Renewed growth

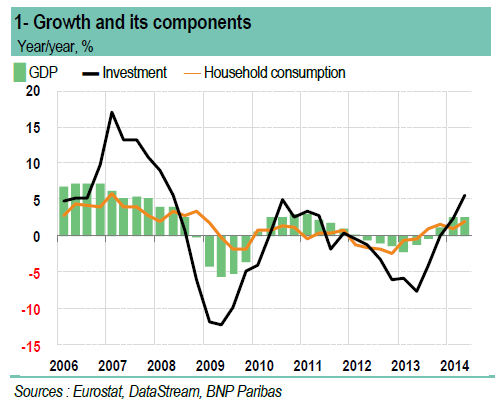

After reaching 2.6% year-on-year in Q1 2014, real GDP growth reached 2.5% in Q2. This performance confirms the reversal after two very sluggish years, with real GDP contracting by 0.9% in 2012 and in 2013.

Industrial sector activity has accelerated, fuelled by exports. After increasing 2% year-on-year in May, the industrial sector reported solid growth of more than 8% y/y in June and July.

Investment is once again trending upwards after two years of decline. Gross fixed capital formation increased 4% y/y in H1 2014. In the quarters ahead, investment should get more support from the government, which plans to increase infrastructure financing, notably by taking advantage of European structural funds.

The economic recovery has also carried over to the job market: the number of vacancies is on the rise, driving up salaries. After peaking at 8.6% in early 2014, the unemployment rate dropped back to 7.37% in August. Wages have begun rising moderately again, up 2% y/y in Q2, after several months of stagnation.

PMI is holding well above 50 and is trending upwards, to 55.6 in September vs. 54.3 in August. For the moment, gloomier dynamics in the German industry and the negative backdrop of the sanctions between the EU and Russia have not had a notable impact on the Czech Republic. This impact may however appear in the coming months.

■ Very low inflation

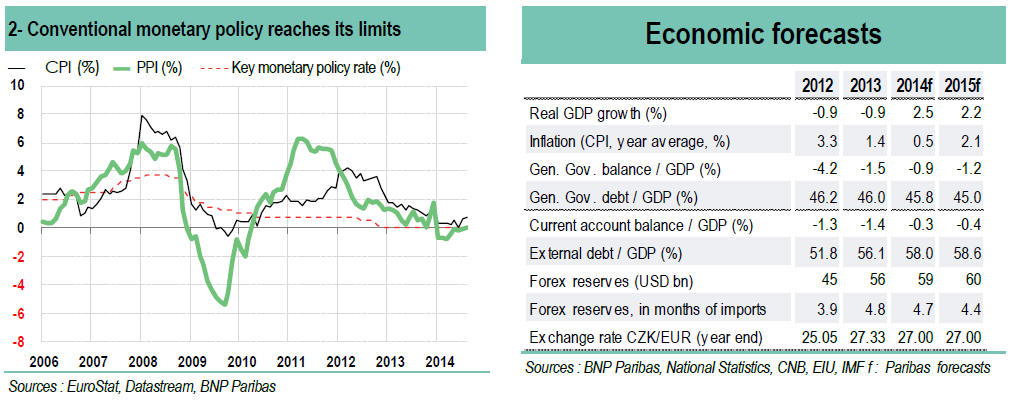

Inflation has slowed since 2012 and approached zero over the summer of 2014. Inflation averaged only 0.4% y/y in the first eight months of the year.

The impact of the Russian embargo has eased pressure on food prices, offsetting the effect of wage growth (itself being rather modest). The central bank’s 2% inflation target is unlikely to be reached this year.

Successful completion of fiscal adjustment

Fiscal consolidation has been successfully completed. Despite the economic contraction of the past two years, the budget deficit was reduced from 4.2% of GDP in 2013 to 1.5% in 2013. Consequently, in June 2014, the country exited the excessive deficit procedure launched by the European Commission in 2009. The main measures (a higher VAT rate and cutbacks in investment spending) were effective in reducing the deficit while maintaining the public debt under control. The public debt is still very low at 46% of GDP at year-end 2013, which leaves the government some leeway in case of a shock.

Stronger economic momentum should enable the country to end the year 2014 with a smaller than expected deficit. Buoyant growth trends combined with a very conservative spending policy enabled the government to report a budget surplus in the first 7 months of 2014. The cumulative deficit for the first 9 months of the year is limited to only 1.1% of GDP.

The 2015 budget proposal that was presented to parliament in September marks the end of austerity, even though it is still conservative. The budget proposal is based on 2.5% growth and inflation of 1.7%. Thanks to brighter growth prospects, the budget proposal calls for further deficit reduction.

Although the VAT rate is to be reduced for certain merchandise categories 1 , fiscal revenues are expected to increase by 2.7% in nominal value to reach 27.2% of GDP. Spending increases are to be tightly restricted (0.8%) despite the revaluation of public sector wages (3.5%), higher pensions, and a few fiscal measures to help families. Public investment spending, mainly for transport infrastructure, is expected to increase by a third to 2.2% of GDP.

In the medium term, the authorities do not expect to exceed the structural deficit of 1% of GDP.

■ Monetary policy remains accommodative to counter deflationary risks

Faced with recession and a significant slowdown in inflation, the Czech National Bank intervened in the forex market at the end of 2013 to weaken the koruna. The exchange rate depreciated by 5% to CZK27.5/USD1 at the end of September 2014. The central bank indicated that it plans to maintain this exchange rate at least until early 2016. Key rates have been stable since October 2012 at a historical low level of 0.05%. Money supply aggregates have increased mildly, by 5% y/y in August 2014. All in all, monetary policy remains accommodative, boosting competitiveness, while containing deflationary risks. Even so, we cannot completely rule out a deflationary scenario given the price dynamics in the eurozone.

A more stable political situation

After six months of a “technocrat” government appointed by the executive branch, the political landscape has become considerably calmer. The new government that took power in January 2014 benefits from the support of a parliamentary coalition comprised of three parties: the Social Democrats (SSSD), the centre-right party (ANO) and the Christian Democrats. Although a certain number of disagreements exist within this coalition (notably on fiscal matters), they are nothing compared with the conflicts that plagued the former government of Peter Necas. Consequently, we can expect the new government to last longer than its predecessors, ensuring continuity in terms of economic policy and the acceleration of structural reforms.

■ Outlook: balanced growth ahead

The return to a more accommodative budget stance in a credible fiscal environment helps boost growth prospects. Public spending should stimulate consumption and investment. Exports are holding up well despite the region’s geopolitical tensions. The economy should grow by 2.5% this year and by 2.2% in 2015, returning to the trajectory that it has strayed from since 2008.

BY Anna DORBEC