It is a slow news day for macro around the world, although the US has a few data points to consider. Front and centre is the weekly update on demand for mortgages and the latest on home prices, plus a regional manufacturing release, which may provide a hint of where the US national data for December is headed.

US MBA Purchase Applications (12:00 GMT): This indicator does not usually receive a lot of attention, but today might be different because it is a light day for scheduled economic news. In addition, the previous update on this weekly report revealed that applications for home mortgages fell to the lowest level since early November. "The Market Composite Index, a measure of mortgage loan application volume, decreased 12.3 percent on a seasonally adjusted basis from one week earlier," leaving this metric at its lowest level since November 2. It may be noise, but another decline, especially if it is hefty, might stoke anxiety on a day with so few numbers competing for attention.

Keep in mind that the recovering housing market is critical at this stage for keeping the US economy out of the business cycle ditch. Positive momentum for real estate requires fuel, of course. The front line for deciding if there is enough gas in the property engine's tank is demand for new mortgage applications.

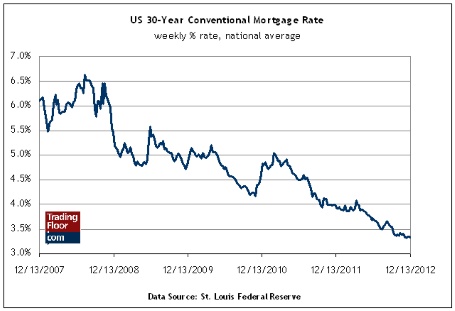

The big-picture momentum is still bullish, of course, thanks to mortgage rates near record lows - the national average for a conventional 30-year fixed rate is roughly 3.3 percent. It has never been more affordable to buy a home. As such, any drop in the demand for mortgages cannot be blamed on high interest rates.

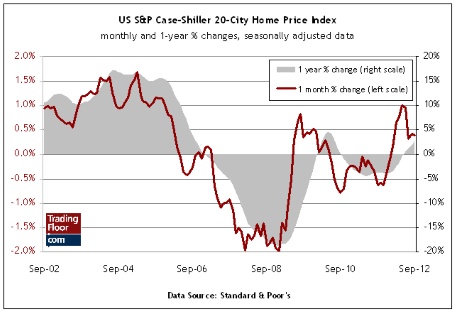

S&P Case-Shiller Home Price Index (14:00 GMT): Updates on this index arrive with a two-month lag, but the news receives a fair amount of attention when it comes to the market's appetite for a single data point that summarises the national trend in home prices. It is clear that housing is doing better these days, but measuring October's numbers could be tricky, thanks to Hurricane Sandy.

Nonetheless, the consensus forecast sees a rise of around 0.5 percent in the October 20-city index over the previous month. That is a bit high relative to my econometric estimates, although a modest increase is still the favoured outlook. Higher prices, despite the weather-related turmoil that derailed several indicators in October, will be an especially encouraging signal that the real estate recovery still has room to run higher.

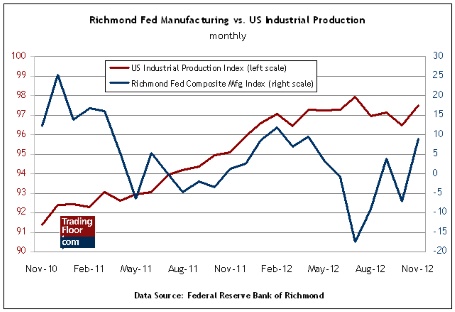

US Richmond Fed Mfg Index (15:00 GMT): Today's update of manufacturing activity for the 5th Federal Reserve district (the Middle Atlantic states around Washington, DC) offers an early read on how the national profile of the sector is shaping up this month. November was clearly a good month for manufacturing, according to industrial production's strong 1.1 percent gain last month — the fastest pace in nearly two years. The news brought a sigh of relief after October's steep decline for US manufacturing.

It now appears that October's slump was a temporary detour, courtesy of the distortions due to Hurricane Sandy. The pressing question is whether November's rebound will extend into December? The Richmond Fed index is a regional benchmark and so its value for analysing the national economy is limited. A big rise, of course, would still bode well for the US data that will begin to hit the streets early next month.

What can we expect in today's Richmond Fed report? The market outlook calls for a pullback to 6 from last month's 9. Running the index's history through several econometric models offers a mixed reading, however, and so I am assuming a more or less unchanged number for December.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Look At This Week's US Data Points

Published 12/26/2012, 12:24 AM

Updated 03/19/2019, 04:00 AM

A Look At This Week's US Data Points

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.