Two thirds of 2012 passed before we saw the first new VIX-based exchange-traded product and it turned out to be an interesting one -- the First Trust CBOE S&P 500 Tail Hedge Fund ETF (VIXH), which was introduced at the end of August. VIXH is essentially a portfolio consisting of 99%-100% SPY, augmented by a dynamic allocation of 0%-1% of VIX options, with the amount of options determined by the level of the VIX at the beginning of each VIX expiration cycle. This is the first VIX-based ETP to include VIX options among its holdings and is notable because it bucks the recent trend as it's an ETF instead of an ETN. There are other features of VIXH worth discussing, which I'll touch on in future posts.

As the VIX ETP product space expands, it also contracts a great deal. Indeed, UBS has elected to close 12 of its ETRACS ETNs, effective tomorrow, September 11, 2012. Those UBS products failed to gain sufficient volume and assets to make them viable over the long haul. Still, when AAVX retires, it will do so with the best VIX ETP track record of all-time. That product was launched on September 8, 2011 and is up about 120% on the year since it was launched. (See ETRACS Volatility ETPs for the full list of ETPs set to close.)

Some Of The VIX Products

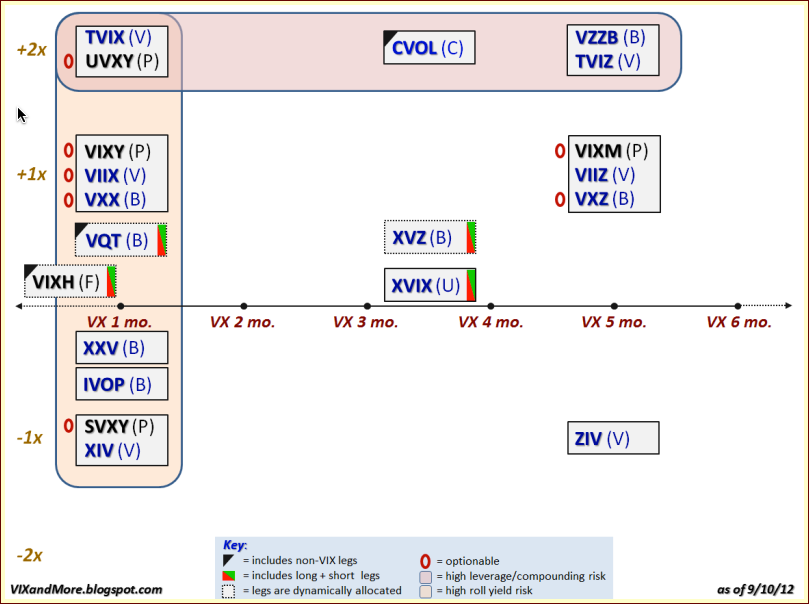

The graphic below is my periodic update of the VIX exchange-traded products (ETP) landscape, using the y-axis to denote leverage and the x-axis to indicate target maturity. In addition to the explanatory notes in the key at the bottom, it is worth noting that I use font color to distinguish between ETFs (black) and ETNs (blue). Also, I have used a parenthetical one letter code to identify the issuer: B = Barclays; C = Citibank; F = First Trust; P = ProShares; U = UBS; and V = VelocityShares.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Look At The VIX ETP Landscape

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.