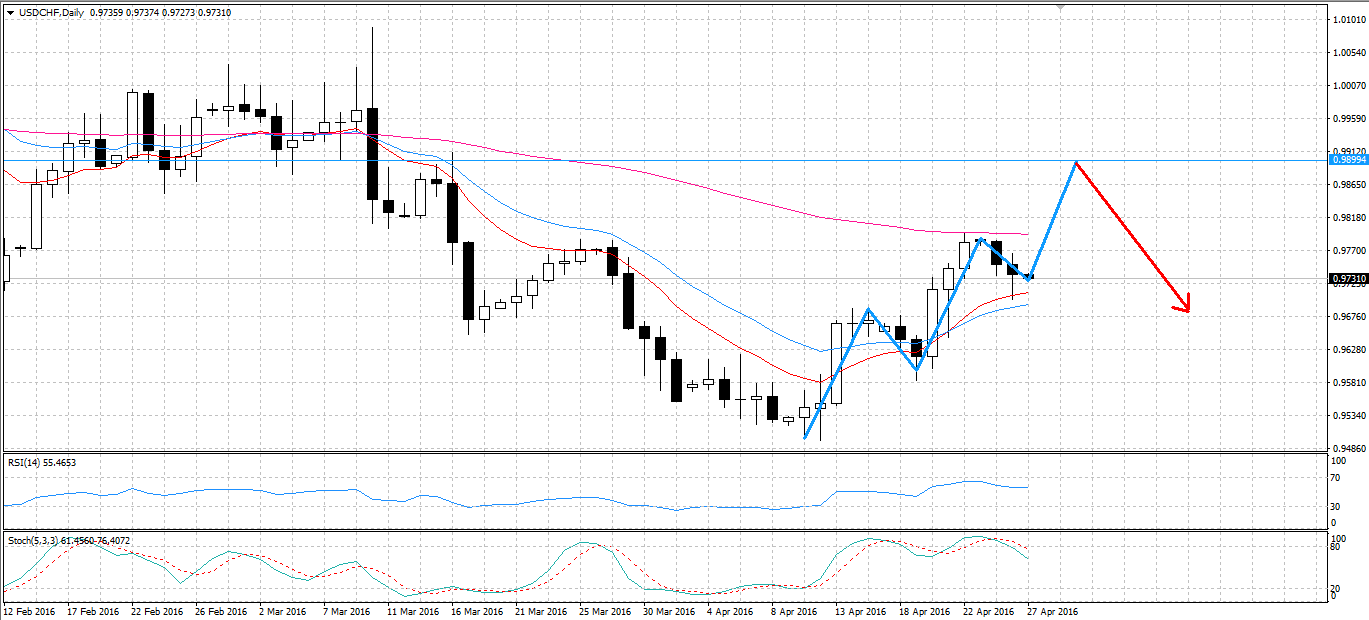

An impending corrective movement for the USD/CHF could see the pair retreat to its recent bottom at 0.9501. The formation of a Three Drive pattern after the recent Zig-Zag movement could undo the hard-won gains the dollar has made on the franc. Consequently, both US and Swiss indicator results will be watched closely in the coming days as they may provide the requisite momentum to see the pattern complete.

Firstly, the currently forming Three Drive pattern is itself the result of a larger Zig-Zag pattern which completed mid-April. Consequently, it is little surprise that this pair has been trending up as the final stage of the Zig-Zag is characterised by a relatively sharp reversal. In this instance, the USD began to reclaim ground from the CHF around the 15th of April and has been making steady progress ever since. As evident on the daily chart, the upwards correction has taken the form of a bullish Three Drive impulse which is currently poised to make the final push higher.

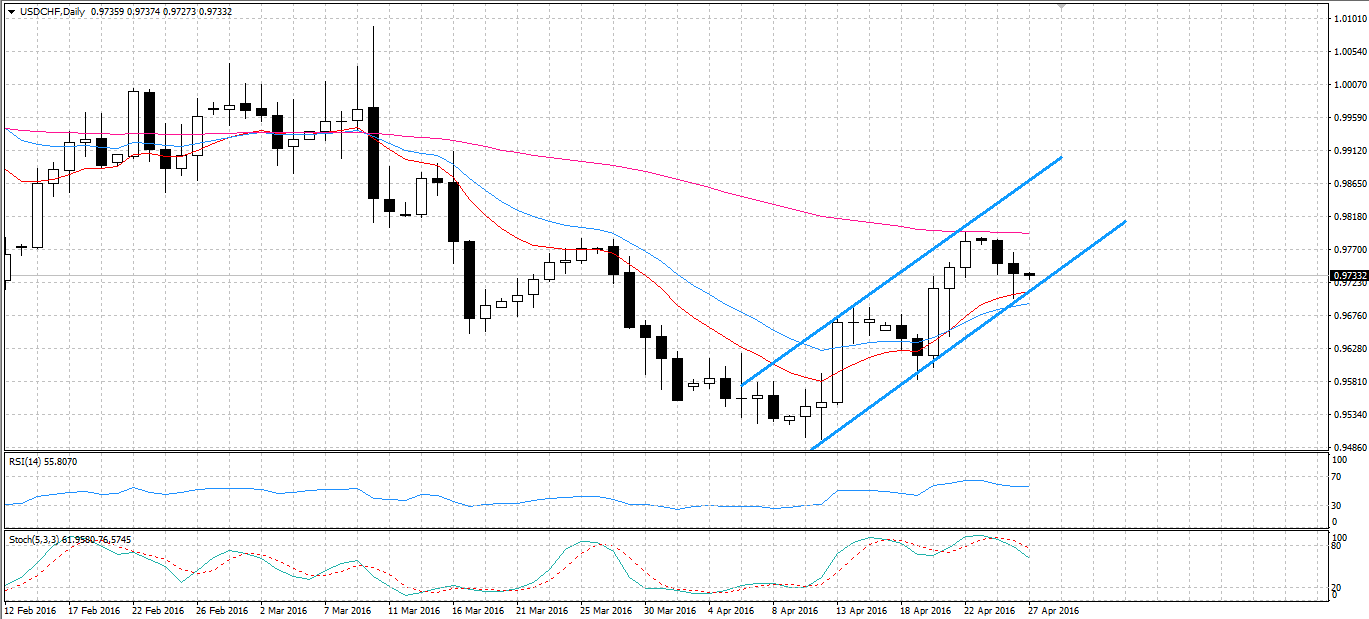

Additionally, it is worth noting that the move higher may not occur as this could be an ABCD correction rather than a Three Drive. The implications of this could be dramatic as the ABCD pattern would predict that the pair is already retreating back to the recent low. However, the 12 and 20 day EMA’s would suggest there is still a bullish trend at play which could see the USD/CHF challenge the 0.9899 zone of resistance prior to the move back to support. In addition, both RSI and Stochastic oscillators are signalling relative neutrality which allows for a degree of upwards mobility.

Furthermore, the pair is confined within a bullish channel and is currently testing the downside constraint of said channel. As a result, it is unlikely that the USD/CHF will break out from the range before finishing the Three Drive. Instead, it remains more probable that the pair will make the move back to the upside constraint before taking the plunge characteristic to the final stage of a Three Drive Pattern.

Ultimately, there remains some upside potential for the USD/CHF in the near future but eventually a significant slip is highly probable. Specifically, the pair should have the momentum to see itself rise to the 0.9899 zone of resistance as the final leg of the Three Drive completes. Once the final leg is completed, a sharp reversal is likely to send the USD/CHF sinking back towards the recent low. However, support at 0.9784 and 0.9671 could prevent the entirety of the recent rally from being erased which could give some hope to those who remain long-term bullish for this pair.