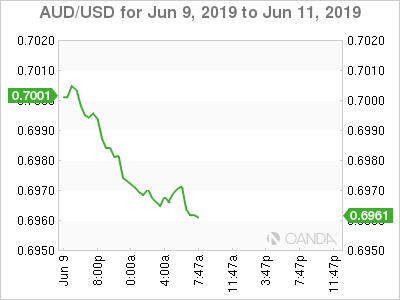

AUD/USD for Thursday, June 10, 2019

AUD/USD June 10 at 7:35 DST

Open: 0.7000 High: 0.7009 Low: 0.6961 Close: 0.6963

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6686 | 0.6744 | 0.6825 | 0.6968 | 0.7085 | 0.7190 |

AUD/USD posted considerable losses in the Asian session and is ticked lower in European trade

- 0.6825 is providing support

- 0.6968 is under pressure in resistance

- Current range: 0.6825 to 0.6968

Further levels in both directions:

- Below: 0.6825, 0.6744 and 0.6686

- Above: 0.6968, 0.7085, 0.7190 and 0.7240