Summertime travel is heating up. As families prepare to embark on their annual excursions, I’m reminded of one of the most iconic movies of my childhood: National Lampoon’s Vacation.

The Griswolds’ misadventures as they made their way from Chicago to Los Angeles always resonated with me. (The movie perfectly captures the highs and lows of any family road trip.) Their destination? The famed theme park Walley World.

Amusement parks have been a summertime staple for decades. According to the International Association of Amusement Parks and Attractions, they take in 375 million guests each year.

That number is split among industry giants like Walt Disney Company’s (NYSE:DIS) Disney World and Disneyland (upon which Walley World was based).

Plus smaller, regional destinations like Six Flags Entertainment (NYSE:SIX) or Kings Dominion, which is owned by Cedar Fair (NYSE:FUN).

Not surprisingly, the summer months are the best time of the year for these businesses -- and their investors as most theme parks close for the winter.

Tis The Season

Which brings me to an important point about seasonal investing.

It can be difficult for some to wrap their heads around the idea of stocks that predictably do well at certain times of the year. But with theme parks, the cycle is quite clear.

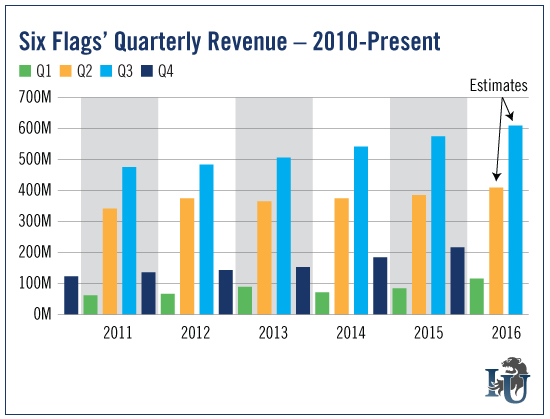

There are quarters when revenue drastically declines and quarters when it suddenly leaps higher. Take a look at this chart showing Six Flags’ quarterly revenue since 2010.

It’s easy to see that the third quarter makes up the bulk of the company’s annual revenue -- 46% on average. Meanwhile, the second quarter represents 31%.

The story is similar for other regional theme parks. But I particularly like Six Flags.

That's because, in addition to ticket sales, a chunk of its revenue comes from concessions. There’s no third party, which allows the company to profit from the whole guest experience.

And so far this year, Six Flags is having the best start to its season ever.

In the first quarter -- its smallest -- revenue increased 36% to $115 million. But since most of the company’s parks aren’t actually open during Q1, it reported an adjusted EBITDA loss of $23 million.

That just happens to be Six Flags’ best first-quarter EBITDA ever.

It’s a promising setup.

Attendance in the first quarter was also exceptionally strong, increasing to 2.1 million. It was helped by an earlier-than-normal Easter, which, on its own, boosted attendance by 200,000.

It’s also worth noting that Six Flags does really well with its season pass and membership business sales. This active base increased 24% in the first quarter.