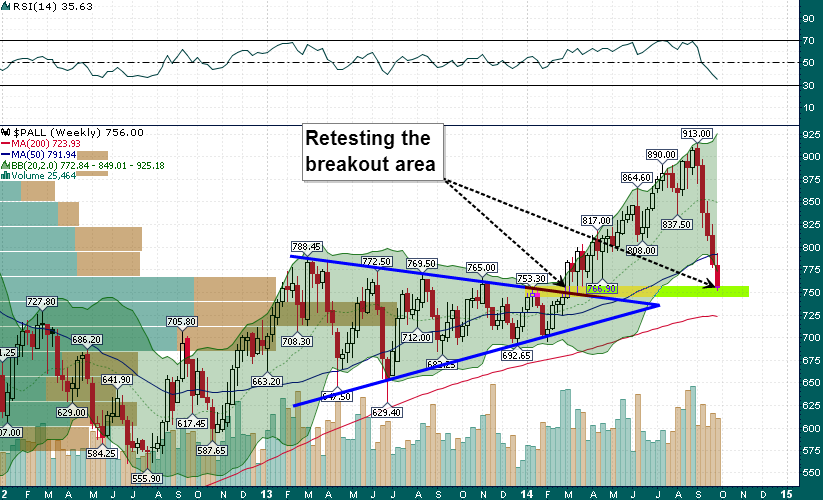

With platinum and silver in free fall, and gold clinging to important support near $1180, there isn’t much for precious metals investors to get excited about. However, the palladium chart offers an intriguing setup which doesn’t come along very often:

Palladium has suffered a brutal decline over the past 5 weeks after topping out at $913 last month. Price is now testing the breakout level from March near $750 – with price below the stretched lower Bollinger band on the weekly, this setup offers a high probability of a snapback rally in the short term.

Even more intriguing is the fact that Russian mega miner Norilsk is in talks with Russia’s central bank to buy up to $2 billion worth of palladium. The company and its CEO (Russia’s 8th richest man) are absolutely convinced that there is an impending supply deficit in palladium:

“Potanin, Russia’s eighth richest man, said he was so convinced the market will be in a supply deficit that he would put his own money into palladium if the company ruled there was no conflict of interest.“