Bulls in the Mexican peso successfully reversed all the post-election gains in USD/MXN. Yet they failed to hold onto a big break through when USD/MXN hit a new 6-month low last week. Buyers quickly stepped in and sent USD/MXN right back to its declining 50-day moving average (DMA).

USD/MXN quickly bounced back from a new 6-month low last week.

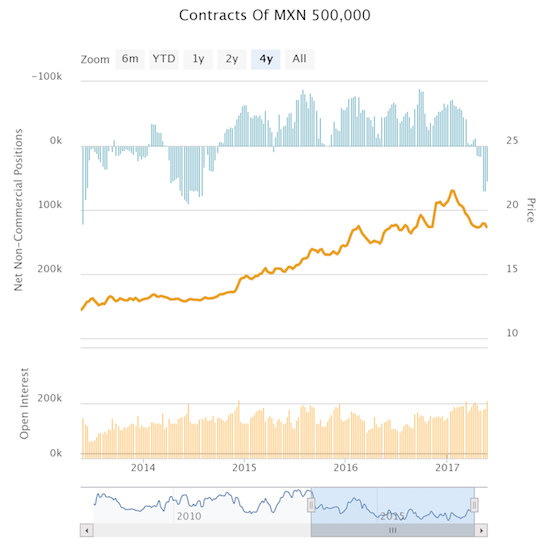

The latest CFTC data on the Commitment of Traders (CoT) shows that for the third week in a row speculators maintained a level of peso bullishness not seen since the summer of 2014. Yet, the lack of follow-through on the 6-month low demonstrates that the increasing bullishness on the Mexican peso needs more firepower. I am waiting on this firepower before getting as aggressively bullish on the Mexican peso as I would like.

Speculators are maintaining healthy net long positions on the Mexican peso in support of a major sentiment shift that abruptly began in March.

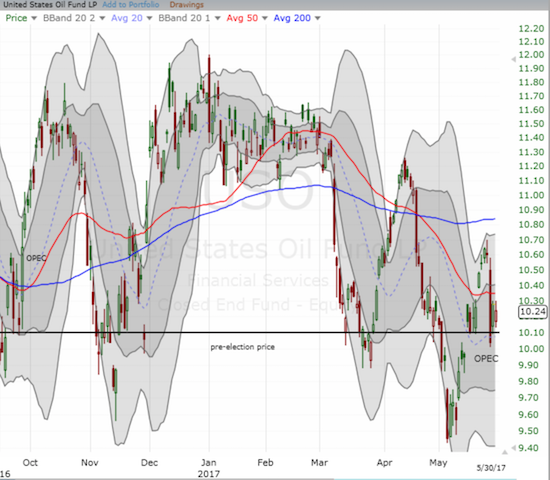

I have had success in fading small rallies on USD/MXN and locking in profits on a resumption of the 2017 downtrend. The 6-month low delivered my best peso trade since I started taking note of the currency’s bullishness. Given the sharp bounce off these lows, I suspect the latest fade will be the toughest to manage yet. The plunge in oil prices after OPEC’s decision to stick with current production cuts certainly helped propel USD/MXN off its low.

The United States Oil Fund LP (NYSE:USO) seems to be pivoting around its price from right before the U.S. Presidential election.

Based on prior forex experience, I am not surprised that the peso’s strength is not building as fast as it was when speculators remained confident in their net short positions. Now, on the edge of a major breakthrough, the peso bulls need to summon the will to get one…more…push…In the meantime I am bracing for large swings leading into and in response to the coming U.S. jobs report on Friday, June 2nd…

Be careful out there!

Full disclosure: short USD/MXN