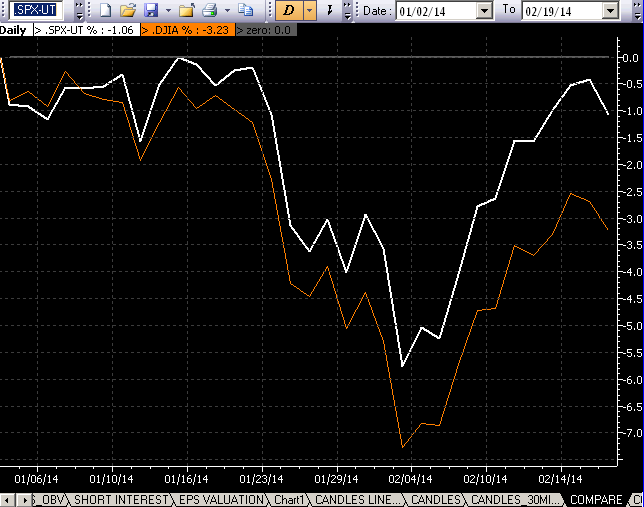

Year to date the S&P 500 Index is down approximately 1% on a price only basis; however, for investors, the start of the year has been anything but a smooth ride. Through early February the S&P 500 Index declined almost 6% before recovering most of the loss these past several weeks.

The question for investors is what lies ahead for the market. For traders, and not necessarily longer term investors, some consolidation of these recent gains would be healthy for the market, but maybe this early February decline was the consolidation.

The first chart below displays several technical indicators relative to the S&P 500 Index on a "daily" basis. As can be seen from the chart, the most recent chart pattern has played out a number of times over the past year. The second chart uses a weekly time frame. Both of these charts taken are suggestive of further market highs ahead, keeping in mind the daily chart still indicates an overbought market based on the full stochastic indicator.

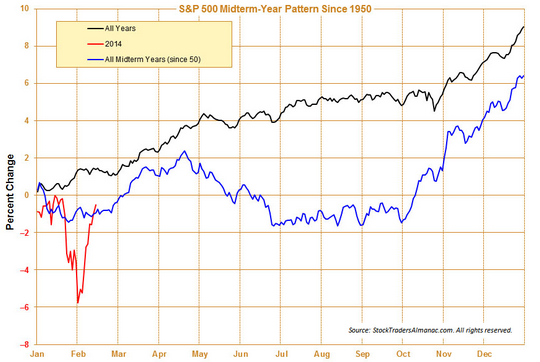

One aspect of the market this year that could unfold is a more "sell in May" type of year. Seasonally, the "sell in May" strategy has rewarded investors, but this was not the case in 2013. The market action so far this year though is resembling that sell in May type of environment on top of which this is a mid term election year.