Investing.com’s stocks of the week

If you have been reading this blog for long enough, you would understand that I am extremely negative on Treasury Bonds (actually almost all bonds). The view stems from the fact that interest rates have declined for over 30 years (in other words bond prices have been rising). Eventually, this trend will end, as previous trends before it in 1981 (peak in rates) and 1949 (trough in rates).

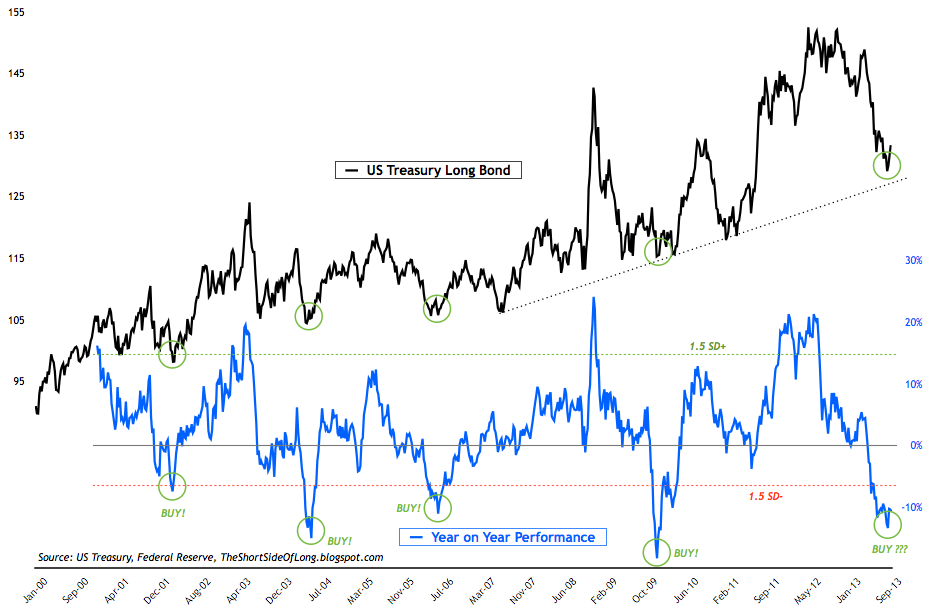

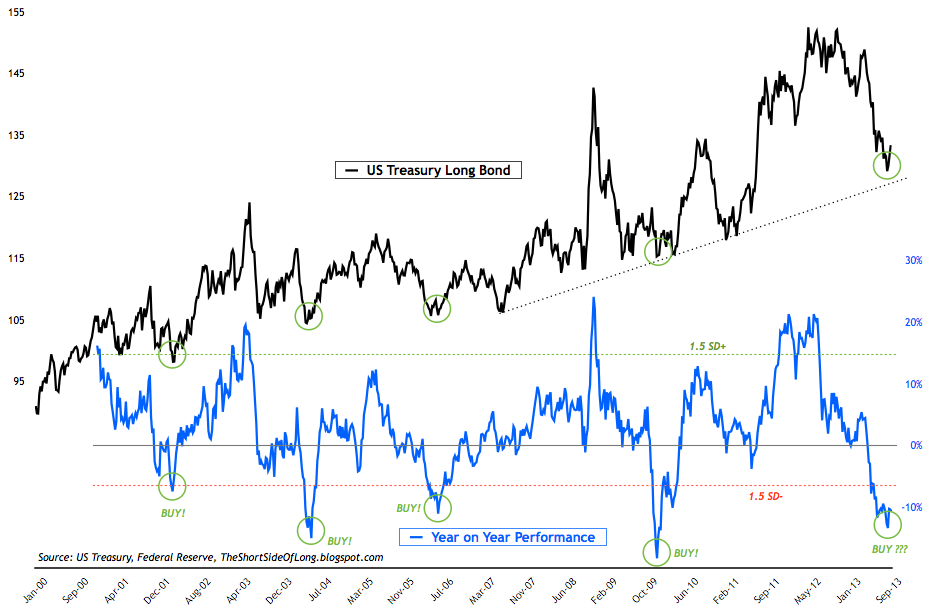

Chart 1: Treasuries have performed awfully over the last 12 months

However, from the shorter term perspective, bond prices have fallen dramatically over the last year and have become very oversold. Truth be told, prices are more than 2 standard deviations below the decade long annual performance mean. Therefore, it would make sense for certain traders with high risk tolerance to consider buying Treasuries for the next 3 to 6 month time frame. They could definitely outperform both stocks and cash.

Chart 1: Treasuries have performed awfully over the last 12 months

However, from the shorter term perspective, bond prices have fallen dramatically over the last year and have become very oversold. Truth be told, prices are more than 2 standard deviations below the decade long annual performance mean. Therefore, it would make sense for certain traders with high risk tolerance to consider buying Treasuries for the next 3 to 6 month time frame. They could definitely outperform both stocks and cash.