Charlize Theron coated in gold seems a perfect way to kick off the New Year. And gold is rallying to boot. I have recently written that despite the rally in gold over the end of the year though, that it seems to be a short term bounce in a the longer term downtrend. So why does a guy that follows price and ignores the news decide to ignore the positive price action in gold?

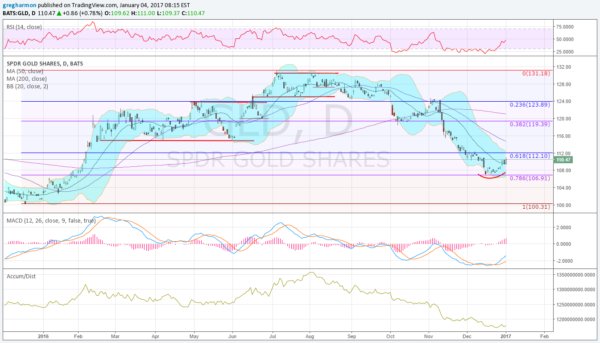

I am not ignoring it, just not seeing it confirm yet. Let me explain. The chart below shows the price of the Gold ETF (NYSE:GLD) over the past year. There is a lot going on in this chart so start at the top panel. The RSI, a momentum indicator, is clearly rising off an oversold condition and near the mid line. For many breaking the mid line would turn momentum bullish, I look for a move over 60. Either way it is not there yet.

Now skip over the price panel to the other momentum indicator the MACD. This too is moving higher, and has crossed up through the signal line. Both are positive for prices, but the indicator is still yet to move into positive territory, where it will give a strong bullish signal.

The Accumulation/distribution indicator below that gives the clearest indication that there has not been a change. This is why I have added it to the chart. There is no accumulation yet. Only distribution. This is an indication that traders are selling into rallies not looking at them as a reversal.

Now focus on the price panel. After a move higher the first 6 months of the year gold topped and then started back lower. in the pullback it has bounce twice. First at the 38.2% retracement of the 6 month rally, and then 2 weeks ago at the 78.6% retracement. These are places traders would close shorts. It has moved back over its 20 day SMA for the first time since the last bounce which is a positive. But it is yet to make a higher high.

All of this shows promise for gold in the short run. But it also shows that there is scant evidence that the long term downtrend is over.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.