This week USD/JPY stands out and currently looks significantly overbought. We expect further weakening of JPY over the coming 6-12 months and we still prefer to buy USD/JPY on dips. However, there are several factors suggesting that the recent spike in USD/JPY currently looks excessive and indicate that a short-term correction could be imminent. Hence, we suggest utilizing a possible correction lower in USD/JPY by buying a 1M USD/JPY 82.50 KI call option with barrier at 81.75.

What stands out

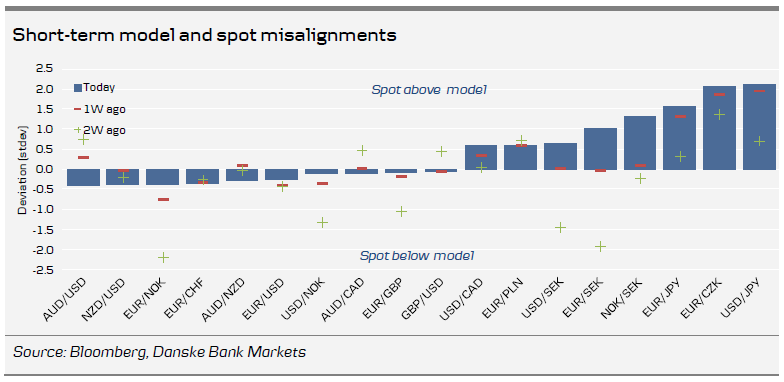

Looking at the signals from our short-term financial models, JPY and CZK stand out. Both currencies have depreciated considerably over the past weeks as the market has been pricing in a higher probability of further central bank easing. According to our short-term models USD/JPY is currently trading with the biggest misalignment (2.1 standard deviation above model estimate) and looks significantly overbought. EUR/JPY and EUR/CZK are also trading with significant misalignments versus models estimates, and we still recommend being long USD/JPY and EUR/CZK, even though our models are unable to explain the current misalignments.

In particular, we see a strong case for a considerably weaker yen as an economic recession and the forthcoming general election in Japan have raised speculations of an increase of the BoJ’s inflation target from the current 1% to 3%. If a credible higher inflation target is introduced, it could prompt a structural shift in the underlying appreciation trend of recent decades and thus pave the way for a significant weakening of the yen.

However, there are several factors suggesting that the recent spike in USD/JPY currently looks excessive and indicates that a short-term correction could be imminent. First, USD/JPY, as mentioned earlier, is significantly overbought according to our short-term financial model. Second, the RSI index has reached levels above 70 (currently 79), which also implies that USD/JPY is overbought. Finally, investors are already net long USD/JPY, according to the latest IMM data. Hence, there are many indications that the recent move higher has been a bit too fast.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Near-Term Correction Lower In USD/JPY Looks Imminent

Published 11/26/2012, 02:21 AM

Updated 05/14/2017, 06:45 AM

A Near-Term Correction Lower In USD/JPY Looks Imminent

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.